July 7, 2023 | 4:45 pm

Setting the right price for your product or service is one of the most complex decisions a

business owner has to make. Key factors must be considered, as you don’t want to price your

product or service so high that customers will steer clear of it. On the other hand, you

also don’t want to price it too low, compromising profitability.

Effective pricing strategy aims to find that sweet spot your target market is willing to pay

and where you can still earn a profit to keep your business sustainable. However, pricing is

not only a decision you make once.

So, how should you price your product to achieve profitability and sustainable growth?

Different business aspects and economic situations must be analyzed and visited often to

determine pricing and revenue optimization.

This guide dives deep into pricing factors to help small businesses identify optimal pricing

strategies to keep their competitive advantage.

What are the pricing considerations for businesses?

Pricing your products or service is as much an art as a science. You don’t simply compute or choose a specific number - many factors come into play, which small business owners should consider to be competitive in their chosen market.

Business goals

Your goals affect the pricing strategy to keep the business at a competitive advantage. Some

common business goals are increasing your market share, maximizing your profits, creating

brand awareness, or being a trendsetter.

For example, if your goal is to increase your market share, opt to lower your prices to

improve sales, attracting more customers and thus widening your customer base.

On the other hand, maximizing profits might mean choosing the highest price the target

market is willing to pay, even if this limits your number of sales. The price increase can

still give more profit with fewer customers compared to selling at a lower price to more

customers.

Whatever business goal you have will dictate your best pricing strategy, so identify your

goals first.

Cost of production

Knowing your costs sets the baseline for pricing - at the very minimum. After all, your

price should always be higher than your costs if you want to turn in a profit and keep your

business running.

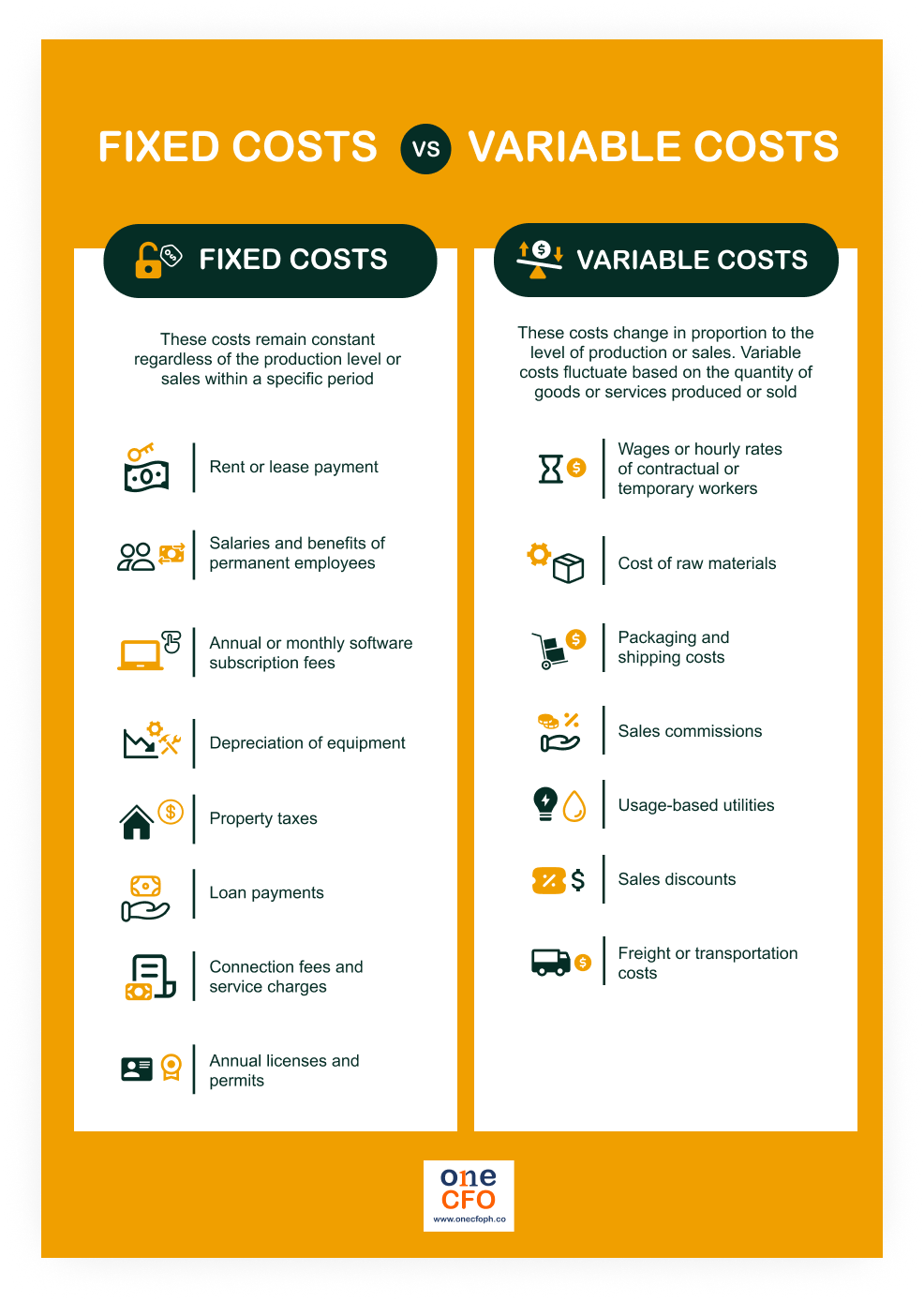

When listing your costs, determine the variable and fixed costs.

Fixed Costs vs. Variable Costs

Variable Cost

The direct costs of producing and delivering goods or services are under variable costs.

Variable costs change depending on how many products or services you sell.

For example, in a cupcake business, the more cupcakes you make, the more flour or sugar you

need to buy. The cost of ingredients used to make cupcakes is variable, as this can increase

or decrease depending on the quantities produced.

Another key consideration is the direct material costs that vary based on the quantity

required for each unit produced. Factor in packaging, shipping, and transportation costs, as

these changes depend on the quantity shipped or distance traveled. Usage-based utilities

like electricity or water increase with higher consumption too.

Consider the pricing tactics for increasing sales, such as discounts offered to customers

based on purchase volume or promotional activities. Commissions paid to sales

representatives based on the number of sales generated should also be part of pricing

analysis and decision-making.

Businesses can employ part-time workers when orders are higher or during high volume season.

Wages paid to these workers change, too, depending on the number of hours and hourly rate

and should be part of calculating the selling price of the product or service.

Therefore, variable costs are typically more directly influenced by production or sales

volume changes, making them dynamic expenses that fluctuate as business activities change.

Fixed Cost

Meanwhile, fixed

costs remain stable regardless of how much a company produces or sells.

These are usually overhead costs that are constantly recurring in your business.

For the same example, suppose you’re only renting a space for your bakery. The rental fee is

an example of a fixed cost since you pay the same fee regularly regardless of the number of

cupcakes sold.

Another fixed cost is the salary you want to receive as a business owner and for permanent

employees. Include the expense incurred in paying government-mandated and other fringe benefits.

Consider the fees paid on an annual or monthly subscription and usage or connection fees for

internet or other utilities to achieve optimal pricing.

If you borrowed funds, this entails paying principal and interest, an obligation even if the

sales volume is low.

Licenses and permits, paid to the government to be able to operate annually, are also fixed

costs to consider.

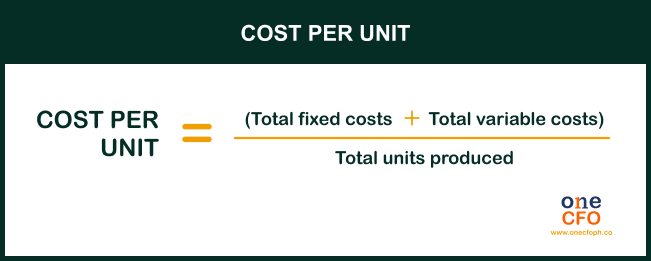

How to calculate the cost per unit

Once you have the total fixed and variable costs, divide the total cost by the number of products produced to get the cost per unit.

Profitability

After arriving at the cost per unit, the next question to ask yourself is, “How much profit

do I want to make?” Always add a profit margin to determine your selling price.

Pricing is crucial for any business as the selling price should be higher than the cost per

unit. Having enough profit margin in a business is essential to keep it sustainable,

especially when sales are lower than usual.

A good range for a profit margin is 20% to 50%, but consider the other

pricing factors

before choosing a certain percentage. Setting your profit margin too high without proper

justification or research can make selling your products difficult.

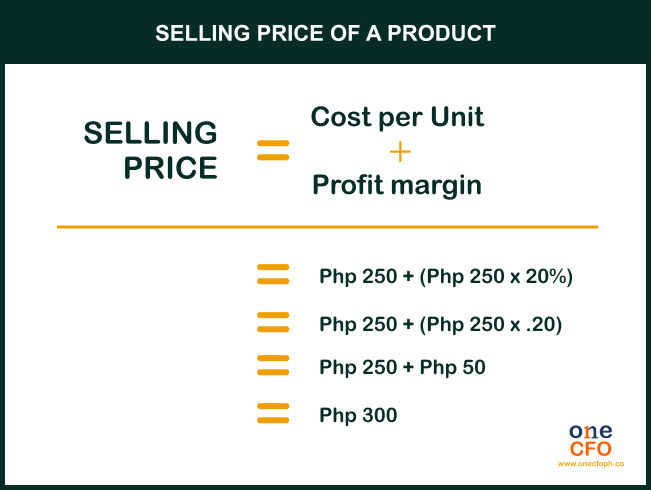

How to calculate the selling price of a product

Once you determine the profit margin rate, calculate the selling price by adding the cost

per unit plus the profit margin.

For example, suppose your profit margin is 20%, and the cost per unit is Php 250. This is

how to arrive at your selling price:

What is LTV:CAC ratio?

To analyze your business profitability deeper, you can also calculate your LTV:CAC ratio or

the lifetime value to customer acquisition cost ratio. Lifetime value (LTV) refers to how

much money you make from an average customer.

Meanwhile, customer

acquisition costs (CAC) refer to how much you spend to get a new

customer, which includes sales and marketing costs.

Ideally, your LTV should be three times greater than your CAC to ensure profitability in

business. If your LTV:CAC ratio is lower than three, conduct a cost analysis to check ways

to minimize marketing costs, increase prices, or find a way to upsell more products to

customers.

Target market

Another critical consideration when choosing a pricing strategy is identifying and

understanding the target market. Are they the type of people willing to splurge on your

product? Or are they the ones always on the lookout for the cheapest price in the market?

Customers have different decision-making styles, which affect

how they see the

value of your

product or service. The important thing is to ensure that the pricing strategy matches

customers' traits or decision-making styles.

Target market segmentation helps determine your value

proposition, what will appeal to them,

and their buying behavior. For example, a more affordable price should be an option if your

target market is from low-income communities.

One way to understand your target market is by conducting buyer persona surveys where you

learn about their demographics, traits, and reasons behind buying your product. You can also

ask them more about their needs to add value to your product.

Market positioning

Knowing your target customers also means choosing your position in the market. Market

positioning means deciding what image you want your customers to perceive about your

product.

Do you want to be known as a luxury status symbol? Or do you want to be known as a low-cost

leader? Of course, market positions are not just limited to these two criteria.

You may settle yourself in the middle, or depending on the urgency of the problem you’re

solving, you could charge premium prices even for average to lower-quality services.

Remember that there are always buyers at different levels of product quality - know how to

position yourself and entice them with attractive product prices.

Competition

Assessing your competition’s prices is also essential when pricing your product. Especially

for new business owners, doing competition or market research can give you an idea of how

much your target market will pay for similar products.

Staying updated on product prices in your industry helps you stay competitive when selling

products or services. However, this doesn’t mean prices should always be lower than everyone

else’s. Instead, know how to justify the product or service's value if you set a higher

price.

Aside from keeping notes of product prices, look at any promos, introductory offers, and

special inclusions your competitors have for their products. Knowing this will also be a

good guide on the unique thing you can offer your customers to stand out.

Economy

Aside from keeping tabs on product prices based on your competitors’ data, consider how

economic factors affect prices in your industry.

For example, prices of raw materials tend to increase during inflation, which means

evaluating the effect of the changes and if there’s a need to raise prices. If you neglect

to adapt to the economic changes, this can affect the business’s survival.

Economic factors can also dictate which industries or products are more in demand, which you

could take advantage of if you want to raise prices.

At the same time, always be ready if business becomes slow due to economic events. A pricing

strategy should help build a cash reserve for times like these to

weather through and keep your business afloat.

Why is pricing strategy important?

Pricing your product is more than just a one-time thing. Your product's pricing evolves as

you gather more customer insights and experience.

Repeatedly consider the different pricing factors to see what would make the most sense for

your product or service. As pricing is a dynamic process, regular monitoring and evaluating

the pricing strategy ensures prices remain effective and competitive.

But if you still don’t know where to start or how you can properly price your products,

OneCFO got your back!

Here at OneCFO, we aim to understand your business and give you CFO-level insights and

advice so you can make the best financial decisions for your business.

Subscribe to OneCFO

services to achieve world-class

finance capabilities without breaking

the bank.

Read our disclaimer here.