April 16, 2024 | 2:53 pm

Table of Contents

Turning your dream business into reality? Many entrepreneurs need proper guidance when

starting a business to avoid costly mistakes. Mastering these 8 crucial lessons equips you

to navigate challenges and set your venture on the path to success.

Whether experienced or starting out, every entrepreneur benefits from insights when

launching and running a business properly. From finding your “why” to maximizing efficiency,

it's the knowledge you wish you had before launching.

Dive deeper into these 8 game-changing lessons and embark on your entrepreneurial journey

with confidence. We’ll show you how to not just survive but excel in the exciting world of

business ownership.

#1 Know your “Why”

Before starting a business, you must ask yourself, "Why are you doing this?" Your answer to

this question will become your inspiration and compass throughout your business journey.

The "why" can be as simple as wanting to

make more money, have more freedom of time, or

follow a personal passion. Meanwhile, some are more philanthropic, such as wanting to serve

specific groups in society or change the world.

If you haven't figured out your "why" yet, take the time to reflect on and articulate the

driving force behind your business. Your "why" will inspire and guide you through strategic

decisions that shape your business.

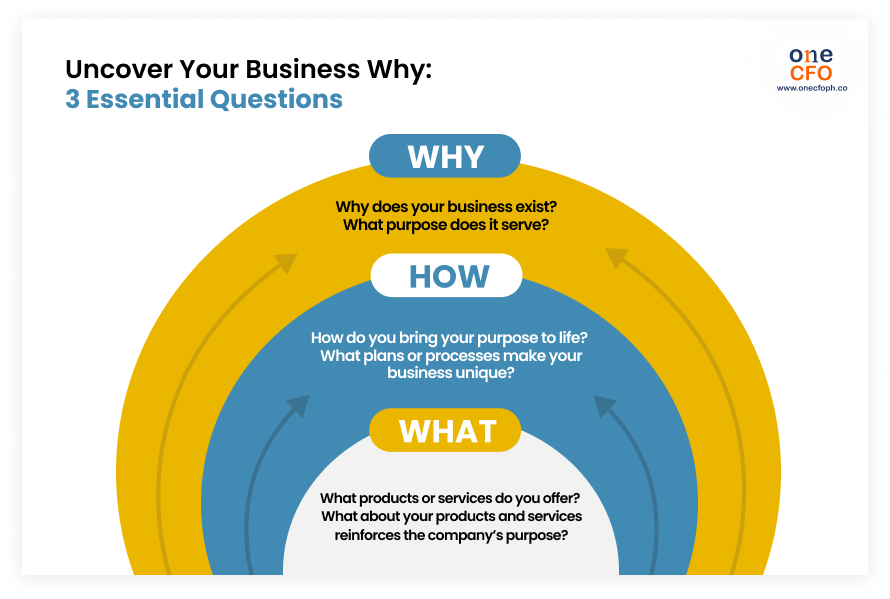

How do you find and understand your why?

Finding and understanding your why involves identifying the problem your business wants to

solve and ensuring it’s relevant to your target market. These solutions could fill a market

gap, ease a pain point, or improve people’s lives.

The ability to solve a real problem for their audience separates profitable and successful

companies from the rest. Customers are also more attracted to supporting businesses that

serve a greater purpose.

Start understanding your why by diving into these questions:

Regardless of your "why," what's important is that it motivates you in your venture. The early stages of a business can be pretty challenging, and having a solid "why" reminds entrepreneurs to keep going and pushing through.

#2 The power of mentorship

Another essential tip for business owners is looking for a good mentor who can guide and advise them while running the business. Ideally, mentors are people you look up to in the industry and are seasoned or have extensive experience.

Benefits of a good mentor for SMEs

Don’t underestimate the power of a good mentor!

Here’s why a mentor is your key to overcoming business challenges and achieving goals:

How to find a business mentor?

Finding a business mentor is about building a strategic partnership.

The first step is to identify your business goals and desired path. Then, you can narrow

down which entrepreneurs or experts have career or business paths that align with yours.

A mentor should also be someone who inspires you and can advise on things specific to your

business industry.

If you can’t think of anyone instantly, don’t worry! You can start by networking through

LinkedIn or in-person events, like conferences. Make sure to get to know them genuinely to

foster a connection built on trust and shared aspirations.

#3 It doesn’t have to be perfect

One of the most common mistakes aspiring entrepreneurs make is waiting for their business to

be perfect before launching it - having the perfect logo, website, marketing materials, and

product or service.

When new business owners wait too long for perfection, they stall their progress and lose

opportunities to grow the business further.

It may seem counterintuitive, but launching your business even when it isn’t perfect helps

you identify critical areas for improvement and move closer to the “perfection” you want to

achieve.

Dropping the perfectionist mindset doesn’t mean it’s okay to be sloppy or hasty in making

decisions—it simply means you shouldn’t let imperfection stop you from taking the first

steps.

Furthermore, remember that mistakes are simply feedback you can use to improve.

Many people have brilliant ideas, but the thought of them needing to be perfect prevents

them from getting started. Separate yourself from the rest and just do it.

#4 Don’t do everything alone

It may be tempting to do everything on your own, especially when you’re on a tight budget.

However, when it’s too much, and you’re spreading yourself thin across many functions in the

business, you should start asking for help and delegating tasks.

In business, one of the things entrepreneurs should learn is to let go. Look for trusted experts and

delegate tasks to them that you don’t enjoy or are outside your

expertise.

This way, you free up time to focus on things you’re good at, which would further grow your

company.

Getting help from others also lessens the risk of burnout, slowing the business’s progress.

Why SMEs should outsource tasks?

Taking on all business tasks by yourself can be exhausting. At the same time, hiring

full-time employees straight from the bat might also be expensive.

A good middle ground to keeping business expenses low and business productivity high

is to

outsource to professionals or contractors instead.

Outsourcing tasks is a real game-changer. It lightens your load and lets you concentrate on

tasks that highly impact revenue generation, such as product ideation or improvement and

increasing customer satisfaction.

For example, outsourcing business registration allows you to focus on your

passion, not

paperwork. Finding an expert who can register your business and all the legal requirements

quickly and accurately means you can get right to what matters most: building a thriving

business and serving your customers.

You can also tap into specialized talents when outsourcing tasks. An example is bringing in

a seasoned fractional CFO to handle your

finances. By doing so, you can be sure that they’ll

do the job right, and you’ll only pay for the help or services you need, saving you more

money.

Know more about how fractional CFOs help SMEs grow their business by watching this video:

#5 Don’t undervalue your products or services

New business owners often undervalue or underprice their products or services because they

lack the confidence to demand what they deserve, do not fully understand the competitive

landscape, or fear losing customers.

The price of your products and services should reflect your worth and market conditions.

Underpricing is a disservice to your business. So, ensure that you are charging a fair and

sustainable price.

To set the right price for your products,

assess your business goals and conduct market

research. Clearly communicate the value proposition to customers by setting prices based on

perceived value, not just production costs.

Pricing can be tricky, especially for new entrepreneurs. But remember that pricing your

products and services is not a one-time thing but should change as the business evolves.

As you gain more experience and feedback, you’ll build confidence in setting the correct

prices that are satisfactory to your growth and customers.

#6 Be open to learning

Successful entrepreneurs are open to learning from others—whether they are customers,

employees, fellow business owners, or just regular folk.

The voice of your customer matters most. Connect with them directly and gather valuable

feedback. Ask about satisfaction, improvement areas, and potential referrals. Their insights

can fuel business growth.

Moreover, entrepreneurs can gain crucial insights from their employees, even as bosses.

Set up regular check-ins and ask if they see anything worth improving or changing in the

company. Asking employees for feedback also makes them feel valued and increases job

satisfaction.

Most importantly, it’s essential for business owners to get themselves out there and

network. Meet people at business events or ask fellow entrepreneurs for a quick chat. You

never know what you might learn when connecting with others.

Ensure there is demand for your product or service

The entrepreneurial journey involves continuous learning, and market validation is one of

the most important lessons. It’s tempting to jump right in with your brilliant idea, but

before you invest everything, take a step back.

Does your product or service solve a real problem for a real audience? Market research helps

you validate demand, refine your offering, and avoid costly mistakes.

Studying industry trends, your competitors' offerings, and potential gaps in the market will

help you make well-informed decisions about your offerings' viability and how to position

them.

Another approach you could take is launching fewer products first to gauge initial interest

and gather real-world feedback. Use these reviews to address any issues and further improve

your offerings before scaling it fully.

#7 Invest in efficiency

Most business owners hold back on paying for tools or software since they can be expensive

upfront. This decision may be okay when you’re in the early stages and only have a few

transactions in between. But when you’re gaining traction and spending most of your time on

grunt work, it’s time to shell out some money to be more efficient.

Buying or subscribing to software seems costly, but they are an investment that will pay off

in the long run. By becoming more efficient, you give yourself more time to work on tasks

that require your expertise and eventually improve your customers’ experience.

An example is using all-in-one finance solutions like the OneCFO app to streamline your

finance processes. With just a few clicks, you can generate and share financial reports,

process payroll and tax returns, organize documents, and securely chat with your team.

#8 Prepare a financial plan

A comprehensive financial plan helps your business prepare for any potential issues and

maximize every opportunity that comes your way.

Here are the key steps you can follow in preparing a financial plan:

Be ready for emergencies

Most entrepreneurs need to remember to set up an emergency fund. This fund helps you

weather

slow months in the business and pay for unexpected expenses.

An emergency fund should cover three to six months of expenses. This fund gives you

more

peace of mind, knowing you won’t need to shut down your business when things get tough or

scramble for the first job you can find when you suddenly need money.

Building this fund is more challenging than it sounds, so you may also choose to have

another stable source of income while still establishing the company. It is best to save up

before quitting your day job.

Your roadmap to entrepreneurship

The entrepreneurial journey is an exciting adventure filled with learning and growth. You’ll

equip yourself to navigate challenges and build a thriving business by embracing these

lessons and fostering a continuous learning mindset.

Remember, even the most successful entrepreneurs make mistakes. The most important thing

when building a business is not to give up when times get tough, to keep testing new ideas,

to get feedback from people, and always aim to grow.

Furthermore, business problems can be challenging, but having a trusted partner beside you,

like OneCFO, will make things more bearable.

OneCFO is your partner for financial growth, providing you with reliable bookkeeping,

payroll, tax, and CFO services. At OneCFO, we understand the intricacies of starting a

business and are here to guide you through all the financial challenges that come with it.

Don’t let the fear of missteps hold you back. Take the first step today, and watch your

business dream become reality.

Visit us at onecfoph.co or email us at [email protected] to

learn

how we can help you launch

and grow your business.

Read our disclaimer here.