July 29, 2025 | 11:53 pm

Table of Contents

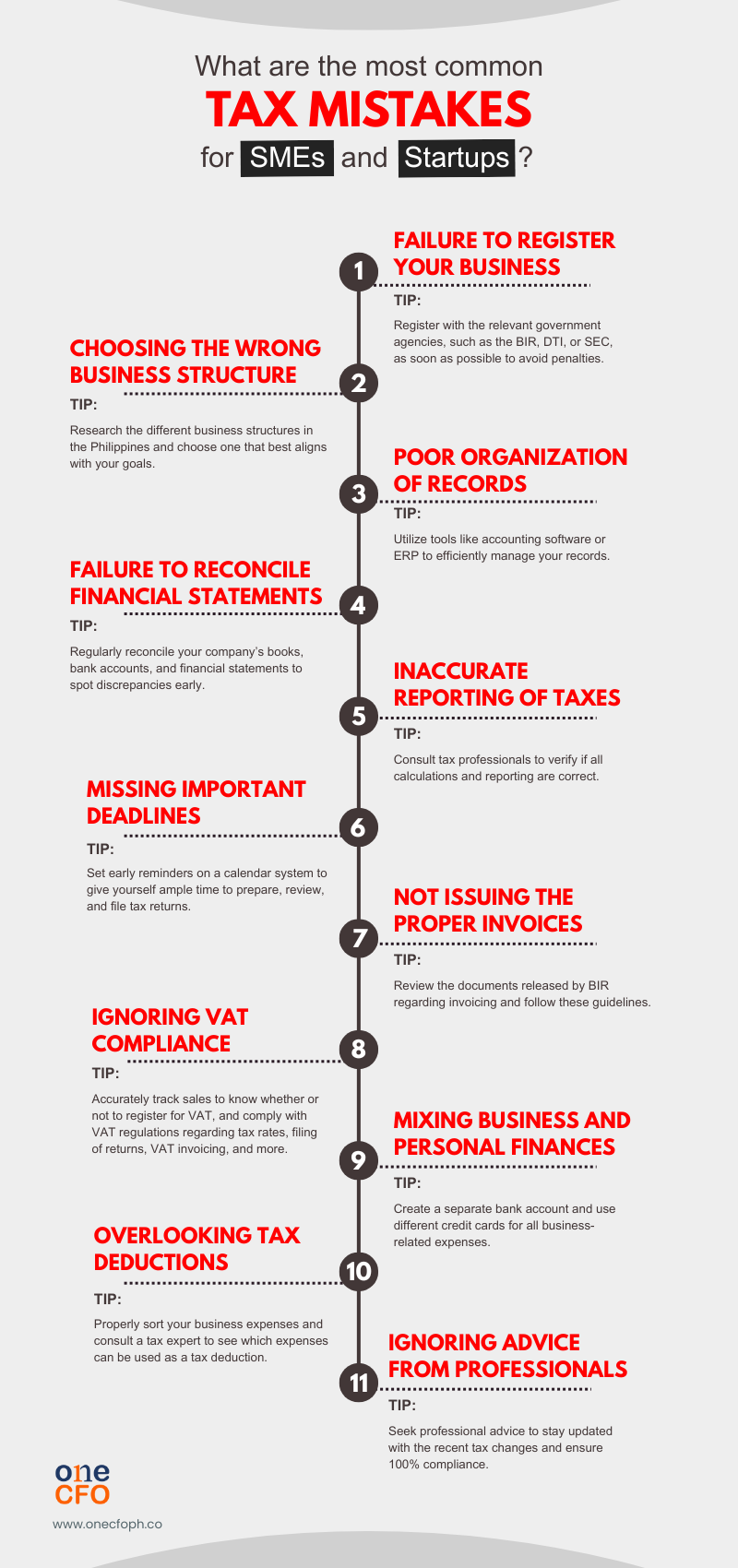

For every aspiring or established business owner in the Philippines, avoiding common tax

mistakes is crucial for BIR compliance. It safeguards your venture's future and ensures

peace of mind.

Unfortunately, with the numerous responsibilities SME owners and startup founders must

juggle, they inadvertently stumble into common tax mistakes that can lead to stressful

audits, hefty fines, and even legal complications with the Bureau of Internal Revenue

(BIR).

The landscape is also constantly evolving, and with recent tax regulations changes, such as

the Ease of Paying Taxes (EOPT) law, in effect, understanding these pitfalls is more

critical than ever.

This essential business owner checklist is designed to provide you with the direct insights

needed to pinpoint and rectify these all-too-frequent errors before they impact your bottom

line. We're talking about avoiding everything from overlooked deductions to misclassified

expenses, ensuring your financial house is in order.

Furthermore, our guide goes beyond simply identifying these issues. We'll delve into

practical, real-world solutions that can save you valuable time, money, and stress.

Discover how strategic record-keeping, timely filings, and a clear understanding of specific

BIR regulations can transform your tax compliance from a burdensome chore into a streamlined

and manageable process.

Ultimately, this comprehensive guide will equip you with the knowledge not only to avoid

common tax mistakes but also to optimize your tax management practices. This empowerment

will allow you to focus more energy on your business and less on the constant worry of

government audits.

What are the common tax mistakes business owners make?

Without proper guidance, many business owners fall prey to tax mistakes that could

negatively impact their finances and legal standing.

Here are the most common tax mistakes and how you can avoid them:

#1 Failure to register your business

Regardless of the size or type, registration with the Bureau of Internal Revenue (BIR) and other government agencies is a legal requirement for all businesses in the Philippines. Failure to properly register your business means operating illegally and exposing yourself to risks such as penalties, tax deficiencies, or even business closure.

How to avoid it:

To ensure compliance, register your business with the appropriate government offices, such

as the Department of Trade and Industry (DTI) or the Securities and Exchange Commission

(SEC).

Additionally, register with the BIR soon after business registration to obtain a Tax

Identification Number (TIN), Certificate of Registration (COR), and Authority to Print (ATP)

for issuing invoices.

#2 Choosing the wrong business structure

Your legal business structure affects the way you register the company, pay taxes, and the requirements you must comply with on a regular basis. Selecting a business structure that doesn’t match your style or business goals can subject you to unexpected liabilities, restrictions, or higher tax obligations.

How to avoid it:

In the Philippines, the most common structures are sole proprietorship, partnership,

corporation, and one-person corporation (OPC). Before registering your business, research

each legal structure to see which aligns with your objectives.

Learning about the crucial differences between business structures in the Philippines

prepares you to navigate the process more efficiently.

Here’s a video that walks you through the various business structures, including their

respective advantages, disadvantages, regulatory requirements, and tax implications.

Seeking fractional CFO expertise is also an effective way to learn which business structure matches you the best. If you have already chosen a business structure but want to switch to another one, a fractional CFO could also help you with the process.

#3 Poor organization of records

Maintaining accurate and organized financial records is helpful not only for business

transparency but also for tax compliance.

Poor record-keeping and document organization can lead to mistakes or discrepancies in tax

filing. When this happens, your business risks unnecessary headaches such as audits and

penalties.

How to avoid it:

Proper recordkeeping can be as simple as having one place to store all your financial

records.

The best way to accomplish this is to utilize a tool that automates your bookkeeping

processes, such as accounting software (i.e., Xero) or enterprise resource

planning (ERP)

software (i.e., Britana).

These tools help business owners organize and update financial transactions, keep

documentation, and even categorize expenses.

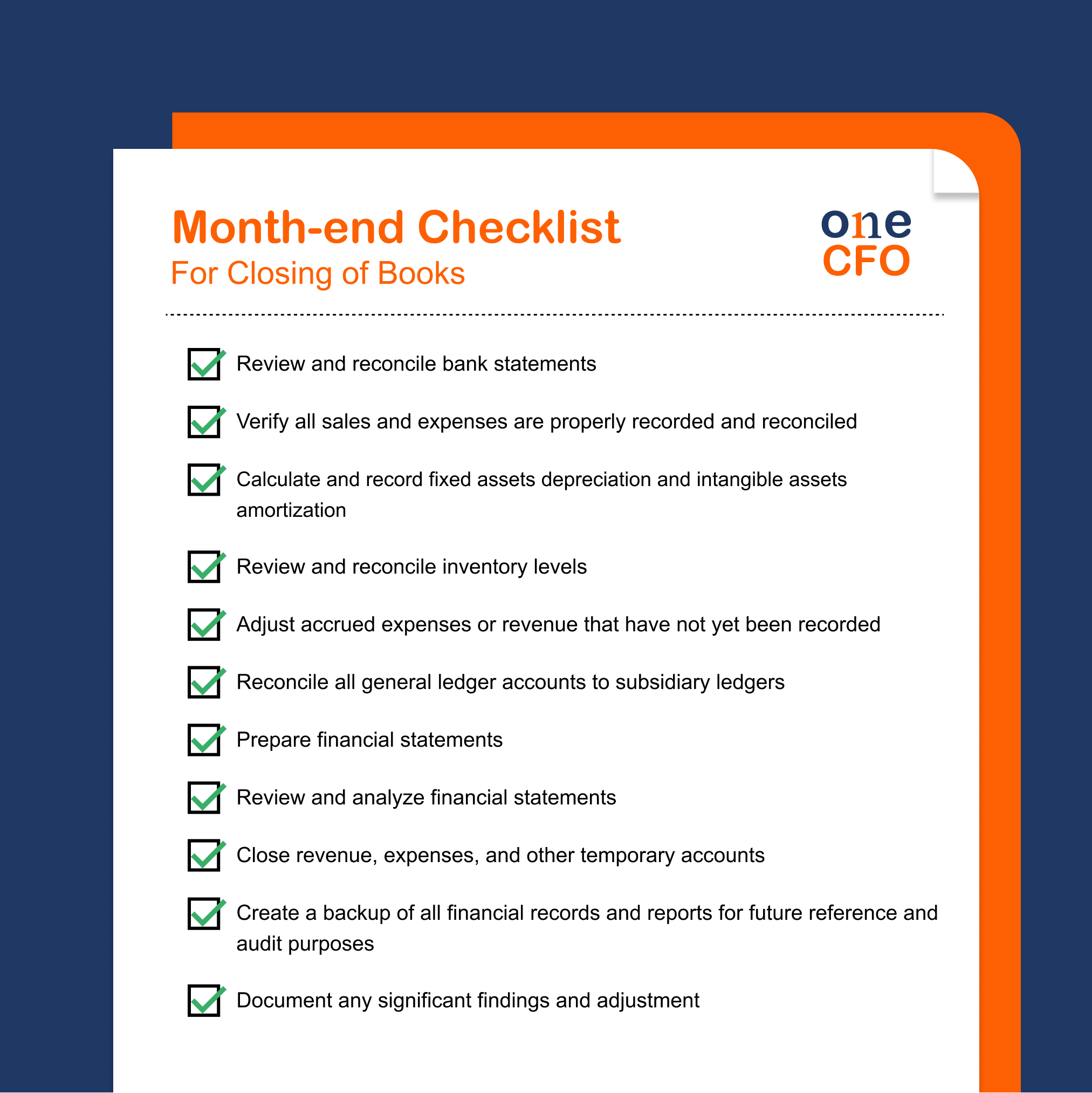

#4 Failure to reconcile financial statements

Reconciling financial statements and accounts means ensuring your books match your bank

statements and other financial documents. Failure to reconcile these documents can result in

errors in your tax calculations and discrepancies in your filing.

Apart from its tax implications, neglecting account reconciliation makes you more

susceptible to overspending or theft since no one is checking your records.

How to avoid it:

To prevent these issues, set aside a schedule to reconcile your accounts and

cross-check all

financial records at least once a month. By doing so, you can quickly spot inconsistencies

and take the necessary steps to resolve them.

Additionally, regularly reconciling your financial statements ensures you always make

business decisions based on accurate data.

#5 Inaccurate reporting of taxes

Inaccurately reporting your taxes, accidentally or not, can have serious consequences on

your business.

Overreporting your taxable income means you have to pay more taxes than necessary, which

only wastes resources you could have used for other means.

On the other hand, underreporting your income can lead to penalties or even tax evasion

charges.

How to avoid it:

Mistakes in tax reporting are often caused by poor recordkeeping or errors in tax

calculations. Apart from using tools or software to track your income and expenses, you

should consult a tax professional to check your tax calculations.

It’s also a best practice to double-check your tax forms before submission to minimize

errors and complications along the way.

#6 Missing important deadlines

Not only do you need to submit accurate tax reports, you must also file them on or before

the deadline. Late tax filings or entirely missing your requirements can result in costly

penalties and interest charges from the BIR.

For instance, BIR imposes 25% penalty (surcharge) on the tax due

for late filing/payment. On

the other hand, 12% interest per annum is charged on the unpaid tax amount.

How to avoid it:

Set personal deadlines that are way ahead of BIR’s tax due dates to give yourself enough

time to prepare, review, and file your tax returns. Using a calendar system can help you

organize these dates and set automated reminders.

Having a tax professional or accountant help with your taxes also ensures you remain

compliant and stay ahead of your deadlines.

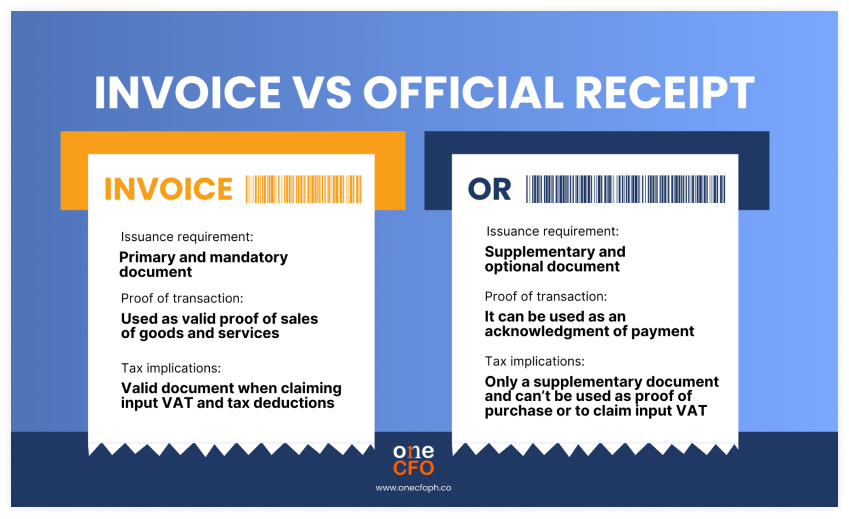

#7 Not issuing the proper invoices

If you don’t know it yet, BIR is now pushing Philippine businesses to use invoices instead of official receipts as the primary document when transacting with customers or clients. Failure to issue invoices when required can result in a penalty of up to ₱50,000 or even imprisonment.

How to avoid it:

Review the memoranda and follow the guidelines set by the BIR

regarding the transition from

using official receipts to invoices.

These guidelines provide in-depth clarification on when businesses should issue invoices,

the specific format to follow, and what they can do with their remaining official receipts,

among other details.

To further illuminate the important distinctions and ensure your compliance, it's essential

to understand the fundamental differences between issuing official receipts and invoices in

the Philippines:

#8 Ignoring VAT compliance

For businesses that exceed the VAT threshold of ₱3 million in sales, compliance with

value-added tax (VAT) regulations is another consideration.

Failure to register for VAT, file VAT returns, and apply the correct VAT rates are just some

of the typical VAT-related pitfalls, which inevitably lead to penalties and inaccurate

filings.

How to avoid it:

Always monitor your sales and prepare to register for VAT once you anticipate that your

sales will exceed the VAT threshold.

Once you’re VAT-registered, ensure that you comply with the regulations surrounding the

issuing of VAT invoices, filing of VAT returns, claiming of input VAT, and more.

Furthermore, if your business avails of or provides digital services, it's crucial to note

that these are now also explicitly subject to VAT.

As of July 1, 2025, the BIR requires businesses engaged in digital services to meticulously

comply with VAT regulations, including proper registration, invoicing, and timely remittance

of taxes.

Click below for more detailed information on VAT on digital services.

#9 Mixing business and personal finances

A common mistake, especially for sole proprietors or solopreneurs, is mixing their business

and personal finances together. This could mean using only a single bank account for both

business and personal purposes.

While you might think commingling is efficient, this practice can make tax filing

complicated since it will be challenging to determine which of your income or expenses are

actually for the business.

How to avoid it:

The simplest solution is also the most effective: open and strictly maintain separate bank

accounts and credit cards solely for business purposes. This small, yet critical, step

instantly clarifies your financial transactions and establishes clear boundaries.

This separation is vital because it creates an undeniable paper trail, essential for

accurate tax preparation and, more critically, for seamless BIR examinations. It builds a

robust foundation for financial compliance, minimizing your risks of costly errors and

future headaches.

Furthermore, a clear distinction between funds makes it significantly easier to distinguish

legitimate business income from personal funds. This clarity also allows you to accurately

identify and claim every expense that qualifies as a tax deduction, ensuring you don't

overpay taxes or face penalties for miscategorized items.

#10 Overlooking tax deductions

Many business owners forget to claim allowable tax deductions whenever

they’re filing for

their taxes. As a result, they miss the opportunity to reduce their tax dues and pay more

than what’s necessary.

Some examples of allowable tax deductions are utility expenses, travel or entertainment

expenses, depreciation, and interest expense from business loans.

How to avoid it:

Keep organized records of all your business-related expenses to efficiently categorize them

and see which are allowable deductions.

To ensure you won’t miss out on any tax savings or deductions, you should also consult

accountants or tax professionals to review your expenses and tax returns.

For an even deeper dive into actionable ways you can legitimately lower your taxable income,

don't miss our comprehensive video guide. Watch now to optimize your savings!

#11 Ignoring advice from professionals

If there’s one constant about the country’s tax laws and regulations, it’s that they

frequently change. Business owners in the Philippines already have their hands full with

managing their companies, so it can be challenging to keep up with all the tax changes and

ensure 100% compliance.

By attempting to handle their tax compliance independently and, crucially, by ignoring

expert professional advice, entrepreneurs often make significant tax mistakes. These errors

not only lead to penalties but also create unnecessary disruptions that pull valuable time

and resources away from core business operations.

How to avoid it:

The most strategic approach is to actively seek and integrate professional advice from

qualified accountants, seasoned tax experts, or even fractional CFO experts in the

Philippines.

These specialists possess the updated knowledge to help you navigate recent tax changes

seamlessly and to identify optimal tax strategies tailored to your business. Their insights

can transform potential compliance headaches into opportunities for efficiency and savings.

Furthermore, a proactive "tax health check" is an

exceptionally effective measure. This

comprehensive review of your business’s overall tax compliance helps in early identification

of potential tax risks, uncovers overlooked deductions, and provides assurance that you are

fully fulfilling all your tax obligations.

Investing in professional guidance is an investment in your business's financial security

and future growth.

Take control of your taxes with OneCFO

Navigating the complexities of Philippine tax compliance doesn't have to be a source of

constant stress for business owners. By proactively addressing these common tax mistakes and

diligently following this business owner checklist, you're not just avoiding

penalties—you're building a stronger, more resilient foundation for your venture.

However, we understand that staying on top of every evolving BIR regulation, ensuring

meticulous record-keeping, and maintaining year-round compliance are demanding and

time-consuming challenges for SMEs and startups. That's where expert support becomes

invaluable.

Imagine having a dedicated financial partner who keeps you compliant, minimizes your tax

burden, and frees you to focus purely on growth.

At OneCFO, we specialize in providing bookkeeping, tax, payroll, and fractional CFO services

that empower Philippine businesses like yours.

OneCFO isn't just about compliance; we're about empowering your growth. We help businesses

like yours not only stay impeccably compliant with all BIR regulations but also develop

effective strategies that genuinely

optimize your resources, maximize savings, and boost

your bottom line.

Whether you need swift expert consultations to clarify a pressing tax query, seamless

assistance with business registration, comprehensive tax health checks to uncover hidden

risks and opportunities, or ongoing financial guidance, OneCFO has your back every step of

the way.

Don't let the complexities of tax compliance divert your focus from what you do best.

Visit us at onecfoph.co or email us at [email protected]. Let OneCFO equip you with the confidence and clarity you need to navigate Philippine tax laws effortlessly, ensuring your business thrives.

Read our disclaimer here.