September 8, 2023 | 3:34 pm

Table of Contents

Small businesses need a cash flow statement to understand the flow of money going in and out

of the company, helping assess its financial health and stability. Thus, all small

businesses need to prepare this important financial statement.

The cash flow statement helps small business owners identify if they have extra cash to

settle their payables or reinvest in the business. It can also show entrepreneurs if they’re

short on money, allowing them to find solutions early on.

However, small businesses may need help and guidance in preparing the cash flow statement.

Cash flow data must be categorized into three important components - operating, investment,

and financing activities.

This guide will explain cash flow statements in-depth, including their importance,

components, and how to prepare this report.

What is a cash flow statement?

Before anything else, what is a cash flow statement?

A cash flow statement, or CFS, is a

financial document showing all incoming and outgoing

transactions in a certain period. Ultimately, this financial statement indicates the

liquidity of a business and your cash position or how

much cash there is as of the moment.

A common mistake among small business owners is solely focusing on profitability. While

profitability is good for the business, knowing your cash flow is equally important. If you

don’t track your cash flow, you might wake up one day unable to pay your suppliers or bills

even though your business is supposedly making money.

The information in the cash flow statement comes from the income statement and balance

sheet, which is why these three financial statements are crucial. With the CFS,

entrepreneurs can identify which parts of the business generate and spend money and exactly

how much.

Why is a cash flow statement important?

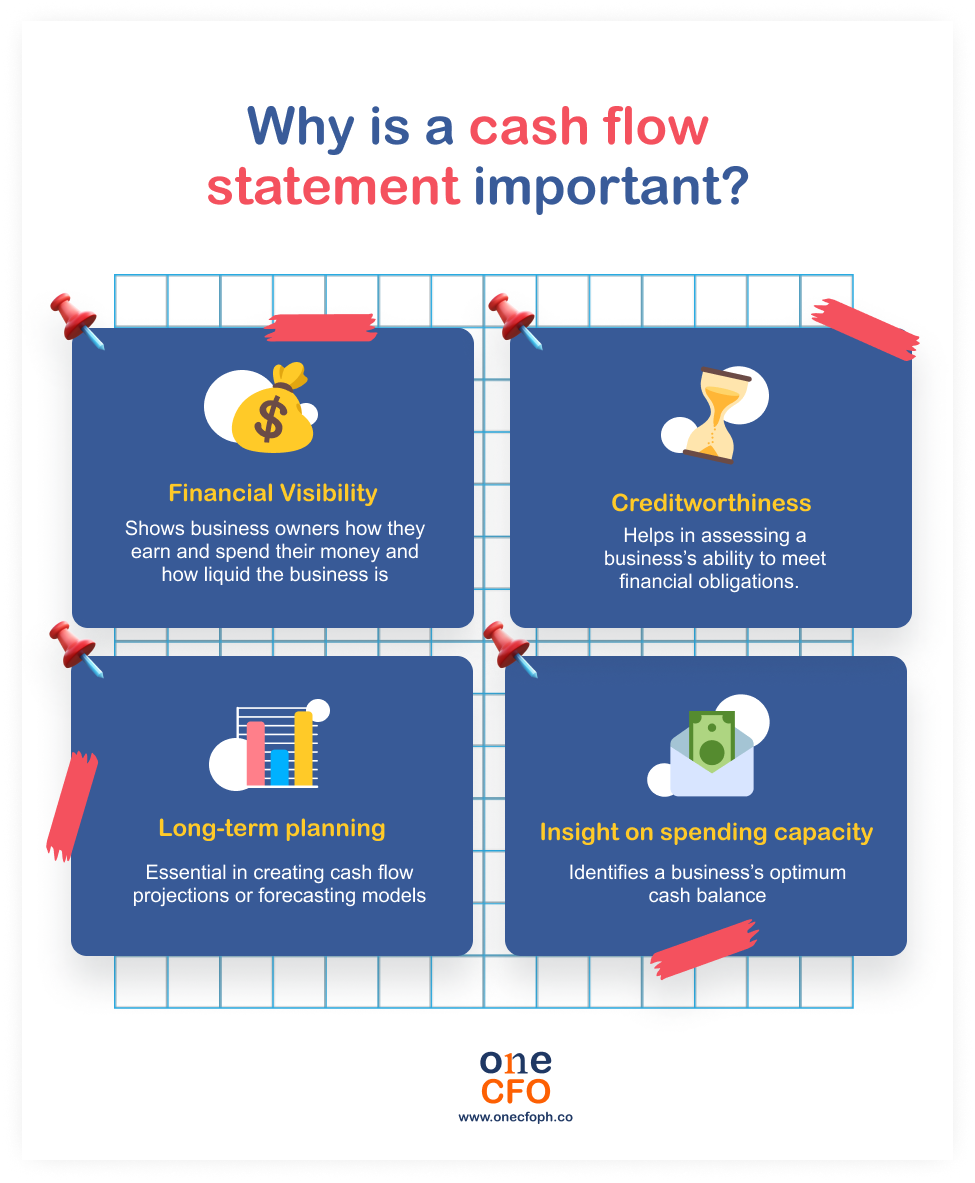

Preparing a cash flow statement is essential for any small business and is an important step in a proper cash flow management system. With vital financial information on the flow of money in and out of the business, entrepreneurs make better short and long-term decisions.

What are the components of a cash flow statement?

The cash flow statement reflects how money or cash moves in and out of the business. This financial document divides your cash activities into three components or activities: operating, investing, and financing.

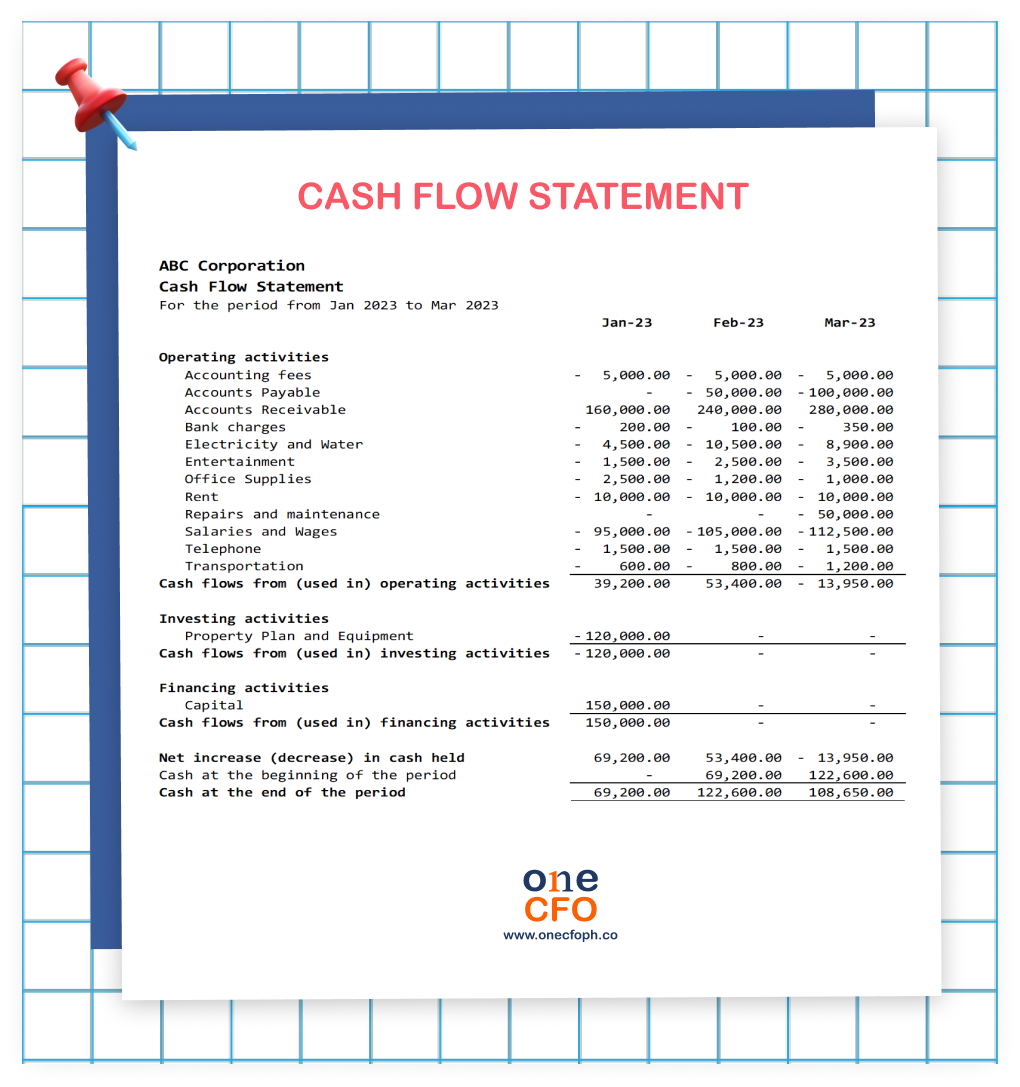

Example of a cash flow statement

Operating

All transactions related to regular business activities or the core of the business are part

of the operating component. These transactions are those needed to continue operations or

provide services and goods.

When organizing the cash flow activities in the operating component, the starting point

should be the net income after expenses. From here, the bookkeeper or accountant lists all

operating transactions and adds or subtracts these from the starting amount.

Ideally, the total cash flow from operating activities should always be positive. A negative

operating cash flow can mean spending too much on inventory, having more employees than you

can pay for, racking up expensive bills, or not making enough sales.

You can bridge a negative operating cash flow by getting funding from loans or investors or

selling your assets; however, always resorting to this solution won’t be sustainable in the

long run.

Most expenses listed in the operating component are deductions you can use for income

tax.

Here are some examples of transactions to include in this component:

Investing

The investing component of a CFS includes financial transactions related to buying and

selling fixed or long-term assets and investments. Entrepreneurs purchase these investments

for the company’s growth and expansion or sell assets to maintain the business’s operations.

For small businesses, the investing portion of their CFS might not be a lot. However, it’s

still important to note these transactions since they affect the working capital.

A business may have a negative investing cash flow after purchasing new properties or

equipment, but it's an investment for the business's benefit and long-term growth.

Some examples of transactions included in the investing component are:

Financing

The third section or component of a CFS includes all transactions involving financing the

company through owners, creditors, or investors. Financing can consist of acquiring business

loans from banks, funds raised from investors, paying dividends, or money given or taken out

by the owners.

The items included in the financing section can be as follows:

How to prepare a cash flow statement?

In preparing a cash flow statement, small business owners should understand how a CFS complements their income statement and balance sheet. There is also a need to choose what method to use when accounting for cash transactions.

How does the cash flow statement relate to the income statement and balance sheet?

Cash flow statement, income statement, and balance sheet are the most important financial

documents a business can have. Even though these three show different aspects of the

company, they are linked together.

As mentioned, the cash flow statement shows how cash moves in and out of the business. It

starts with using the net income from the income statement, which shows a company's revenue,

expenses, and profitability.

Meanwhile, a balance sheet indicates changes in

assets, liabilities, and shareholder's

equity. This document starts with the cash balance shown in the CFS and shows how the

company divides this balance between different components.

It's also best to remember that cash flow statements and other financial documents are only

as accurate as your bookkeeping. Knowing how to employ the best bookkeeping practices

ensures you have the correct information when preparing the CFS.

What are the two cash flow calculation methods?

There are two methods for calculating operating cash flow: the direct method and the indirect method.

Direct method

The direct approach is recommended for cash flow

calculations using the cash basis accounting. Cash basis

accounting only records financial activities once the company

receives or spends the money.

In the direct method, the bookkeeper records all cash transactions during the period.

Although it’s more straightforward, it can also be time-consuming since you need to track

the cash and receipts of every transaction.

Indirect method

On the other hand, the indirect method of preparing a cash

flow statement uses accrual-based

accounting data as a starting point. Accrual basis accounting records income even if a

customer has not paid yet and the expense even when you haven’t settled the bill.

In the indirect method, you start with the net income and then adjust for non-cash items and

changes in the working capital to arrive at the cash flow from operating activities.

For example, suppose you add revenue to the income statement, but the business hasn’t

received the money yet. Deduct the same revenue amount from the net income to reflect that

no cash came in the cash flow statement.

Another example is when a business deducts depreciation when computing the net income in the

income statement. The depreciation amount is then added to the cash flow statement to

indicate that no cash went out.

The indirect method may seem more complicated. However, it’s the more common approach.

Backtracking transactions or accruals from the income statement is easier and takes less

time to prepare, which is why it’s more suitable for small businesses.

What does positive and negative cash flow mean?

After listing all cash transactions in the cash flow statement, you can compute your overall net cash flow, either positive or negative. What does each of these mean?

Positive cash flow

There is a positive cash flow if more money goes into the business than out. A positive cash

flow is ideal for businesses; however, this is not enough to indicate good business

performance.

A business with a positive cash flow doesn’t automatically mean it’s profitable - it could

have raised funds from investors, increasing its incoming cash flow. It’s also possible for

a business to have a positive cash flow if they take out large business loans. However, they

must also prove they can pay the borrowing through revenue generation.

Positive cash flow can also mean the business has excess cash on hand, which it can use to

expand operations or reinvest for business growth.

Negative cash flow

On the contrary, spending more money than what your business earned results in a negative

cash flow.

A negative cash flow sometimes happens among startups as they usually aim for fast growth to

attract venture capital funding. They spend much capital on

improving their product or

increasing market share.

Some businesses may also get a negative cash flow, especially after investing huge amounts

of money for future growth. So, a negative cash flow isn’t an indicator of poor business

performance.

However, negative cash flow for extended periods can also be a red flag and show signs of

unsustainability. If this happens, the business owner should have a concrete plan to keep

operating and turn their cash flow positive sooner than later.

Need help in preparing and interpreting cash flow statements?

Creating an accurate cash flow statement is a way to keep your business financially healthy.

On top of this, business owners should also learn how to correctly interpret these

statements so they can take the right business actions.

If you need help keeping your financial data in order or need expert advice on managing

your business financially, OneCFO is here!

OneCFO is your outsourced finance department, providing reliable and tech-enabled payroll,

bookkeeping, tax compliance, and CFO services. As your partner, OneCFO provides the

financial management support you need so you can focus on growing and managing the business.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you

prepare and understand your cash flow statements and financial operations to propel business

growth.

Read our disclaimer here.