June 29, 2025 | 9:08 pm

Table of Contents

Managing your SME's finances can be a real challenge. Don't you wish you had expert insights

to gain full control, make confident decisions, and secure your business's future? This is

where you’ll need a strategic CFO.

Many believe that only giant companies need a CFO. However, for SMEs in the Philippines, a

CFO is no longer just about crunching numbers. Instead, they are strategic partners who can

be a game-changer, offering crucial support in navigating growth, avoiding costly risks,

crafting smart plans, and boosting your company's reputation to help your SME reach new

heights.

If you're tired of financial worries and ready to unlock serious growth, this guide will

explain why a strategic CFO is essential for your company. Plus, we'll help you figure out

how to pick the right one for your business.

How a strategic CFO empowers your SME

A strategic Chief Financial Officer (CFO) is your C-level

navigator for financial growth.

This top-ranking executive goes beyond mere bookkeeping to lead your entire financial

journey, transforming raw numbers into clear paths for success.

There’s a common misconception that a CFO’s

role is limited to just financial reporting or

that only giant corporations need one. But on the contrary, a strategic CFO for SMEs plays a

much more significant and dynamic role than just crunching numbers for reports. They are

integral to your business's overall health and future.

Here are the key roles and responsibilities of a strategic CFO and how they empower your

SME:

Financial command center

As someone who leads the company’s finance function, a strategic CFO oversees all financial

planning processes. This includes mastering smart budgeting, accurate forecasting, and

clever tax planning to ensure your money works for you.

Having a strategic CFO in your SME team also ensures strict compliance with financial

reporting requirements and optimize every cent of your cash flow, to keep your

SME

financially healthy.

Strategic Visionary & Risk Shield

A strategic CFO helps you see the bigger picture. They constantly monitor business

performance through key performance indicators (KPIs),

identifying hidden risks, spotting

new market trends, and uncovering exciting opportunities.

They take complex financial data and transform it into actionable insights that truly shape

your business's future and protect it from potential challenges, keeping your SME on track

towards sustainable growth.

Bridge Builder & Storyteller

Strategic CFOs work closely with your key stakeholders, including the executive team,

investors, and the board of directors. They provide transparent and accurate financial

updates, translating complex financial information into clear, compelling stories.

Having a dedicated strategic CFO helps build trust and confidence among stakeholders,

assuring them that an expert is not just overseeing, but strategically guiding all major

financial decisions for your SME.

Talent Architect & Growth Driver

As one of the leaders of the company, a strategic CFO plays a vital role in building a

skilled and capable finance team within your SME. Beyond their own expertise, they provide

mentorship and empower your people.

By identifying future leaders and fostering a

strategically-minded finance department, they

ensure efficient cash flow management and lay the robust groundwork for your SME's long-term

business growth.

What are the benefits of hiring a strategic CFO?

For ambitious SMEs, a strategic CFO isn't just another hire; they're a true game-changer.

This forward-thinking leader provides provide the critical support and expert guidance

necessary to navigate your business's financial direction, ensuring stability and fueling

growth.

Beyond traditional number-crunching, here's how having a financial navigator as a key

partner can profoundly benefit your business:

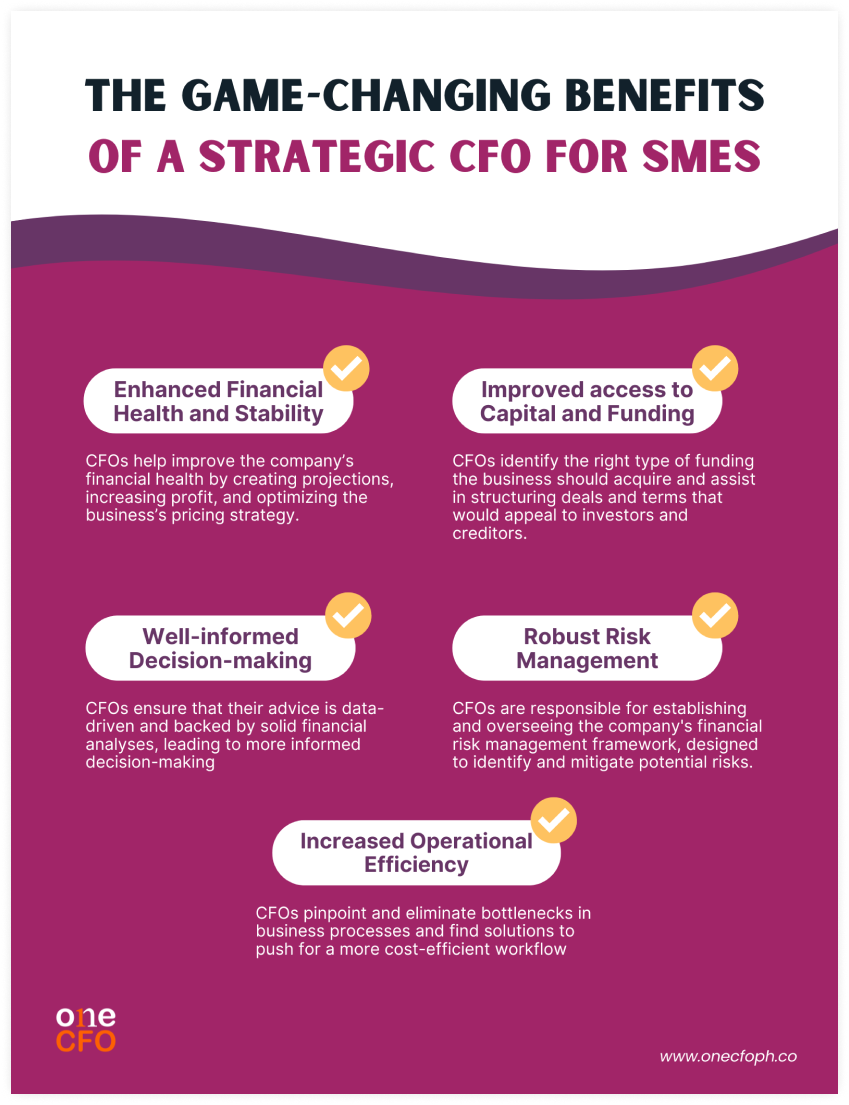

Enhanced financial health and stability

At the core of every thriving SME is robust financial health. While every team member

contributes to profitability, it's the strategic CFO who is uniquely positioned to

significantly boost your business's financial health and ensure its long-term stability.

Here's how this financial visionary helps elevate your company's financial standing:

Improved access to capital and funding

For any SME looking to expand, securing additional funds – whether from investors or through

loans – can be a significant hurdle.

This is where having a strategic CFO on your team becomes an undeniable advantage,

especially for businesses in the Philippines. Their expertise can make the journey to

securing capital much smoother and more successful.

Here's how this financial executive makes a difference:

If you want to dive deeper into fundraising strategies for startups and SMEs, check out this video where we discuss practical tips and expert insights:

Well-informed decision-making

A strategic CFO offers a significant benefit to SMEs by providing data-backed insights and

expert advice. This empowers the SME owner to make well-informed decisions and develop more

effective business strategies, moving beyond guesswork to achieve their goals.

When sharing insights, this financial leader meticulously considers all financial factors

affecting decision-making, including competition, market trends, operational locations, and

the company’s strengths and weaknesses.

The strategic advice offered by a CFO is particularly useful since it gives the team a more

holistic financial perspective and ensures decisions are supported by strong financial data

and analysis.

Furthermore, a CFOs industry knowledge allows SMEs to assess the business’s performance

against similar companies. Knowing the industry benchmarks guides businesses on what KPIs or

metrics to target and strategize accordingly.

Robust risk management

There are always risks associated with running a business, regardless of your business size

or industry. As an SME owner, your goal should be to have measures in place that lower risks

to a tolerable level, which is where CFOs come in.

Robust risk management is a strategic CFO's value proposition. Their role specifically aims

to identify, analyze, and proactively mitigate the various financial and operational risks

that companies may encounter.

This finance expert help the executive team develop a comprehensive risk management

framework. This framework equips the SME to effectively deal with a range of challenges,

including fraud, credit risk, liquidity risk, regulatory risk, and many others, safeguarding

the business's future.

Increased operational efficiency

Finally, expert CFOs in the Philippines contribute greatly to the company by significantly

increasing its operational efficiency.

A key part of their role involves thoroughly investigating existing business processes and

identify bottlenecks costing the company more money. They then recommend improvements to

remove inefficiencies so the business can save time and money.

Another way strategic CFOs promote efficiency is by spearheading the company's financial and

digital transformation. They incorporate technology and automation into the finance team’s

day-to-day activities, helping others learn new software and adapt to current best

practices, thereby modernizing and streamlining operations.

CFO vs. Controller: What’s the difference?

Some SMEs might wonder how different a CFO is from a finance controller. While both these

roles are within the company’s finance function, the scope of their responsibilities is very

different.

A controller is the chief accountant of the business, mainly managing the company’s

day-to-day financial operations. Controllers handle the business’s accounting operations,

financial reporting, and internal controls. They often manage a team of accountants and

oversee the daily financial transactions and records.

On the other hand, the CFO takes on a more strategic role by managing the company's overall

financial strategy.

CFOs use the controller’s financial reports to advise the CEO and board on business

decisions, though this constitutes only a portion of their work. Tasks like managing

investor relations, long-term business planning, forming strategic partnerships, and more

are also part of a CFO’s job.

How to find an expert strategic CFO in the Philippines?

Given the impact a strategic CFO has on your business, it’s crucial that you invest time and effort into finding the right fit. Here are some tips for small businesses on finding a good CFO:

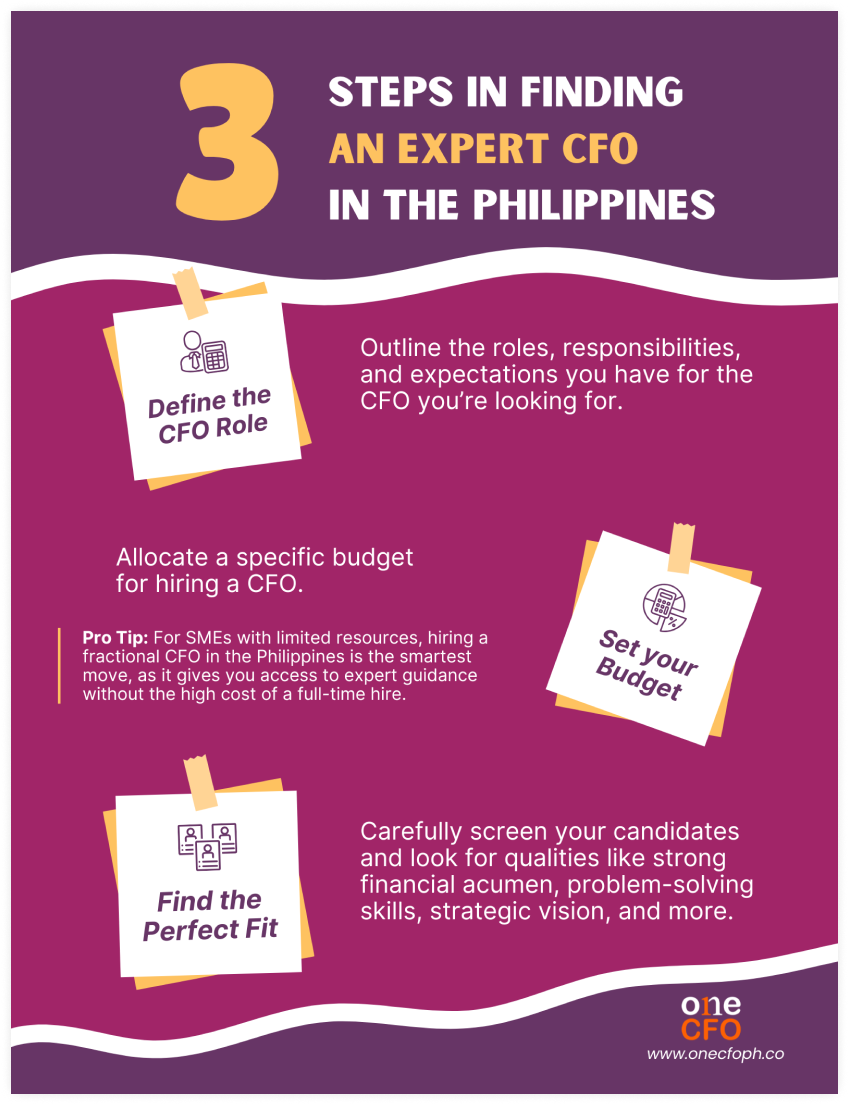

Define the strategic CFO role

The first step any SME should take when hiring a strategic CFO is to clearly define the role

based on the business’s specific needs. Job descriptions are not one-size-fits-all — they

vary depending on the company’s current goals, size, or growth stage.

For example, SMEs may need a CFO to establish and implement their finance processes.

Meanwhile, growing startups seek CFOs for their expertise in fundraising.

A clear outline of the responsibilities, objectives, and expectations for the role will help

you determine what to look for in a candidate.

Set your budget

You're convinced about the benefits of a strategic CFO, but what about the price tag? It's a

common concern, especially for SMEs, who might assume a senior finance executive is beyond

their budget.

While a full-time entry-level CFO in the Philippines typically earns around ₱125,000 monthly

(plus benefits), that doesn't mean strategic financial insight is out of reach for smaller

businesses.

Here's the secret: you don't need a full-time commitment to gain executive-level financial

wisdom.

Instead, many SMEs are finding success with fractional CFOs. This allows you to tap into

experienced financial leadership on a part-time or project basis, giving you the strategic

support you need at a cost that aligns with your financial plan.

Find the perfect fit

Once you’ve laid out the job scope and your budget for the CFO role, it’s time to spread the

word. Leverage your professional network and consider engaging executive headhunters to help

you identify candidates who would be good for the role.

It’s also vital to properly screen all your candidates and assess if they truly understand

your goals for the company. Your future CFO will be your partner in growing the business, so

it’s just right that they see your vision and can help you pave the way towards it.

While every CFO role is unique, here are some common qualities that you should always look

for in a CFO:

Empower your business with a strategic CFO

Gone are the days when a CFO's role was confined to crunching numbers. In today's dynamic

business landscape, these financial leaders have fundamentally transformed into

indispensable strategic partners who help businesses achieve stability and long-term

success.

By investing in a strategic CFO in the Philippines, your business gains more than just

financial oversight. You unlock world-class insights, robust financial management, and

invaluable strategic guidance — all the essential ingredients for sustainable, healthy

business growth.

If the prospect of gaining such powerful financial leadership excites you, yet the idea of a

full-time executive salary seems daunting, then look no further than OneCFO!

At OneCFO we

understand the unique needs of ambitious SMEs. We provide world class

fractional CFO services in the Philippines, specifically designed to deliver all the

benefits of a top-tier CFO without the hefty price tag of a full-time hire.

As your dedicated strategic partner, OneCFO brings unparalleled fractional CFO expertise

directly to your SME.

We don't just offer support; we actively drive strategic growth initiatives and provide

top-notch financial management, all meticulously tailored to your unique business needs and

goals. We are committed to being the strategic financial brain your SME deserves.

So, what are you waiting for?

Visit us at onecfoph.co or email us at [email protected]

today. Discover first-hand how our

fractional CFO expertise can elevate and empower your business to thrive in the competitive

Philippine market and beyond!

Read our disclaimer here.