September 14, 2023 | 4:40 pm

Moving from manual recording of business transactions to automation as your small business

grows is essential to achieve efficiency. But is it time to get accounting software or use a

more comprehensive tool like ERP software?

While both software have some standard features, they are still different programs. These

differences determine whether a small business should use accounting software or ERP.

Accounting software, as described by its name, is mainly used for a business's accounting

and financial management purposes. This software solution covers basic financial tasks,

including managing account payables and receivables, generating financial reports, and more.

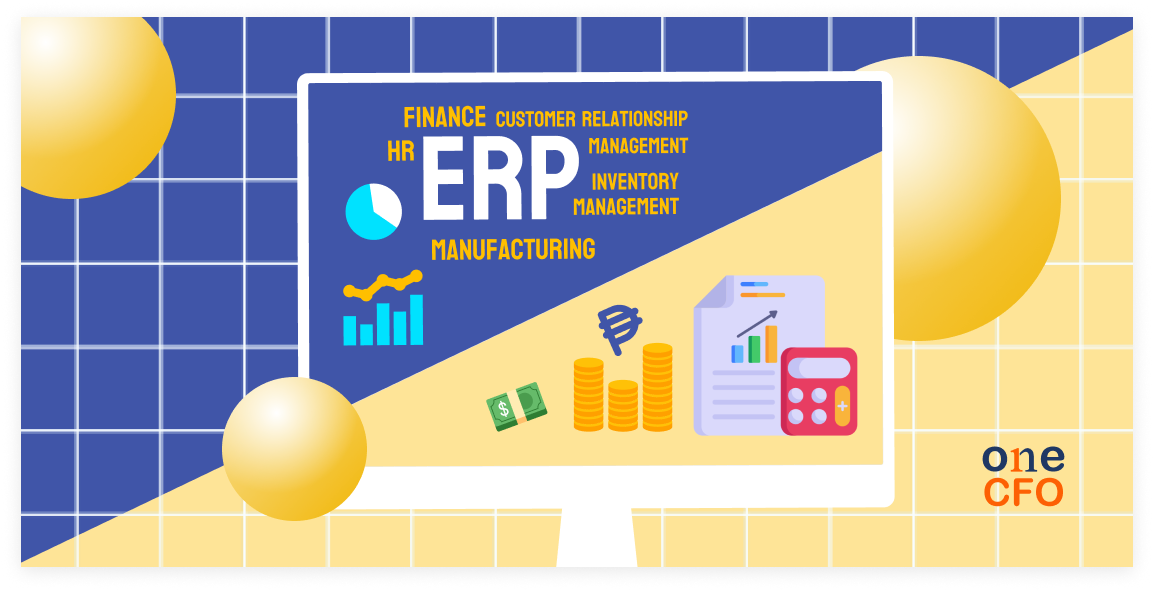

Meanwhile, enterprise resource planning or ERP software covers not only accounting functions

but also a whole lot of other business essentials. ERP software is a fully integrated system

handling supply chain management, human resource planning, warehouse management, customer

relationship management, and other critical business areas.

Understanding the differences between accounting software and ERP is helpful for small

business owners who need help deciding what to use or what fits their needs better. This

article will explain accounting software and ERP, their differences, benefits, and when you

should use each solution.

What is accounting software?

Accounting software is a computer program mainly

covering a company’s financial and

accounting activities. Businesses and individuals use this software to automate and

efficiently perform bookkeeping tasks, managing accounts

payables and receivables, sales

recording, expense tracking, cash flow management, and more.

Aside from the essential accounting functions, small business accounting software like Xero

offers more advanced features such as automatic recording of bank transactions, project

trackers that monitor costs and profitability, online file storage, and various app

integrations are available.

Moreover, small business owners use accounting software to generate financial reports like

income statements, balance sheets, and cash flow statements. With all the financial data

already entered into the system, the accounting software can quickly assemble these

statements for you.

Accounting software helps businesses increase work efficiency and reduce costs by automating

tasks that business owners used to do manually. Additionally, accounting programs give

entrepreneurs insights into their finances, improving and speeding up decision-making.

Companies mainly use accounting software to handle their financial activities while using

other programs for other business functions. However, as the business grows, using different

software for each business area may become unsustainable, especially when dealing with

multiple daily transactions.

What are the benefits of accounting software?

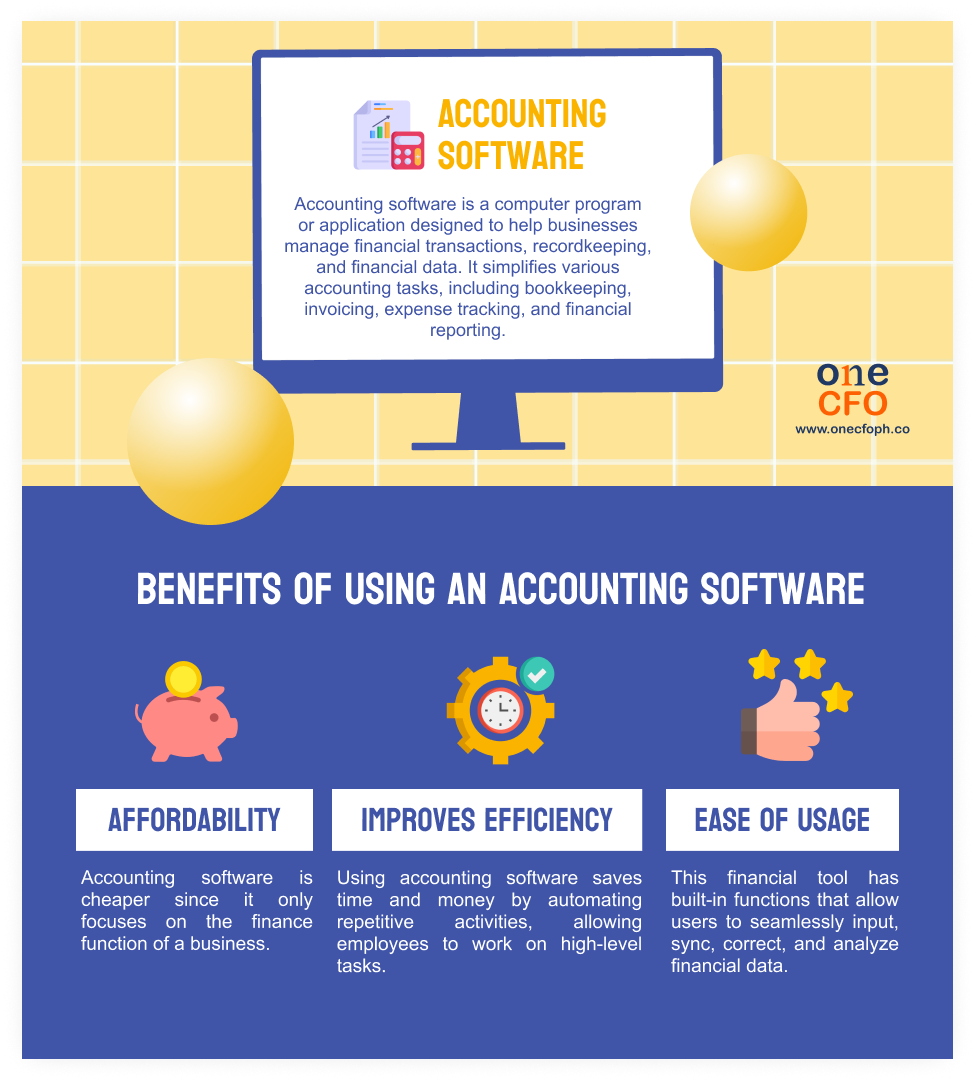

One of the main benefits of using accounting software is it’s the cheaper option. Since

accounting software only focuses on the financial aspect of a business, it’s less costly

than having software that can handle multiple business functions. Its affordability also

makes it attractive to small businesses that don’t have a lot of resources yet to invest in

software applications.

Using accounting software also improves the business’s efficiency and productivity.

Accounting software saves companies time by automating bookkeeping and other finance

activities that would otherwise done using electronic spreadsheets or manually. Automation

also allows business owners and employees to focus their energy on tasks that impact revenue

and business growth more.

Accounting software makes handling financial data easier. The software’s capabilities allow

business owners to connect and sync data across different platforms. There are also built-in

functions available that help detect and correct errors within the platform. Analyzing

financial data and creating reports also become more instant with accounting software.

What is ERP software?

Enterprise resource planning software, or ERP, is a suite of integrated software

applications covering almost every business area, including accounting. In short, ERP

software is like accounting software plus more!

Businesses use ERP software as a comprehensive and end-to-end solution since it serves most,

if not all, business functions in a single platform. ERP software also offers seamless

integrations across all business areas since they store the data in one place.

Some of the modules included in an ERP are functions for project management, human

resources, supply chain and operations, warehouse management, marketing, customer

relationship management, and other industry-specific solutions.

Because of its wide range of capabilities, there is a common misconception that ERP can be

very expensive; hence, only large businesses can use it. However, ERPs can also be

affordable and SME-friendly, like Britana.

Using ERP instead of basic accounting software gives businesses a unified view of their

enterprise data, allowing them to make relevant analyses and decisions for multiple

departments. Having access to data across all business functions also makes planning and

reporting more accurate and increases transparency within the company.

What are the benefits of ERP software?

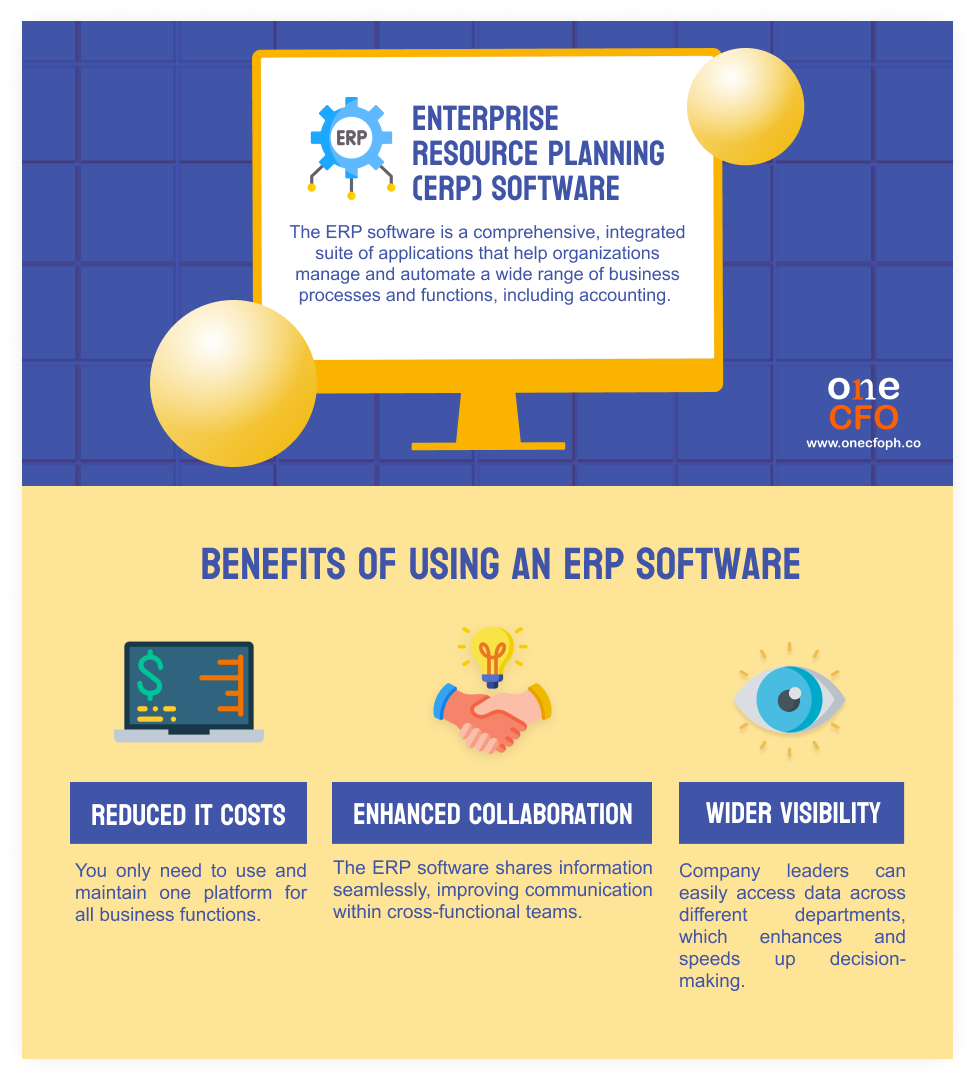

ERP software dramatically reduces IT costs since using and maintaining different programs

for every business function is unnecessary. Additionally, using a single platform for all

departments lessens the time required to train your employees to use the software.

Collaboration between teams also improves when using ERP software. This software

automatically shares data and information across departments, reducing back-and-forth

communication between employees. ERP software also helps cross-functional teams track the

progress of each team member, increasing efficiency.

There is also more comprehensive visibility into company data when a business uses ERP

software, a centralized platform for all business information. ERP software also allows

company leaders to make and implement data-driven decisions and policies using real-time

data they can access from the software.

Accounting software vs. ERP software: What is the difference?

Even though accounting software and ERP software have overlapping features, they are still different in many ways. Here are some of the key differences between accounting software and ERP:

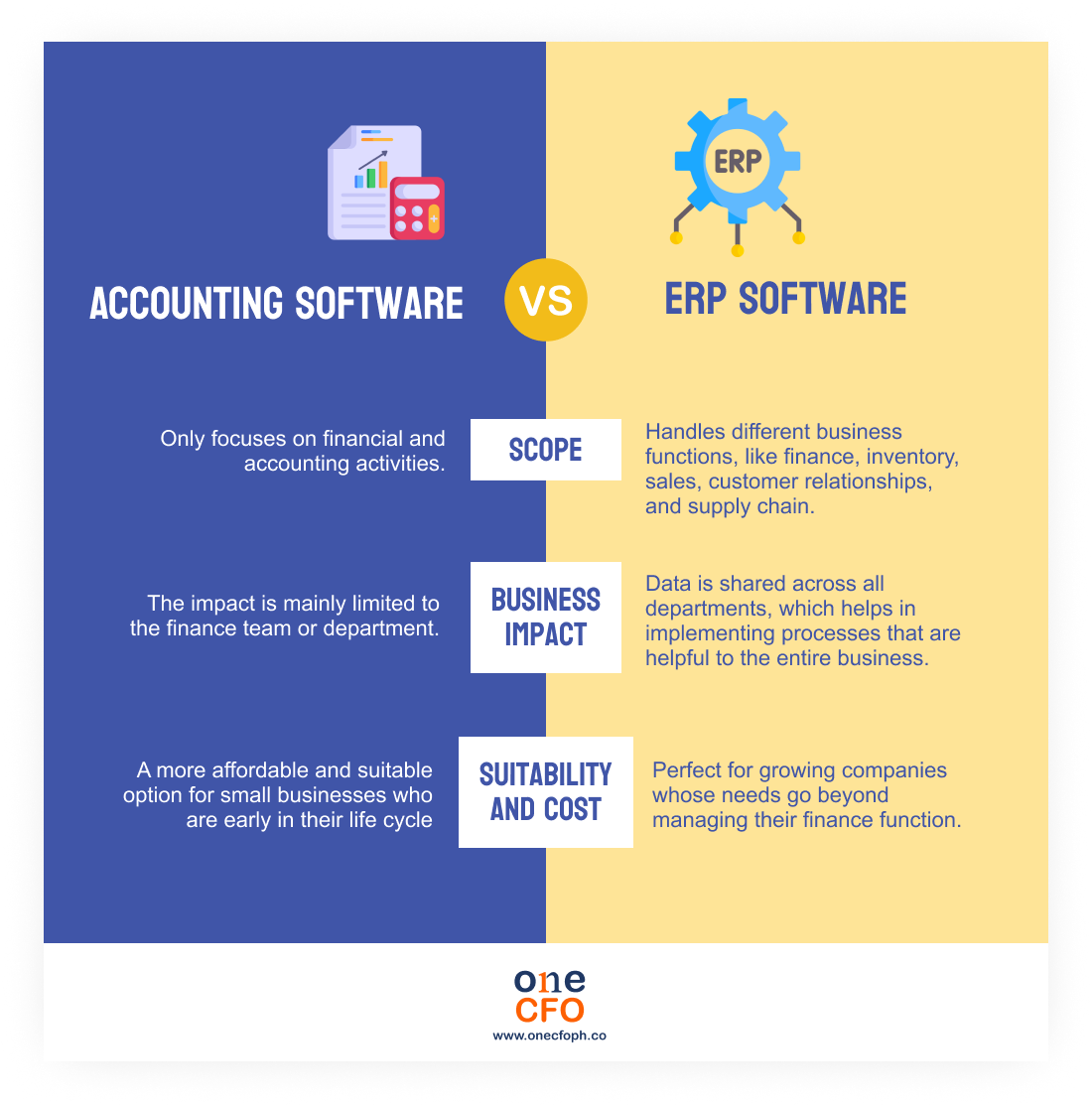

Scope

One of the most significant differences between accounting and ERP software is their

scope. Accounting software handles financial and accounting transactions, which helps create

finance strategies, monitor key performance indicators, and

manage risk. Small businesses

that use accounting software resort to using other programs or applications for tasks

unrelated to finance.

For example, a small business owner may use accounting software to automate and

handle their

bookkeeping, invoicing, and financial reporting. If the business owner decides to automate

another business function, such as customer relationship management, they must look for

another software.

Fortunately, most accounting software has multiple integrations, which can help sync data

across different software. However, setting up these integrations can also take time and

additional work.

On the other hand, ERP software has a broader range of functions, covering almost all

business facets. Using an ERP helps small businesses seamlessly link their financial data to

all other systems and processes of the company.

Since ERP is a fully integrated system of different applications, syncing data across

multiple departments is much easier.

For example, suppose a small business uses an ERP software. With ERP, small

business owners

can easily track their bills, manage sales, monitor inventory, and automate their

bookkeeping in a single platform.

Business Impact

Compared to accounting software focusing on financial data, ERP software can track and

optimize many business factors such as sales, human resources, and inventory.

To paint a better picture, you can think of ERP as a house made of different blocks, where

each block represents the various functionalities of the software. With an ERP, business

owners have a ready-built system for all their business needs.

Meanwhile, accounting software is only a block in the ERP house since it only serves one

business function - finance and accounting.

A primary advantage of ERP is its access to business data from multiple departments and the

ability to integrate them automatically. ERP software can generate more detailed reports,

which helps businesses make data-driven decisions. For example, a small business owner can

use ERP to create a financial forecast while considering historical sales and inventory

data.

Suitability and cost

Entrepreneurs may not need ERP software yet, depending on the stage of a business.

Accounting software is more suitable for small businesses starting out with only a few

orders or clients. At this stage, small companies only worry about tracking their finances

and have a smaller budget for software

services.

However, switching to ERP software can be more viable once sales pick up and the business

hires more staff or purchases more inventory. Using a single integrated system for all

business data gives small business owners more visibility that can help their company grow

faster.

When looking for ERP software, it's best to check its available functionalities and if it

fits your business needs. Large enterprises may need ERPs that are more comprehensive yet

expensive. However, ERPs are available specifically designed for small businesses, making

them much more affordable.

When should small businesses use ERP software?

Most of the time, small companies still early in the life cycle only focus on selling their

products or services and being profitable. Since the concern of small businesses is mainly

about managing finances, they need to use accounting software in the early stages.

But as business operations grow and expand, business owners must set up more processes to

manage their staff, inventory, customer relationships, and more. At this point, small

businesses may use different spreadsheets or software applications to manage each business

function.

However, relying on various programs to manage your business can be unsustainable or

confusing for your team. Using multiple applications can also increase IT costs since you

need to pay for and maintain all these programs. Once your business needs to go beyond the

capabilities of your accounting software, it’s time to switch to using ERP.

With an ERP, businesses won’t need to silo their data and processes to different programs.

Scaling the business also becomes more manageable with ERP since you will have more

visibility into what’s happening in the company.

Choosing between accounting software and ERP

Every entrepreneur has varying needs depending on where they are in the business. If you

only want to focus on improving your finance management, then accounting software may be for

you.

However, there comes a point when small businesses outgrow their simple accounting software.

When a business starts to gain traction, expand its customer base, and see increases in

revenue and transactions, ERP software becomes more suitable to address the business’s

growing operational needs and agile requirements.

Whether you choose accounting or ERP software, OneCFO is here to help you with your

business!

OneCFO is your outsourced finance

department, managing your bookkeeping, tax compliance, and

payroll needs using tech-enabled services and software, including Xero.

Additionally, OneCFO recently partnered with Britana to further empower small

businesses

with their ERP solution.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with

financial management and business growth.

Read our disclaimer here.