By Maric De Castro

April 14, 2023 | 4:14 pm

Table of Contents

What is your MRR? Startup founders can be caught off guard when asked about finance

acronyms. Familiarizing yourself and understanding the acronyms widely used in conversations

with founders and investors is crucial.

We will share with you the fundamental and often talked about finance acronyms that are

indicators of the financial health of an early-stage startup. These financial abbreviations

also measure business performance and guide founders to make informed decisions.

In addition, knowing and understanding the importance of these ubiquitous letters leaves a

good impression on investors. You can readily provide insights relevant to your business

financials and give assurance that your business is doing well and growing.

KPI: Key Performance Indicators

The financial acronyms are not just a set of letters. These are primarily shortened terms

for key performance indicators (KPIs) used to evaluate a startup's financials.

KPIs are metrics used by businesses to measure growth and monitor operations and their

impact on profitability. These metrics help assess the business’ progress versus the

strategies employed to find customers and generate sales.

MRR: Monthly Recurring Revenue

The monthly recurring revenue (MRR) forecasts the sales or revenue a company will likely

generate monthly. It also shows fluctuations in income given the different customer

behaviors - from new subscriptions to cancellations.

Saas or subscription-based companies commonly use MRR. They offer different pricing plans,

so revenue has to be normalized to evaluate its

performance and growth.

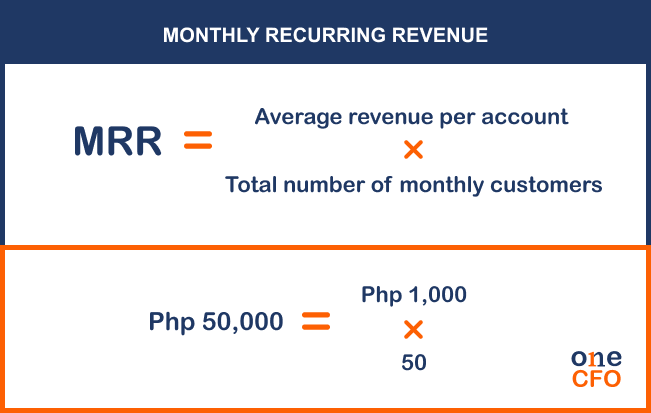

How to calculate MRR

If you have 50 customers, and the average amount each customer pays is Php 1,000 per month, the MRR would be Php 50,000.

What factors affect MRR?

The MRR is a sound basis for revenue that the company can continue to earn in the coming months. However, some factors affect this number, showing revenue growth or a slowdown in sales.

Why do you need to track changes in MRR?

Accurately tracking the factors affecting the MRR shows which business activity contributed

the most to the revenue. Tracking also allows startup founders to pinpoint red flags, such

as increasing cancellations or more customer downgrades.

For example, a churned MRR that constantly grows may mean the existing clients are not happy

with the product or service, or they maybe be into cost-cutting measures. Thus, you may need

to revisit marketing strategies and adjust

accordingly.

Also, knowing the MRR and the factors affecting it, gives founders and investors insights

into whether the business will achieve revenue forecasts. Losing clients faster than gaining

new ones is a signal to improve products or services to beef up sales.

ARR: Annual Recurring Revenue

The Annual Recurring Revenue, commonly abbreviated as ARR, is similar to MRR as both

calculate recurring revenue. Where MMR is normalized monthly, ARR, on the other hand, is

annual.

ARR measures the revenue a company expects from its subscriptions or contracts committed for

a specific period paying the same rate.

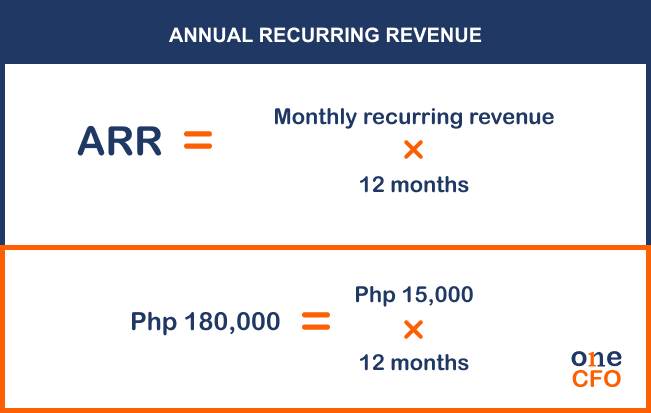

How to calculate ARR

Like the MRR, downgrades and cancellations for the month must be deducted from the revenue

generated from existing and new subscriptions to arrive at an accurate ARR.

However, startups need to consider business activities that can affect the ARR. Marketing

strategies such as free trials or discounts are given to customers to make them sign up and

try the product or service.

The period for free trial should not be part of calculating the ARR. Customers need to be

converted to a recurring subscription to make the revenue generated part of the ARR

calculation.

Specific industries treat discounts and incentives as part of marketing expenses. But this

can be treated too as part of calculating the ARR. The discounted amount, not the original

contract price, should be reflected in the ARR calculation.

Once the amount of recurring revenue is determined, multiply this amount by 12 months to get

the ARR. For example, if the expected monthly recurring revenue is Php 15,000, the ARR would

be Php 180,000 (15,000 x 12).

Why is ARR significant to a startup?

The ARR provides a good picture of the long-term viability of the business, making it easy

to set realistic goals and track the company's progress.

Furthermore, the ARR helps assess how the business strategies are performing. Positive

results mean you can maintain pricing and subscription offers. When revenues are not

improving, it signals a need to revisit marketing and pricing strategies.

CAC: Customer Acquisition Cost

To realize revenue, you must first find paying customers. Acquiring customers and converting

them to take on your product or service entails marketing costs. A metric that measures this

cost is the CAC which stands for Customer Acquisition Cost.

The CAC outlines the financial resources to attract leads and convert these into sales. A

startup must spend on advertisement and promotional expenses, employee salaries, software

and technical tools, and other overhead costs related to marketing efforts.

How to calculate CAC

Before you can compute for the CAC, determine first the reckoning period, whether monthly,

quarterly, or year. Once the period is determined, gather all the marketing, sales, and

other expenses incurred. Then, divide the total expense amount by the customers acquired in

the given period.

For example, expenses incurred for the month totaled to Php 200,000, and for the same

period, customers acquired were 500. The CAC for the month is Php 400 (Php200,000/500 =

Php400).

Importance of CAC

Is the amount spent to acquire customers translated to customers gained? Knowing the CAC

allows a startup to determine if the marketing efforts are cost-effective.

Analyzing the CAC also shows how long it can recoup costs. A business can recover the costs

incurred for customer acquisition through customer monetization, wherein the revenue from

the customer must be higher than the cost to acquire.

You may also improve the product or service value to facilitate a quicker lead conversion.

Fixing the product, adding more features, and bundling it with other products or services

are ways to encourage potential customers to take on your product or service.

In addition, one can also pinpoint how to lower cost centers. Suppose the ad campaign or

joining a marketing event did not generate enough revenue. In that case, it's time to

explore other ways to market the product or service.

LTV: Lifetime Value

How much did a customer spend on your product or service throughout your business

relationship? Forecasting the revenue generated from one customer is called LTV or lifetime

value, considering the value it can give the company over time.

The LTV shows the average time a customer stays and spends. Understanding what can make the

client stay longer translates into higher LTF.

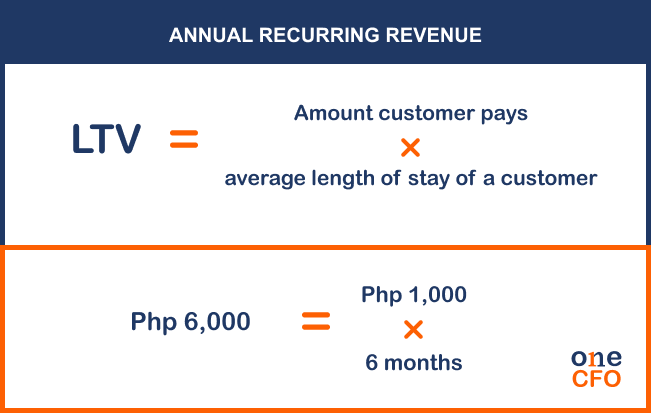

How to compute for LTV:

For example, if your customer pays Php 1000 for your service and the average period a customer stays with the business is six months, the LTV is 6,000.

What is an LTV:CAC ratio?

Combining the LTV metric with CAC gives a better picture of the startup’s profitability in

the long run. Coming up with your business’ LTV:CAC ratio helps determine the

optimal cost

to acquire the customers and the revenue needed to cover these expenses and see profits.

A good balance between marketing expenditures and reaching revenue targets can be tricky.

Spending less on marketing can help the cash flow and budget. But keeping a tight leash on

expenses will also not help you reach your customer or generate enough sales for your

business.

With LTV:CAC ratio, one will understand how much it will cost to acquire customers in

different channels and see the effectiveness in terms of the value it gives to the bottom

line.

A 3:1 ratio shows that your business

earns three times more than the cost of getting each

customer. The higher the CAC to the LTV indicates a less efficient use of the marketing

budget, low sales price, or small quantity generated.

For this reason, tracking your marketing expenses and allocating them to channels that will

effectively bring in more customers is essential.

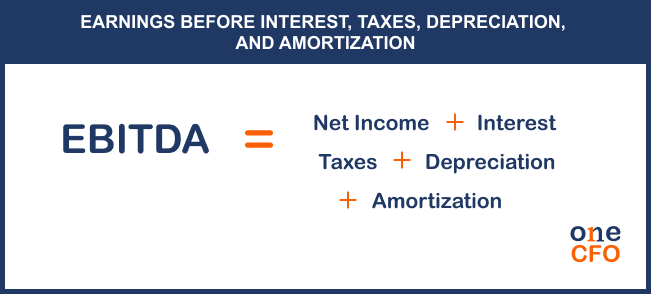

EBITDA: Earnings before Interest, Taxes, Depreciation, and Amortization

Over the years, EBITDA, or Earnings before Interest, Taxes, Depreciation, and Amortization,

became a popular benchmarking tool by investors on a

company’s profitability over its

competitors and the industry.

EBITDA shows the operating profitability as it strips off non-cash expenses such as income

tax payments, interest expenses, depreciation of fixed company assets, and amortization of

intangible assets.

How to calculate EBITDA

EBITDA helps determine the company's valuation for acquisition purposes. To attract buyers

or new investors, EBITDA shows the company’s value in terms of profitability and growth

opportunities.

Bankers also look at EBITDA to indicate the company's cash flow and capability to pay its

long-term obligations.

What are other KPIs relevant to startups?

Additional financial terms may not have acronyms but are equally crucial for startup founders to understand.

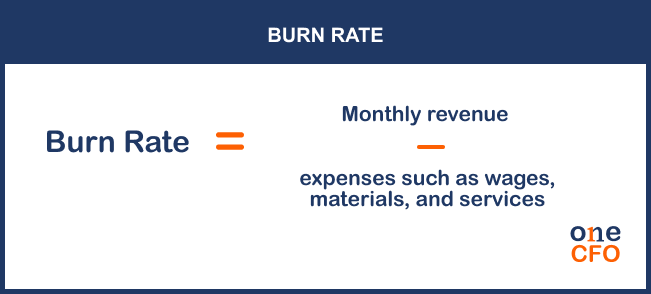

Burn Rate

The rate at which startups use their available cash for their operations is called the burn rate. With this rate, one can track sales versus expenses to see if you are breaking even or realizing monthly profits.

How to calculate Burn rate

The burn rate shows whether the business has positive or negative cash flow. Early-stage

startups commonly have a negative burn rate. They need to incur expenses in the early years

to create the product and generate enough revenue so they’ll be cashflow positive.

A startup founder must understand the burn rate to keep the business viable. One can adjust

costs accordingly and anticipate future challenges.

Runway

The financial term runaway is different from the airport's runway. In startup terms, runway

shows how long the business can operate before the money runs out.

Startups should have at least a runway of 12 to 18 months, and this period

should allow

startups to find clients and realize their revenue.

A startup's average monthly burn rate is vital in projecting the startup's runway. Taking

the amount of funding left and dividing this by the burn rate will lead you to how many

months the runway is.

How to calculate Runway

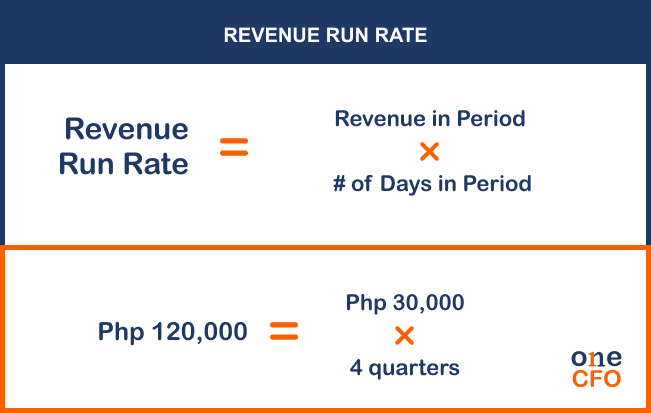

Revenue Run Rate

The revenue run rate allows startups to

make annual revenue projections. This projection is

based on previous revenues earned and assumes that current conditions will remain the same.

Take the current revenue for the week, month, or quarter and multiply this by the number of

periods in a year to get an annualized revenue run rate.

Let’s say your business generated Php 30,000 in revenue in the first quarter; multiply this

amount by four (for the four quarters in a year) to arrive at an annual revenue run rate of

Php 120,000.

How to calculate Revenue Run Rate

Sometimes known as the sales run rate, the revenue run rate helps new and growing companies benchmark their progress even if they have been doing business for a short period. This metric also helps capital-raising activities by providing annual sales predictions when historical data is unavailable.

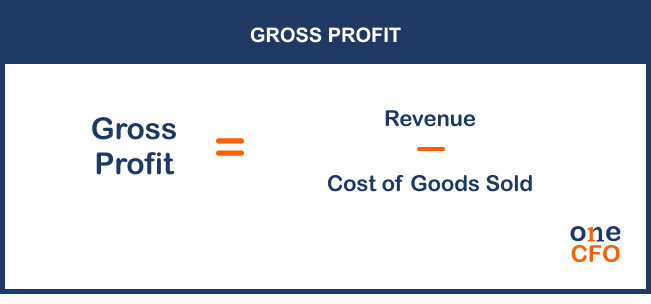

Gross Profit

A commonly heard finance term, gross profit is the company's revenue after deducting the cost of goods sold (COGS). The COGS includes costs of making a product or expenses incurred in providing a service.

How to calculate gross profit

Calculate the gross profit by subtracting the COGS from the revenue. Revenue is the sales generated for a specific period.

Gross profit or gross income appears on the income statement, but what story does this number tell? It shows how profitable a company is for every product or service sold. It can also show how efficiently a business uses human resources and supplies to produce a product or service.

How can bookkeeping help startups?

Startup founders need to know the meaning of the finance acronyms and their impact on the

business's financial health. These metrics provide insights into profitability, cash flow,

and cost efficiency.

Analyze the company with not just one metric. Different key performance indicators, when

combined, give a better picture of the business’s long-term potential and growth.

To track these metrics accurately, a sound system in bookkeeping is vital.

The books provide

information - expenses, and revenue needed to calculate the different metrics.

The books show the expenses incurred in the ordinary course of business. Operational costs

such as salaries, tools, and marketing are necessary to generate leads and sales conversion.

Tracking revenue evaluates how much money the company brings in, which allows startup

founders to develop KPIs to forecast revenue and measure the effectiveness of their

marketing and sales strategies.

Would you like to learn more about using these metrics in developing sound business

strategies? OneCFO PH aims to help startups understand and use

business finance acronyms to

accelerate business growth.

Book a free

consultation now!

Read our disclaimer here.