November 21, 2023 | 9:19 pm

Table of Contents

As we get closer to the end of the year, businesses must organize their finances and aim to

start 2024 right proactively. By learning different small business finance tips, you can

build on good habits and best practices that ensure the business’s growth and success for

the following year.

Why is it essential to get your small business in order as you approach the new year? The

answer lies in the numerous benefits it brings to your small business.

First and foremost, it allows for a comprehensive assessment of your financial health. Doing

so enables small business owners to identify areas that need improvement and potential

growth areas.

By organizing your finances, you gain a clearer understanding of your cash flow, expenses,

and revenue, which in turn helps make informed decisions.

Moreover, early financial planning sets the stage for effective budgeting, tax preparation,

and strategic investments, which can significantly impact your bottom line.

With the proper financial groundwork, your business will be better equipped to navigate

challenges and seize opportunities in the year ahead. Discover nine invaluable finance tips

your small business can implement to kickstart a prosperous 2024.

How to improve your small business finances for 2024?

Business owners shouldn’t wait until January to prepare for 2024. Even before 2023 ends, setting your plans and strategies for the following year is essential. Here are some small business finance tips:

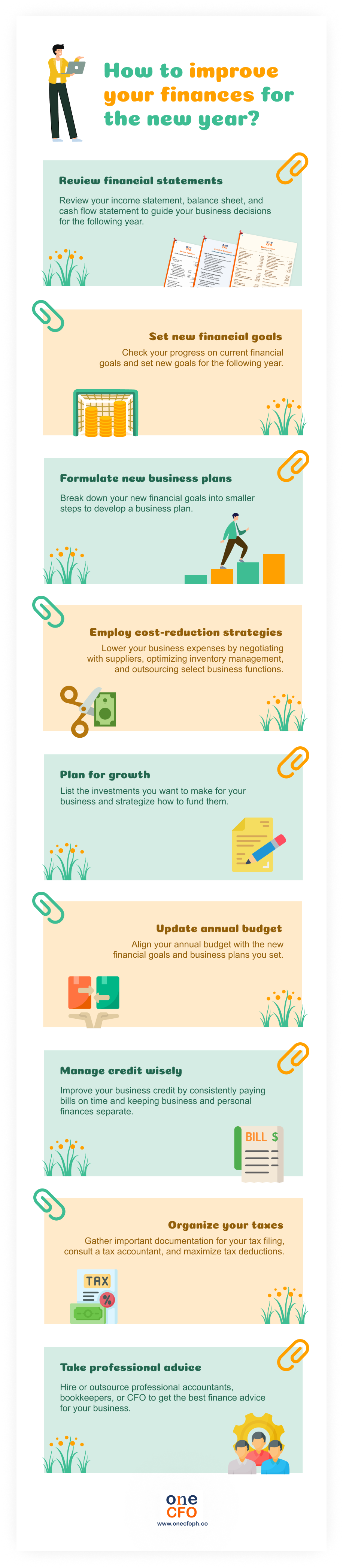

Review financial statements

Before setting any new financial plans for the next year, you need to assess the health of your business first by reviewing the three critical financial statements:

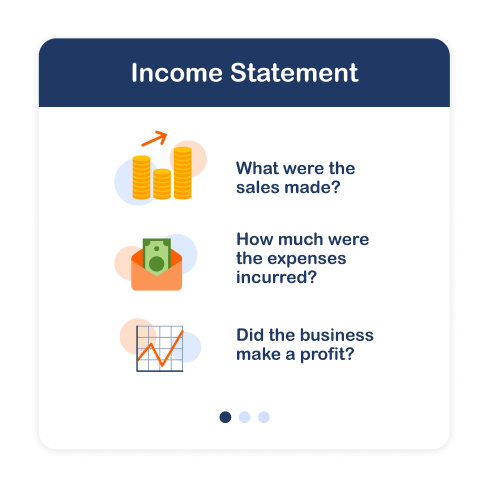

Income statement: An income statement, or profit & loss statement, shows all the business’s income and expenses in a period. This document gives you a snapshot of the company’s operations in terms of revenue and spending.

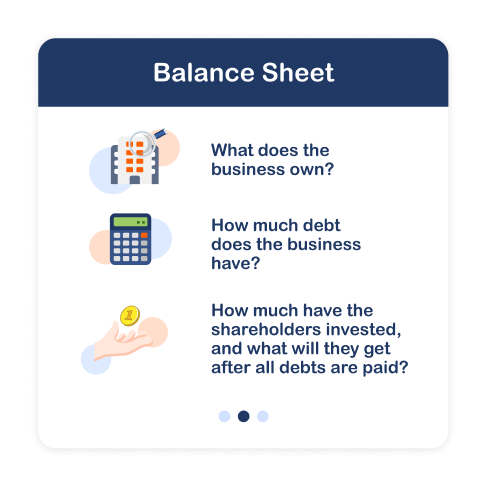

Balance sheet: A balance sheet summarizes the company’s assets, liabilities, and shareholder equity in a period. In short, this financial statement shows how much the business currently owns and owes.

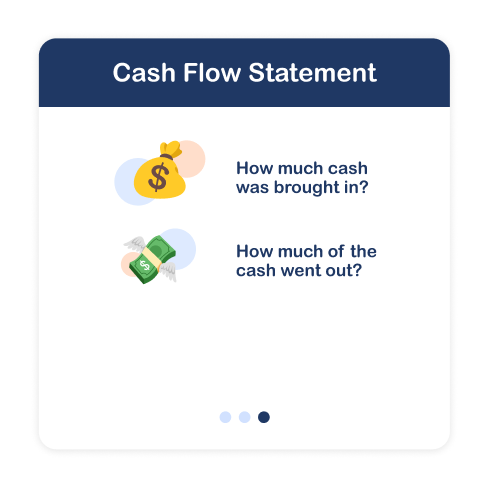

Cash flow statement: Lastly, a cash flow statement or CFS provides data on the business’s cash flow or how much money is coming in and out at a given period. The CFS helps business owners assess their cash position and liquidity.

Preparing and reviewing all the key financial statements can help business owners make the

right decisions for the following year.

Does the company have extra money to make more investments? Is there a need to adjust next

year’s budget? Your financial statements can answer these questions and more.

Set new financial goals

Aside from checking the financial statements, it’s also crucial for the business to review

its financial goals for the current year and set new goals for the next one.

Check the current financial goals individually and see if you’ve achieved them. In the areas

where the company fell short, you should investigate what went wrong and how you can fix it

in the coming year.

Knowing what worked and didn’t can help formulate your new financial goals and strategies.

Short-term vs. long-term financial goals

It’s also best to set both short-term and long-term goals. The long-term goal can be the

same as the previous years’ and will provide the business’ main direction.

Meanwhile, short-term goals aim to break down the long-term goal into smaller steps so you

can work through it bit by bit.

Setting financial goals, like increasing

business profitability, helps the company stick to

a plan and work together for a desired outcome.

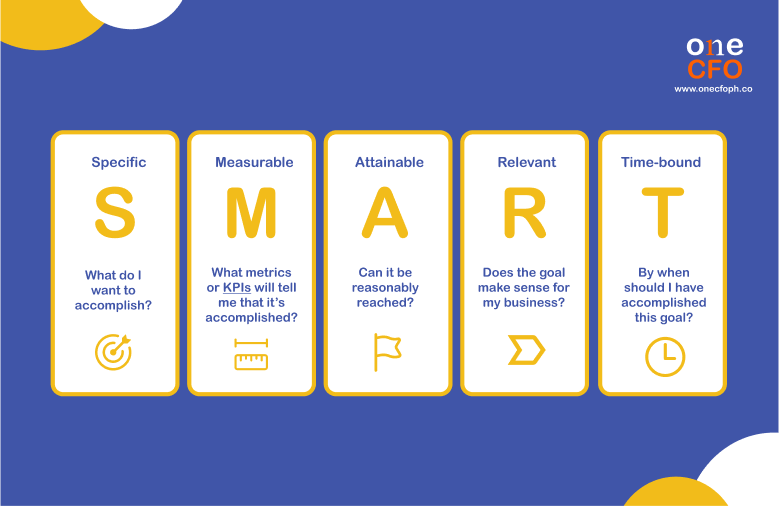

One tip when setting financial goals is to be SMART - specific, measurable, attainable,

relevant, and time-bound. This framework ensures your goals remain realistic and aligned

with the company’s vision.

Formulate new business plans

Once you have your new financial goals, it’s time to collaborate with the team and translate

these goals into detailed action plans.

For example, if the business aims to increase its market reach for the next year, its

business plan could be to launch extensive marketing campaigns every quarter. You can

outline the needed steps, identify staffing requirements, and set a timeline.

Formulating business plans early helps avoid cramming the steps to achieve them. For

instance, applying for business loans can take more than a month, so you’ll need to

process

them before the year ends to use the money immediately for next year.

Also, create a system to track progress when executing the new business plans. You can do

this by setting regular meetings for each department to share what they accomplished or by

creating a simple tracker in a project management tool to monitor

progress remotely.

Employ cost-reduction strategies

It’s always good practice to monitor costs and lower expenses when possible.

Reducing

business costs and increasing revenue is an effective growth strategy for businesses.

One of the common cost-reduction strategies is ensuring you have the best supplier possible

in terms of price and quality.

It’s best to shop around yearly and see if your current supplier can still meet your

business needs. You may also negotiate with them for better deals, especially if you already

have a long-standing relationship with the supplier.

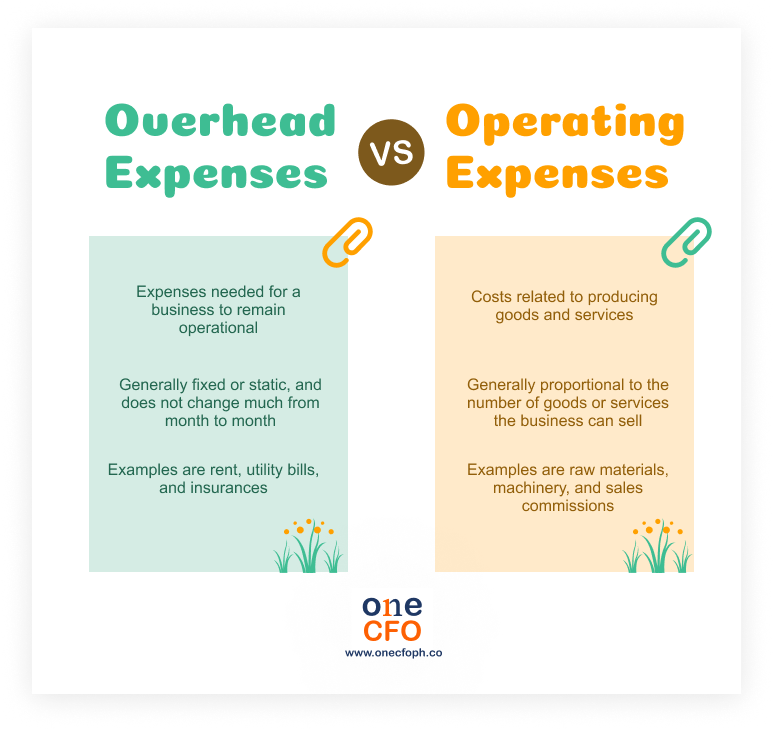

What is the difference between overhead expenses and operating expenses?

Knowing the difference between overhead and operating expenses allows businesses to identify

specific areas for cost reduction.

Operating expenses are a business's

variable costs in producing specific products or

services. These expenses fluctuate depending on the volume of goods produced or services

rendered.

Whereas overhead expenses, often called indirect costs, are

the steady support for your

business and are typically incurred regardless of variations in production or sales.

As these expenses affect the bottom line, small business owners must look for ways to reduce

these expenses.

For example, if overhead expenses are high, look for opportunities to streamline some

business processes.

One way is to automate bookkeeping processes to

streamline finance operations. Not only can

you save more money, but you also improve the efficiency of the business.

Businesses can also outsource functions like accounting or marketing to agencies to save

money on hiring full-time employees. By outsourcing, companies can also get quality service

only at a fraction of the price.

Plan for growth

It might sound ironic, but in business, you need to “spend money to make more money.” This

quote simply means that growing the company will require investments and resources you must

plan for.

From your business plan, list all the significant investments you plan to make next year

that will contribute to the company’s growth. Examples are purchasing new equipment,

increasing the workforce, or acquiring properties for expansion.

While these investments can eventually increase revenue, you still need money to buy them.

Unless you have a big pile of cash, you should look for funding options like getting a bank

loan or raising money from investors.

Apart from having the money, business owners should also consider when it’s best to make

such investments. For example, it might be best to hire new employees when the company has

the resources to onboard and train them properly and when it consistently earns a positive

cash flow.

Update annual budget

Updating the annual budget is another best practice in preparing for a new business year.

Budgets are simply a spending plan

that shows what business expenditures the company can

afford based on their income or resources.

Setting annual budgets is crucial for businesses to plan for the coming year properly. Watch

this video for more in-depth tips on preparing your annual budget.

One thing to remember about budgets is that they’re intricately linked with the business’s

goals and plans.

Your financial goals and plans can dictate how much funding you need. But at the same time,

the budget you set can also restrict how big your business goals should be.

When creating a budget, it’s crucial to consider both worst-case and best-case scenarios to

ensure the business can be flexible for any changes. It’s also best to consult with other

executives or managers to have a more accurate estimate of how much the budget should be for

each department.

Moreover, don’t forget to add a buffer to the budget for emergencies or unexpected expenses

during the year.

Manage credit wisely

Growing your business requires significant funding, so many companies take out loans to

expand their venture further. And if you want to go the same path, you must have excellent

business credit.

Business credit reflects the company’s ability to borrow money or creditworthiness. Banks

assess business credit to see if a business can repay the money it borrows or if the banks

can trust the company enough to lend it money.

One of the ways you can improve your credit standing is by always paying existing loans on

time. Doing so builds trust with financing institutions that you’re responsible for paying

your dues.

Another good practice is keeping business

and personal finances separate using separate bank

accounts or a business credit card. Not only does this help build your business credit, but

it also becomes easier for the bank to assess your company’s cash flow and finances when

you’re applying for loans.

Organize your taxes

The end of the year also signals the need to prepare for tax filings. Even though the

deadline for the annual income tax return (ITR) is still on April 15 next year, it’s always

helpful to start organizing early.

Aside from being compliant, paying the proper taxes is also beneficial for loan applications

since the ITR serves as the business’s proof of income.

Take the time to meet with a tax accountant to ensure you’re updated with all the relevant

tax regulations.

Consulting an accountant also ensures you get the best advice for optimizing your tax

payments. Your business can take advantage of numerous tax deductions to lower your taxable

income.

Some examples of expenses you can use as deductions are utility expenses, government

contributions, and benefits. Even entertainment expenses, like Christmas parties, can also

be used as a tax deduction!

Watch this video about the nine tax deductions to learn how to save more money on your

taxes.

Take professional advice

Small business owners take on many things on their plate. Aside from managing finances, they

also need to think about other functions like operations, sales, and the overall future

growth of the company.

One way to help business owners run their companies more smoothly is by hiring or

outsourcing professionals who can handle some of their business functions - especially

finance!

A professional accountant or bookkeeper can help the business track its cash flow better and

ensure all its finances are in order.

Small businesses may outsource a CFO to get more high-level advice

regarding tax planning

and business growth.

Outsourcing financial management matters to finance professionals may seem like an expense

initially. Still, outsourcing will become an investment in the long run as it helps you

improve your finance management, grow the business, and save money through strategies.

Start 2024 right

By practicing the small business finance tips listed, you can start the next year stronger

and build a good foundation for a successful business!

As you establish these best practices and navigate the new year, finding the right finance

partner for you can go well beyond in bringing your business to greater heights.

OneCFO, your

partner in growth, can provide you with

excellent and reliable bookkeeping, tax

planning, payroll, and CFO services.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with

your budgeting, forecasting, and finance strategies.

Our team of hands-on professionals is well-equipped to manage the technicalities of business

finances and provide valuable insights and expertise on navigating 2024 right.

Read our disclaimer here.