March 5, 2024 | 3:12 pm

Table of Contents

Curious if your small business holds enough cash to thrive? Building cash projections

provides clarity on your cash position. Take steps to prepare one for better financial

foresight.

Cash projections are predictions or forecasts of the amount of cash coming in and out of the

business for a specific period. By making cash flow projections, the company can estimate if

they will experience a shortage or surplus in cash and factor that into their

decision-making.

Preparing cash projections involves:

Learn why cash projections are important for your business to thrive. Improve the future of your business by knowing the steps to preparing one.

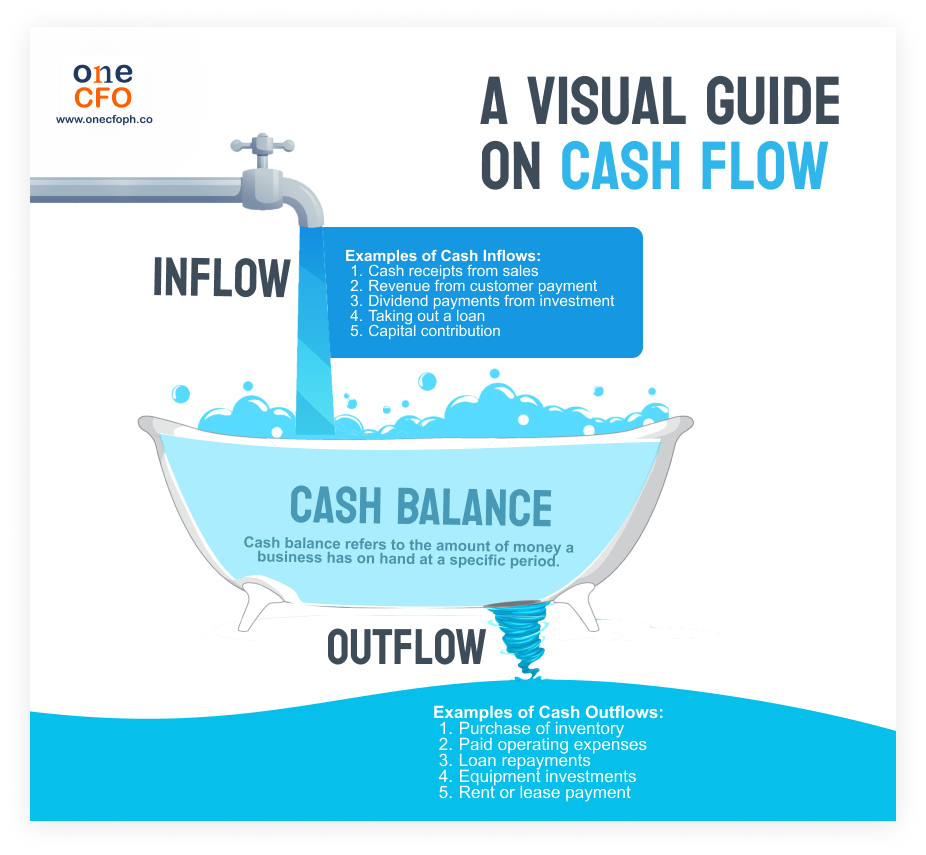

What is cash flow?

Before discussing cash flow projections, it’s best to understand first what a cash flow is.

Cash flow is the movement or flow of

money in and out of the business. You can compute this

by getting the difference between cash inflows and outflows.

In the book Personal MBA by Josh Kaufman, the author compared the cash flow cycle to running

a bath. To make the water in the tub rise, you must keep adding water while preventing it

from flowing out.

Similarly, you need more cash inflow or revenue in business than outflow or expenses if you

want more cash.

What are the three types of cash flow?

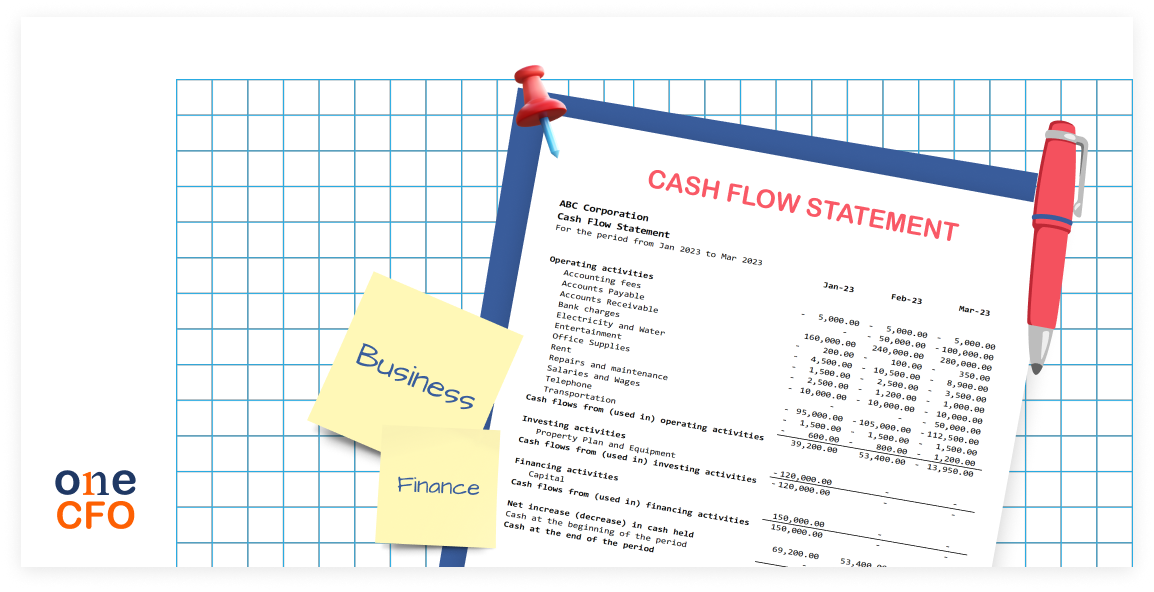

As reflected in cash flow statements, your cash flow transactions can be divided into three types:

The cash flow statement tracks the inflow and outflow of money over a set period. While striving for a positive cash flow is essential, it’s common for small businesses to face challenges with negative cash flow.

What is negative cash flow?

A negative cash flow happens when a

business spends more money than it makes. It is similar

to using up your allowance faster than you receive it.

Companies should have a positive cash flow to ensure enough cash to cover payables for the

period. However, there are instances when a business experiences negative cash flow.

One scenario is when a company hasn’t received their customers' pending payments. Recording

these receivables in the income statement will make them look profitable on paper, but they

don’t have the cash on hand.

Another common reason for negative cash flow is when the company makes investments that may

take some time to generate inflow. This scenario is common in startups, where they must keep

spending money on growth initiatives.

If inconsistencies in your cash flow happen often enough, this can spell trouble for the

business. Thus, cash flow projections are important to identify potential cash shortfalls in

the coming months.

What is a cash flow projection?

Cash flow projection estimates cash inflows and outflows a small business expects to have

over a certain period. It helps businesses forecast their financial position, anticipate

cash shortages or surpluses, and make informed decisions to manage their finances

effectively.

More established businesses can predict their cash flow for extended periods, such as six

months to a year, since they have more data to back up their estimates.

Meanwhile, it is ideal for newer businesses to project their cash flow weekly or monthly.

Since these businesses have less past data they can use, it would be better to create

forecasts more often to get accurate predictions.

Why is a cash flow projection important to your business?

Creating a cash flow projection is like looking into a crystal ball, predicting your business’ future.

Predicts cash shortages

A cash flow projection helps businesses avoid and remedy shortages that may cause financial

challenges. Owners can check liquidity in the coming weeks or months and the possible

shortfalls before they happen.

Shortages typically happen when there is low customer demand or poor cash flow management.

Other times, a company experiences negative cash flow when it makes significant investments,

such as buying properties, where they tend to spend more money than what they earned for the

period.

Once the company foresees a shortage, the management can find immediate solutions to avoid

the problem quickly.

A business can solve shortages by raising funds, taking loans,

boosting income streams, reducing customers’ payment terms, and negotiating with vendors.

Watch this video to get more insights on how to manage cash flow and avoid liquidity issues:

Maximizes cash surpluses

As financial forecasts predict cash shortages, they can also predict future cash surpluses!

By knowing when the company will likely have a surplus or extra cash, business owners can

strategize on maximizing the situation to their advantage.

For example, entrepreneurs can use cash surpluses to reinvest in the company and boost the

business’s growth. They can do this by hiring more people, purchasing new equipment,

increasing their marketing budget, and more.

Companies can also settle payables in advance to foster better relationships with their

vendors and suppliers.

Debt management

Cash flow projections also help businesses manage their debts in many ways:

Scenario planning

Another advantage of making cash flow projections is the ability to predict your cash flow

in different scenarios.

Businesses can repeatedly tweak their forecasts to depict scenarios like hiring more people

and launching a new product.

On the other hand, they can also plan for not-so-good scenarios like sales dropping by a

certain percentage or losing a specific amount of customers.

By plotting the company's best-case, worst-case, and most likely scenarios, business owners

can better prepare themselves and manage their cash flow accordingly.

Aside from planning different scenarios, businesses can also plan the best time to implement

their decisions.

For example, if a company wants to expand into new markets by building branches in other

cities, it can expand when the business has a cash surplus. By doing so, business owners

won’t risk experiencing shortages while supporting company growth.

How do you make cash flow projections?

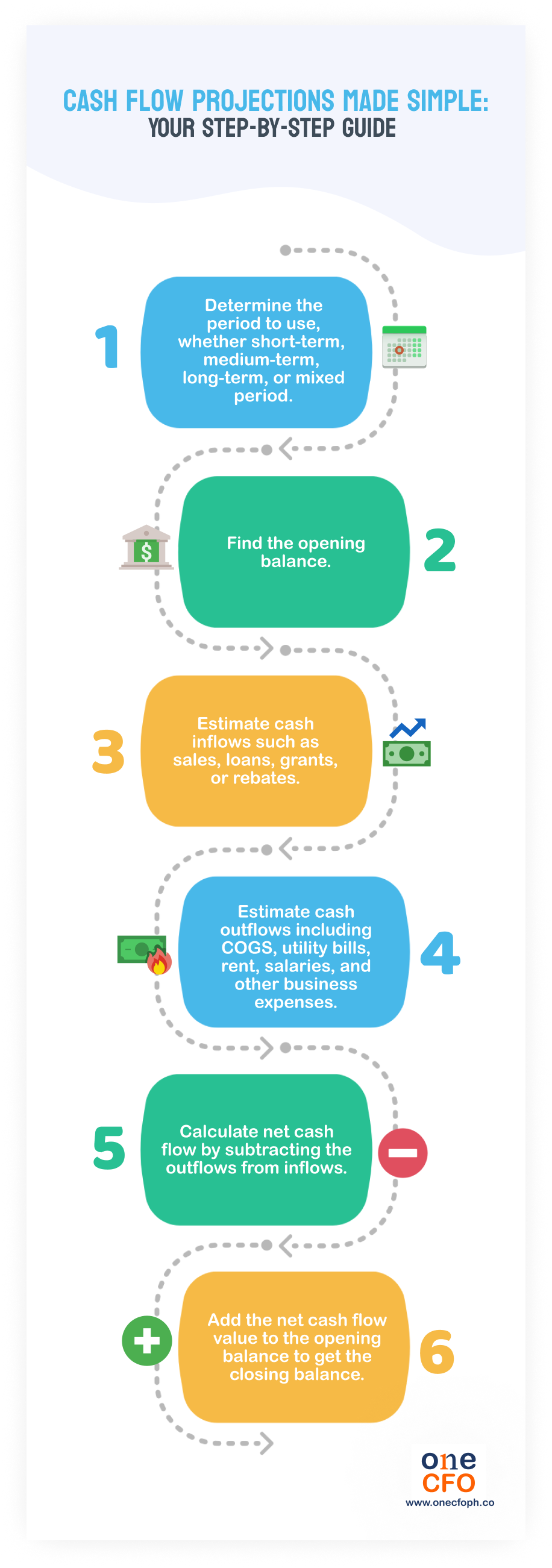

Creating cash flow projections helps make better business plans and decisions. Here are the steps to make your cash forecast:

Determine the period to use

The first step in creating cash flow projections is determining the period or how far you

want to look into the future.

It’s also important to remember that there’s a trade-off between the forecast duration and

its accuracy. Predicting too far ahead means you have less information to work with, and the

accuracy or reliability of the forecast is also affected.

Short-term

Forecasts with a shorter period are best for new or small businesses that need to manage

their day-to-day needs. Typically, these businesses can look at short-term liquidity

planning one to four weeks into the future.

Creating short-term projections may require automation in collecting data from

bank

transactions. Accounting software or ERP systems with real-time inflows

and outflows allow

business owners to automatically update their forecasts and create strategies around them.

Medium-term

A medium-term forecast is more suitable when planning for debt or interest payments. This

forecast can be good for two to six months and helps businesses foresee possible liquidity

issues in the coming months.

Companies typically create financial reports for key dates such as month-end or quarter-end.

It’s best to use medium-term forecasting for these kinds of reports since the estimation

period aligns well with the cadence of such reports.

Long-term

Cash projections with a long-term period usually forecast cash flow six to 12 months into

the future.

This long-term projection is suitable for established businesses with more data to use in

the forecast. Having available information reduces the inaccuracies in the projection, even

when it predicts cash flow far ahead.

Long-term cash projections are also used for long-term growth strategies and planning.

When using these projections, businesses look at the bigger picture and use this as a

reference when planning annual budgets or the capital they’ll need for the following year.

Mixed-term

Businesses can also create forecasts with mixed periods as they see fit for the business.

Mixed-period projections are helpful for companies that want to spot potential risks in

liquidity early on.

For example, a new entrepreneur can choose to create a weekly forecast for their first three

to six months in the business. Once they have more information, they may change the forecast

period to monthly or quarterly.

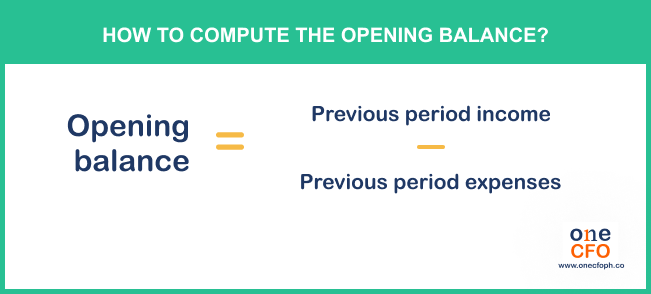

Find the opening balance

After determining the period, you need to find or identify the opening balance for the

forecast. Opening balance is the amount of money the business is starting with.

If the company is new, the opening balance is the investments and capital prepared to run

the business.

On the other hand, businesses that have operated for some time can find their opening

balance by subtracting the previous period’s expenses from their income, as seen in the

formula below. They may also check their balance from their last cash flow statement.

Estimate cash inflows

The next step is to predict how much cash inflows the business will have for the next

period, including revenue or sales, loans, grants, or rebates.

Since cash flows essentially measure how liquid the business is, remember to only consider

on-hand cash or those in the bank account as an inflow. Doing so gives you an accurate

picture of how much cash the business can use now.

To predict the inflows, businesses can look into trends from the previous periods or

estimate based on the current state of the market.

Estimate cash outflows

Likewise, you need to estimate the business’s cash outflows or expenses.

Common business expenses include the cost of goods sold,

utility bills, rent, salary, taxes,

marketing spending, and debt repayments.

Also, consider any one-time or seasonal business expenses like

employee Christmas parties.

A good practice is adding an “Other expenses” category, a buffer in your projection for

unexpected expenses.

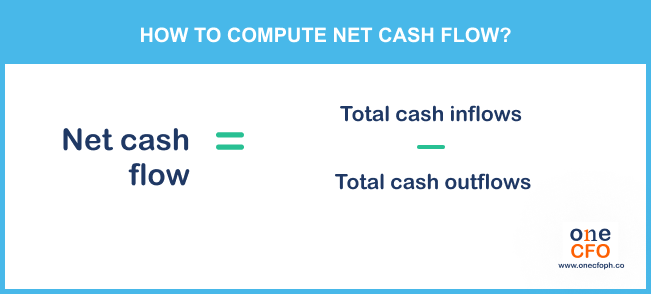

Calculate net cash flow

Once you have estimated the total cash inflows and outflows, then simply use the net cash flow formula to compute the net cash flow:

From here, you can easily see whether you will have a positive or negative cash flow.

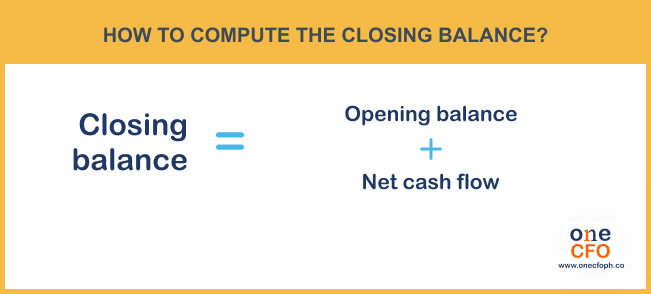

Compute the closing balance

The final step is to add the calculated net cash flow to the opening balance, giving you the closing balance. See the formula below:

The closing balance gives businesses an overview of how much money they will have remaining after the period. This balance is also the opening balance for the next period’s projection.

Leveraging financial acumen for optimal cash flow projections

Creating cash flow projections can be daunting, especially for small business owners. Aside

from the needed computations, entrepreneurs must also ensure the accuracy of the data they

use and create meaningful insights from their forecasts.

Fortunately, there's a solution that doesn't require small business owners to become

financial experts just to have cash projections - letting pros, such as OneCFO, do the work!

OneCFO is your

outsourced finance department offering tech-enabled bookkeeping, payroll,

tax, and CFO services to small businesses at an affordable price.

In addition, OneCFO’s team of financial experts is also well-equipped to provide your

business with essential reports and insights, like cash projections, helping you build

strategies for long-term growth.

Visit us at onecfoph.co or

contacting us at [email protected] to learn how we can help with your

cash flow projections and optimize your growth.

Read our disclaimer here.