January 2, 2024 | 9:03 pm

Table of Contents

To ensure a thriving 2024, every entrepreneur must craft impactful financial resolutions.

Contrary to popular belief, making financial resolutions isn’t just a cliché; it's the

compass guiding your business toward resiliency and success.

As we bid adieu to the past year, it’s time to reminisce and pave the way for a more

flourishing future. Enter 2024 armed with goals and actionable plans to elevate your

business.

Take a closer look at the nine straightforward financial resolutions that will elevate your

business to new heights this year. From fine-tuning cash flow strategies to optimizing

budgets and mastering tax planning, we have the practical insights to make resolutions that

truly stick and are achievable.

Discover the game plan for a flourishing 2024 - where your business doesn’t merely get by

but truly excels. Seize the opportunity to set the perfect tone for your business finances.

Kickstart your success now!

What resolutions should entrepreneurs make in 2024?

#1 Assess and improve cash flow

An entrepreneur's typical New Year’s resolution might lean toward generating more profit

this year. However, it is equally crucial for business owners to prioritize the meticulous

management and enhancement of cash flow.

The first step to improving cash flow is identifying the

challenges your business faces

regarding the matter. Do you frequently encounter delays in payments from your customers? Or

are you faced with challenges related to timely payments to your suppliers?

Once you pinpoint the prevalent cash flow issues in the business, you can create ways to

eliminate them.

How can I enhance the cash flow of my business?

A common strategy for enhancing cash flow efficiency is incentivizing customers to pay early

by providing discounts.

Business owners can also negotiate better credit terms with

suppliers to give them more time

to collect the money they need for payments.

Another option is to set up automated alerts of their payment deadlines to avoid being late.

Similarly, they can send automatic invoice reminders to customers to encourage them to pay

on time.

After putting all strategies together, it’s time to formulate your cash flow management

plan. Developing this plan will solidify the changes you want to implement and give you

clear targets for a better year.

Dive deeper into financial mastery. Hit the play button to uncover the expert tips on

mastering cash flow management.

#2 Start budgeting for growth

Leveling up your business this 2024 requires more than just a vision - it’s about strategic

budgeting for growth.

A business budget isn’t simply a

number you set - it also serves as a roadmap for

decision-making and goal-setting. Budgets allow business owners to monitor expenses better,

mitigate financial risks, and promote overall transparency within the company.

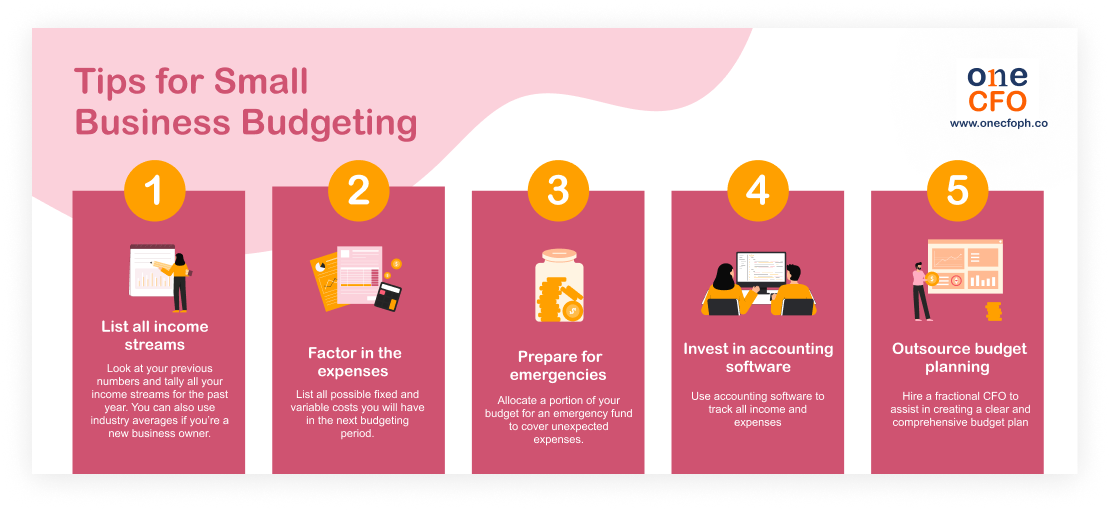

But first, how do you effectively craft a budget that fuels your business to new heights?

When creating a realistic budget, you must consider

how much you typically earn and spend in

a year. It’s best to look at historical data in the business or research industry standards

to increase accuracy.

In addition, think about the worst- and best-case scenarios when budgeting to prepare

yourself for changes in the business landscape.

Another key aspect of budgeting is knowing how to allocate resources for strategic growth.

Allocating funds to invest in cutting-edge technology, expand marketing efforts, and enhance

your employees’ skill sets fosters innovation and adaptability. These deliberate budgeting

strategies serve as the fuel propelling your business to new heights.

Watch this video to get insights on how to make budgeting easy for your small business:

#3 Better tax planning and compliance

Working on taxes might be less exciting, but it's crucial to success in 2024.

For better tax planning, you must be familiar with your small business's specific tax

obligations, which mainly depend on your legal structure. Knowing the

different

requirements, deadlines, and types of taxes you must pay will prevent you from getting

caught off-guard and penalized.

Being informed of your obligations is only the first step in tax planning. Aside from that,

business owners need to practice good bookkeeping to avoid errors in

filing taxes and easily

access financial records when required.

Furthermore, it's also best to explore tax deductions tailored to your

business to save

money. This proactive approach minimizes your tax burden and frees up funds for crucial

investments, such as upgrading equipment, hiring additional talent, or expanding operations.

Lastly, businesses need to be vigilant and stay abreast of updates from the BIR regarding changes in tax regulations. Staying compliant demonstrates good corporate citizenship and mitigates potential challenges in your business operations.

#4 Build an emergency fund

Emergencies and problems arise, whether we like it or not. And sometimes, they even happen

when we’re the least prepared.

To mitigate this in 2024, it’s essential to always have a financial safety net in the form

of an emergency fund. An emergency fund is a cash reserve of three to six months of business

expenses.

This fund is a game-changer - it gives you peace of mind and weather through any low points

in the business. It becomes the business’s buffer during downturns and unexpected shifts in

the market.

Building an emergency fund requires a systematic approach. One way to do this is to

calculate your monthly expenses, set a savings goal, and make consistent contributions.

In addition, you can also incorporate emergency fund savings into your budgeting to ensure

you can add to it regularly.

#5 Invest in technology

Another resolution business owners should have on their list is embracing new technology

solutions for financial management.

This 2024, it’s time to say goodbye to manual tracking with notebooks and spreadsheets.

Start transitioning to intuitive accounting software like Xero or ERP systems like Britana,

which tracks your financial and accounting activities and gives you insights for

decision-making.

Using technology and digital tools makes financial management much more efficient. With

these tools as your partners, you can instantly automate bookkeeping, invoicing,

payment

reminders, financial reports, and more - saving you more time and money.

Aside from automating tasks, you can integrate accounting software and ERP with bank

accounts and CRM software to streamline financial processes.

For example, accounting software automatically pulls sales data from the CRM to give

business owners real-time financial snapshots whenever needed.

#6 Negotiate and manage debt

Navigating business debts is a strategic aspect of financial management, often a necessity

for business growth and profitability. The key lies in adeptly managing and negotiating

these financial obligations.

Begin by assessing your business’s financial standing with the latest balance sheet. This

comprehensive review sheds light on the debts and liabilities, providing a foundation for

crafting a strategic plan.

Review every debt's interest rates, repayment terms, and overall loan structure. Also,

incorporate all scheduled debt payments in the budget and cash flow projection for a

comprehensive financial outlook.

When meeting debt payments becomes challenging, proactive communication with lenders is

paramount. Negotiating favorable terms, such as reduced interest rates or extended repayment

periods, can alleviate financial strain.

When settling debts, always make sure to have a plan in place. Continuously monitor debt

portfolio to gauge borrowing patterns, prioritize high-interest debts, and allocate

resources accordingly.

#7 Diversify revenue streams

Another crucial business resolution is diversifying revenue streams to grow your business

further. Relying on only one product or service is good when starting.

Still, to increase your business longevity and sustainability, you must diversify. Multiple

income streams can stabilize the business and help weather economic uncertainties.

One way to approach this is to investigate your current offerings and see if there are

complementary products or services you can add. For example, a baker selling customized

cakes can also sell flowers on the side so that customers can combine these cakes and

flowers as a perfect gift!

Business owners can also tap into emerging markets by working with businesses that

complement theirs. For example, small businesses can expand their reach with e-commerce

platforms like Shopee and Lazada.

However, carefully evaluate the risks and rewards linked to diversification, adopting a

strategic approach to prevent the pitfalls of selling various products without overextending

your business. Striking the right balance is essential to maintain operational efficiency

and sustain growth while exploring new opportunities.

#8 Monitor key financial metrics

For a better business in 2024, entrepreneurs should also monitor the key financial metrics

they need for success.

There are a lot of financial metrics you can track, but

if you’re only starting, tracking

them all at once can easily overwhelm you.

Small businesses should prioritize monitoring key financial metrics such as revenue growth

rate, profit margin, cash flow, return on investment (ROI), and accounts receivable

turnover.

These metrics offer critical insights into income generation, cost management, liquidity,

investment efficiency, and cash collection processes, guiding informed decisions for

sustainable financial health and growth.

How often are metrics tracked?

Apart from knowing what to track, consistency is also important. Monitoring key financial

metrics should be an ongoing commitment and routine. Business owners can check these weekly,

monthly, or quarterly to catch trends and assess if the business is performing as expected.

These metrics are not just numbers; they’re your guides. Monitoring and measuring financial

metrics allow business owners to make data-driven decisions to steer their business toward a

more strategic path.

#9 Efficient expense tracking

For our final New Year’s resolution, businesses must comprehensively analyze their financial health and growth trajectory. This assessment not only sheds light on the business's profitability but also reveals whether your expenses are well-aligned or if there’s an issue with a high cost of operation.

A comprehensive assessment of why your business is not making money can pinpoint expenses

not working for your business or if it's lowering your revenue - Are there subscriptions you

no longer use? Can you negotiate cheaper prices from suppliers?

The key to efficient expense tracking is ensuring each penny you use contributes to the

growth of the business. This involves implementing effective expense monitoring systems and

identifying cost-saving opportunities.

Furthermore, analyze your previous costs, see where you may be overspending, and allocate

resources more effectively.

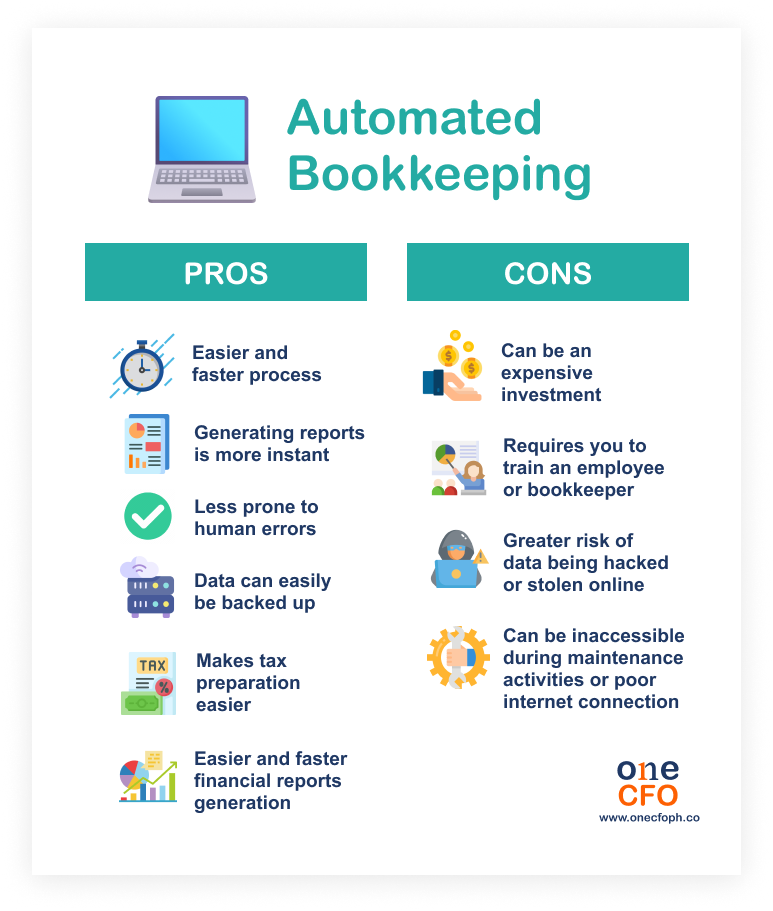

Leverage digital solutions that streamline monitoring expenses to make it more efficient.

An example is switching to automated bookkeeping to speed up data entry, categorize

expenses, and give you more insights into where your money is going.

How do you stick to New Year’s financial resolutions?

Every new year is a chance to improve and bring your small business to greater heights.

Implement the top nine financial resolutions we provided and make 2024 the most successful

business year you have to date!

If you need more guidance on sticking to these financial resolutions and other best

practices, OneCFO is here to guide you.

OneCFO is your

partner for growth, empowering small businesses and startups so you can start

the year with a bang and keep growing from there!

Aside from helping you with bookkeeping, taxes, and payroll, OneCFO also provides CFO-level

insights that could change the game for your business.

Explore the possibilities with OneCFO by visiting us at onecfoph.co or reaching out to us at

[email protected].

Read our disclaimer here.