August 8, 2023 | 12:14 am

Efficient and proper bookkeeping is vital to the success of small businesses. But even with

technology, many still manually track expenses and sales. Is this the best way, or should

businesses start automating their bookkeeping?

Manual bookkeeping uses pen and paper instead of a computer. On the other hand, automated

bookkeeping uses computerized spreadsheets or accounting software to record transactions,

automate computations electronically, and generate financial reports.

Both bookkeeping methods are still used today and present different advantages and

disadvantages. Small businesses may choose a bookkeeping method depending on how complex or

heavy their financial transactions are.

Some may only have a few sales or expenses daily and prefer recording them by hand.

Meanwhile, those aiming for efficiency in their business embrace the power of automated

bookkeeping.

Is it a good time to start automating your small business bookkeeping? Read on to learn how

you can achieve efficiency with the way you do bookkeeping.

What is bookkeeping?

Proper bookkeeping is integral to any small business since it helps entrepreneurs manage

their money better and comply with regulations.

Bookkeeping accurately

tracks all financial transactions, classifying and recording how much

your business earns and spends. Every peso that flows in and out of the business is tracked

and categorized to help entrepreneurs manage their money better.

Aside from having an accurate record of your finances, bookkeeping helps small business

owners set a budget as they see how much money goes in and out of their accounts.

Bookkeeping also helps prevent any mistakes or fraud in finances since this process requires

regular reconciliation of business accounts.

Moreover, organizing your income and expenses makes tax preparation simpler. There is no

need for guesswork when inputting how much your business earned, and claiming tax deductions

is much easier.

How does manual and automated bookkeeping compare?

Small business owners typically record their financial activities manually using ledgers or

books. But nowadays, many software and applications can do the same thing more efficiently.

Know the differences between manual and automated bookkeeping and see which method suits

your business.

What is manual bookkeeping?

Manual bookkeeping is a more conventional way of

keeping financial records. The bookkeeper

or business owner records the transactions by hand and uses paper worksheets, ledgers,

subsidiary books, or journals.

Small businesses that are only starting or those with only a few transactions mainly use

manual bookkeeping. Recording financial activities manually is much simpler and more

cost-effective but can also be time-consuming.

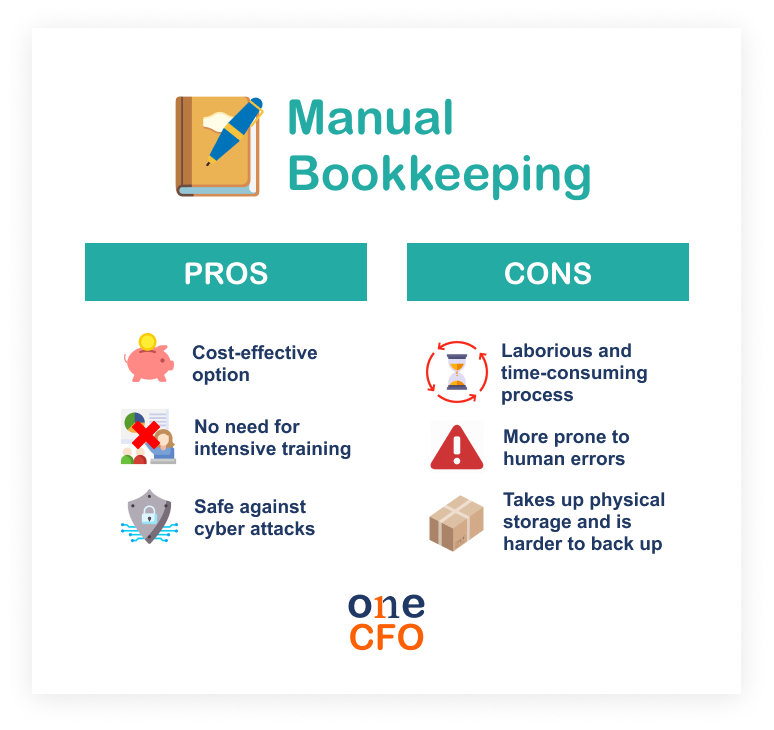

What are the advantages of manual bookkeeping?

The main advantage of manual bookkeeping is its simplicity. Tracking sales and expenses on

paper requires less upkeep and doesn’t need any expensive equipment right off the bat.

Unlike when teaching employees how to use bookkeeping software, manual bookkeeping does not

require intensive training.

Moreover, bookkeeping manually means you only need a pen, paper, and a handy calculator as

your tools. This method is more cost-effective and perfect for small business owners who

don’t want to invest in software and heavy technology.

Since manual bookkeeping doesn’t use the internet, your records are safe against cyber

attacks or online theft. As long as the data is stored safely with you, you can access it

anytime without worrying about system maintenance.

What are the disadvantages of manual bookkeeping?

Even though manual bookkeeping is simple and cheap, it’s also very laborious. It can consume

a lot of your time, especially if your business makes a lot of financial transactions every

day. You need to list every activity involving money, which can take hours of your day.

Since writing down transactions and the computations are done manually, there are also more

chances for human error. Misplacing a decimal point or incorrectly writing a digit can lead

to mistakes that affect the accuracy and reliability of your financial records.

Looking for errors in your manual records is tedious since you must check everything

individually. And once you find the mistake, you need to fix them manually, and there may

even be a need to rewrite whole pages.

Manual bookkeeping also takes up more physical storage since the bookkeeper records all data

in non-digital journals and ledgers. And even though the records are safe from cyber

attacks, there is also a chance of losing these files if they are not stored properly.

Physical data rarely have backups, so extra care is highly needed.

What is automated bookkeeping?

Automated or computerized bookkeeping uses a

computer and software to manage financial

activities. Transactions are entered into a program that automatically calculates and stores

data and produces reports or statements when needed.

Unlike manual bookkeeping, automated bookkeeping is more contemporary and dependent on

technology. While it utilizes the same accounting fundamentals and concepts used in manual

bookkeeping, automation makes the process more convenient for those who can use or afford

it.

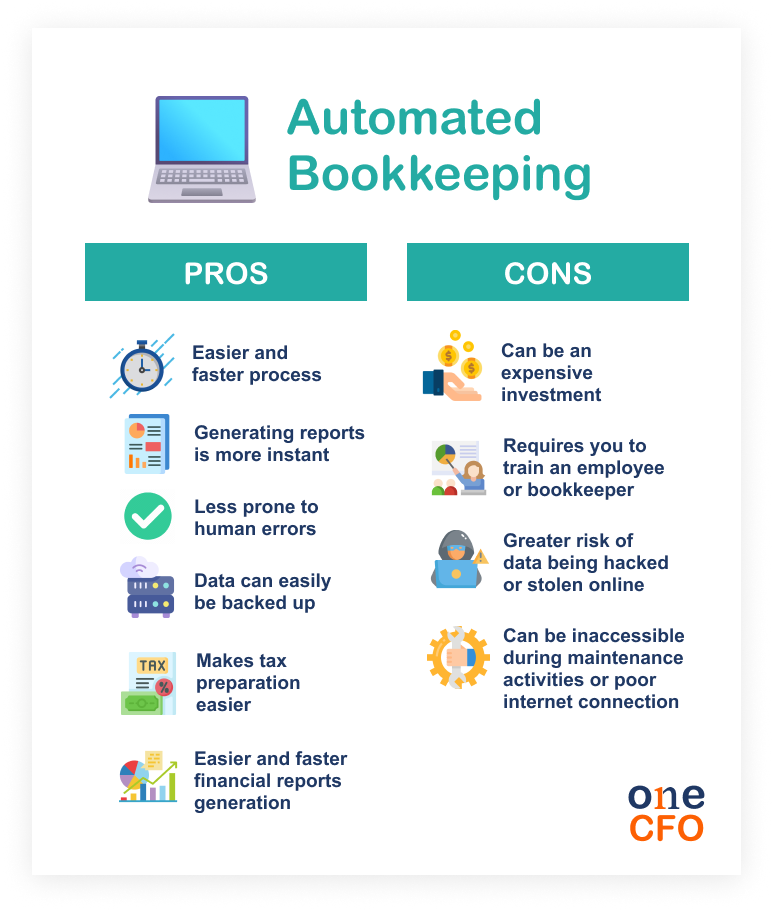

What are the advantages of an automated bookkeeping system?

Automated bookkeeping makes recording, computing, and storing financial data easier and faster. All the user needs to do is configure the program, enter the business transactions, and the program will automate the rest of the processes for you.

How can automating bookkeeping improve productivity and efficiency?

Automation helps simplify the bookkeeping process, making you more efficient and productive.

Generating reports and financial statements also becomes a lot quicker with automation.

Computerized bookkeeping also reduces the number of times the user needs to input the data.

Calculations are done within the computer, reducing the chances of human error and

increasing the data’s accuracy and reliability.

Depending on how advanced the accounting software is, bank accounts can be linked, making

categorizing transactions easier and faster.

When a user makes a mistake in the data entry, they can find them easily using the computer

functions. Any corrections made will also automatically change the rest of the data, saving

you time and the hassle of checking everything manually.

As long as you back up your financial records to the cloud, there is no need to worry

about losing your data or your files taking up physical space. You can also access the data

using different devices anytime and anywhere.

Can automating bookkeeping help you save money?

When you use automation, there is less need for additional staff to run the business’s

bookkeeping system. The accounting software takes care of repetitive tasks that an employee

would do otherwise if they were using manual bookkeeping.

Instead of manually spending time and resources in bookkeeping, you could focus on business

tasks that could earn you money, such as optimizing processes, developing strategies, and

analyzing financial data.

Automated bookkeeping offers convenience

Using automated bookkeeping also makes tax preparation more convenient. You can confidently

check income earned and taxes to pay. Bookkeeping software also clearly lists your expenses

which you can use for tax deductions and enjoy tax savings.

There’s also an option of storing receipts via the cloud through your software, which makes

it easier to find supporting documentation.

With accounting software, generating financial reports becomes quicker and on-demand. Small

business owners can readily use these reports to review their financial status and leverage

them when working with banks and investors or formulating business strategies.

What are the disadvantages of automated bookkeeping?

One of the reasons why some small business owners don’t use automated bookkeeping is that it

can be expensive at the start. Entrepreneurs must invest in computer and accounting

software.

Aside from money, small businesses also need to dedicate their time to learning and

configuring the software to fit their businesses. Business owners must be more

technologically adept and stick to the pen-and-paper route.

Since the data is stored online, hacking or theft can happen. To prevent this from

happening, ensure that your software has cybersecurity measures in place.

Even though your data is generally available most of the time, thanks to the cloud,

there may be instances when your software or computer needs to undergo maintenance

activities or you are experiencing a poor internet connection. During these times, you may

be unable to access your financial records.

What are the common bookkeeping practices to remember?

Choosing what bookkeeping system to use is just half the battle. Consider the common bookkeeping

practices to ensure all your finances are in order.

An important thing to remember when doing bookkeeping is to record all economic transactions

diligently. When you make a sale or spend business money, it’s best to record them as soon

as possible.

You should also keep all documentation, such as invoices, receipts, and paid bills, mainly

since they help claim tax deductions. The BIR also advises business owners to

preserve

relevant documentation for ten years in case of a BIR audit.

A paper trail of each financial transaction also tracks where the money goes and prevents

fraudulent activities.

Also, keep your personal and business finances separate to avoid confusion. This way, you

won’t accidentally spend business money on private expenditures and vice versa.

Separating personal from business also helps you analyze financials more accurately and

prevents you from categorizing personal expenses as a business.

A tip is to create a separate bank account or open a

business line of credit which you can

use purely for business transactions.

Small businesses make common mistakes in bookkeeping.

Avoid these mistakes, develop proper

bookkeeping habits, and prevent grave errors in your business finances.

Improve business efficiency with automated bookkeeping

For small business owners who are only starting or don’t have a lot of transactions yet,

manual bookkeeping may work for now. However, transitioning to an automated bookkeeping

system can boost productivity and efficiency in your small business, helping you grow much

faster.

Automating your bookkeeping is a solid investment that saves you time and money in the long

run. Moreover, automation proves to be more convenient as your business grows and

transactions become complex.

If the resources you need to buy and train for the software are holding you back from

switching to an automated system, outsourcing your bookkeeping would be the best choice!

Outsourcing your bookkeeping to experts, like OneCFO, means there is no need to worry about

purchasing software or training your employees since these experts already got you covered.

OneCFO can also handle your tax concerns and payroll duties and provide CFO-level advice to

help your business!

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with your bookkeeping and more.

Read our disclaimer here.