November 7, 2023 | 11:41 pm

Table of Contents

Picture this scenario - a small business owner navigating turbulent financial waters without

a clear budget to guide him. The result? Uncertainty, overspending, missed opportunities,

and financial chaos.

But don’t worry, we’ve got the answer to make your entrepreneurial journey safer. Learn how

budgeting can make your small business stable and successful.

A budget isn’t just about money - it’s your roadmap. Budgeting is your way to avoid

financial problems and spend money wisely. It’s your strategy to make the right decisions

and grab opportunities.

Setting up a small business budget may sound intimidating, especially to new business

owners. In this blog, we’ll explain why having a budget is essential for small businesses.

Plus, we’ll share five practical tips to help you develop the proper budget and steer your

business toward growth and success.

What is a budget?

Budgeting is estimating your income and expenses, which serves as the business’s roadmap for using and maximizing each peso. Having a budget gives small companies an overview of their finances and answers questions like:

A business budget

outlines possible income and expected expenses over a certain period.

Entrepreneurs use numbers from their financial statements to create detailed spending plans

or cash flow

projections.

New small business owners can do their research regarding common expenses in the industry or

consult with other companies similar to them.

Budgets can be good for the whole year, a quarter, or even a month. Once you set a budget,

it’s crucial to constantly check this against how the business used the money for that

period. This way, business owners will see how accurate their budgeting is and if they need

to adjust for the next budgeting period.

Why is budgeting important to a business?

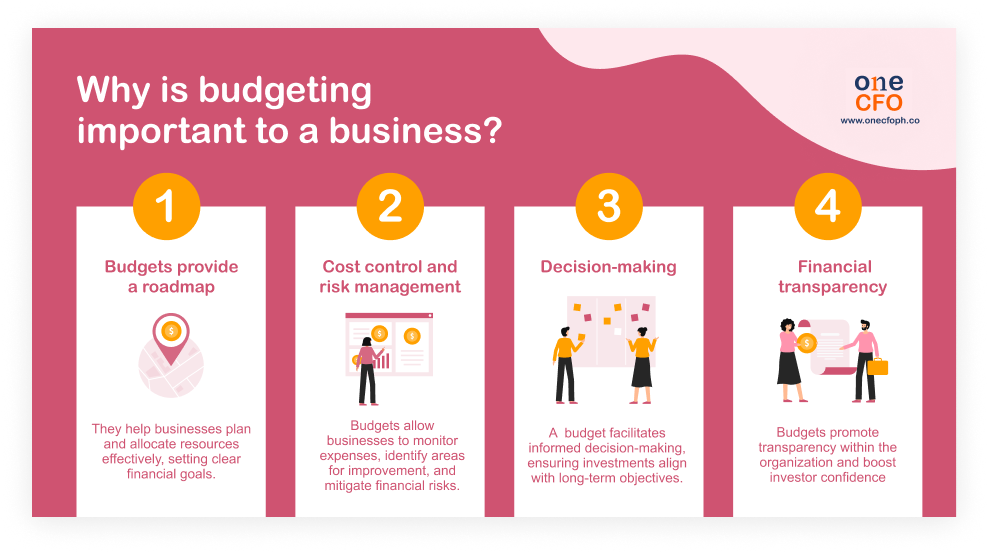

Whether you are a startup, a small business, or a large corporation, you need a budget. Without a budget, entrepreneurs risk spending money they don’t have or missing growth opportunities. Here are more reasons why budgeting is essential and beneficial to businesses:

Budgets provide a roadmap

Budgets and goals are intricately linked because budgets are the practical roadmaps that

help small businesses achieve their financial goals. They provide a clear plan and structure

to manage resources effectively in pursuit of the company’s objectives.

As an example, one of the typical goals for a business is to increase its workforce by

hiring more people. Companies allot a staffing budget covering the salaries and benefits

employees and contractors receive. You may also alot a recruiting budget, which covers costs

like job advertisements, hiring agency fees, and other expenses related to the hiring

process.

Having a budget as a roadmap helps businesses identify when to make capital expenditures,

pay debts, or settle their bills. Additionally, budgeting helps with tax season preparations

since business owners can easily estimate how much to pay in taxes or if they can still

lower them.

Cost control and risk management

Budgets allow businesses to monitor expenses and identify possible areas for improvement.

For example, a common mistake small businesses make is undervaluing their products and

setting the wrong prices. A budget clearly outlines direct and indirect costs companies

incur in producing goods or providing services, helping them manage pricing better.

Budgeting also helps mitigate financial risks. Since unexpected costs always arise in a

business, it’s best to have an emergency fund ready. A budget lets business owners set a

realistic target for their emergency fund, usually three to six months’ worth of expenses.

It also identifies how much leftover money they can allocate to building this fund.

Another financial risk businesses face is overborrowing money. Creating a budget can improve

a business’s debt management since you’ll need to list down all the payments you need to

make and when your creditors expect you to pay. With this list, entrepreneurs can see

whether they can still afford any additional loan payments or if they should avoid borrowing

more money.

Decision-making

Every successful business outcome results from good decision-making, and having a business

budget helps significantly with this.

When entrepreneurs set a budget, they also become more proactive in ensuring their

investments and resources align with long-term objectives. Every action you take in a

business, such as increasing your prices, offering a new service, or attending a conference,

is an example of a business decision. A budget tells you whether or not this action is the

right decision.

Creating a budget also puts you more in control of the business. Knowing how much money you

have and where to spend it lays out any obstacles you might encounter and helps you plan.

Budgets also give small business owners more confidence and certainty that they use their

money in the best way possible.

Financial transparency

When creating a budget, the business owner collaborates with other managers or team leaders

to collect inputs and assess how to divide the allocation among different departments. This

collaboration promotes transparency within the organization since each member becomes aware

of how the company uses its resources.

Moreover, budgets boost investor confidence by showing the company's financial position, the

rationale for raising funds, and where they will use their money. Businesses can also use

their budgets to showcase how they will use the invested capital for growth to increase the

company's value.

It's best to consult a CFO to help create a

comprehensive budget plan. Having an expert look

over your business and prepare your budgets and forecasts will increase your chances of

attracting investors.

5 Tips for Small Business Budgeting

If you don’t know where to start, here are five handy tips to follow in setting up your small business budget:

List all income streams

The first step in creating a budget is to list all your income streams. From here, business

owners can get their total revenue, the total money coming into the business, mainly from

selling goods and services.

You can calculate the monthly averages using the total

revenue, ideally for one year.

Estimating the average revenue for the entire 12 months will better represent the business

income, especially if there’s a need to consider seasonal factors.

If the business has been operating for at least a year, then looking over previous numbers

makes tallying income streams much easier. Otherwise, there is a need to estimate how much

income the business will have based on industry standards. You can also talk to other

business owners of the same industry or business type to estimate how much revenue you can

earn.

Factor in the expenses

The next step is to use the total revenue to account for all business expenses, which you

can group into fixed and variable costs.

Fixed costs are recurring and unchanging regardless of the business's income. Some examples

of fixed costs are rent, internet bills, payroll, and loan payments.

On the other hand, variable costs are costs directly related to producing goods and

services. As given in the name, variable costs change occasionally depending on how many the

business sells. Expenses related to "costs of goods sold," like raw

materials, packaging,

shipping, and utilities, are variable.

Use expense records from previous periods to make your budget more accurate or research

industry standards if past numbers are unavailable.

What is top-down budgeting?

Another way small businesses can project their expenses is to do the top-down approach. This

approach in budgeting starts at the top of the organization and then breaks down the budget

into smaller parts for each department or unit to follow.

Once the senior management team sets an overall budget, individual departments, such as

sales and marketing, will have budget allocation. It is up to the department heads to manage

their budgets effectively by properly analyzing projected expenses while staying within the

allocated limits.

This approach ensures the company’s financial strategy and goals are cascaded to all levels

of the organization, helping to align departmental activities with the company’s overall

objectives.

The video below further explains the top-down approach and other terms to prepare the budget

simple and easy to do:

Prepare for emergencies

As the saying goes, “Expect the unexpected.” Emergencies and unplanned expenses are part of

running a business, so you need to be ready for them by having a backup plan or an emergency

fund.

The numbers you include in your budget are not final, so your budget must remain flexible.

To do this, business owners can create different versions of their budgets to accommodate

various scenarios. At the very least, you can create a budget assuming a solid year and

another considering a slow one.

Budgets should also include a debt management plan in case the

business doesn’t

have enough

emergency funds yet and needs to borrow money from financial institutions.

The budget management plan can be as simple as listing down your current debts, if any, and

the additional loan payments you’ll incur if you borrow more money. The business owner can

project the listed payments into the future to see if their cash flow is enough to make all

the payments on time.

Invest in accounting software

If you spend hours tracking your income and expenses, it’s time to invest in accounting

software. These software programs help automate repetitive tasks, like recording

income and

expenses, significantly boosting the efficiency of your

small business.

Using accounting software also reduces chances for human error, increasing the accuracy of

the numbers you use in the business budget. Additionally, accounting software can provide

visualizations of the business’s income and expenses through graphs and charts, making it

easier to understand for entrepreneurs.

Outsource budget planning

Even when using accounting software, getting an expert, like a bookkeeper or accountant, is

helpful to check your numbers. These professionals can organize your business records and

help generate financial documents, including income statements, balance sheets, and cash

flow statements - all help make the budgeting process easier.

In addition, you may opt to hire a Chief Financial Officer or a CFO to ensure you have a

clear and comprehensive budget plan.

A CFO can analyze past financial data to identify trends, areas for improvement, and

potential cost savings. Furthermore, they consider potential risks and uncertainties that

could impact the budget and create contingency plans for unexpected situations.

Is hiring a CFO too expensive for a small business?

Hiring a full-time CFO can be out of budget for most businesses, but you can now outsource a

CFO for a fraction of the price, making it a friendlier option for SMEs! Outsourced CFOs or

fractional CFOs function like

regular CFOs, except they work part-time or on a contractual

basis and may have multiple clients in their roster.

Hiring a fractional CFO improves how a business plans and customizes its budgets. Most

importantly, CFOs provide companies with expertise and strategic thinking skills that no

accounting software can match.

Outsourcing a CFO for your business significantly helps grow it and ensures your company's

finance function remains robust. The video below further discusses the benefits of hiring a

CFO for any business.

Improve your budgeting with outsourced CFO services

Budgeting is an essential part of the business as it gives you a roadmap on how to use your

resources, allows you to be proactive in handling risk, helps you make decisions, and

enhances transparency in the company.

Given how vital budgeting is, it’s best to let experts like OneCFO, guide you in creating an

accurate and comprehensive budget fit for your business. With OneCFO, our team of highly

experienced CFOs is committed to learning your pain points and giving you agile CFO-level

insights to propel business success.

Moreover, OneCFO can also assist your business with any bookkeeping, payroll, and tax

concerns.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with

your budgeting, forecasting, and business growth.

Read our disclaimer here.