October 3, 2023 | 8:45 pm

Besides a viable product or service, selecting the right legal business structure is

essential when starting a business. In the Philippines, you may register your business as a

sole proprietorship, partnership, corporation, and one-person corporation or OPC. But which

one is the best option for your business?

Choosing among the four common business structures in the Philippines dictates where you

register your business, the additional requirements, taxes, and the extent of liability.

Furthermore, registering your business is not just a legal requirement for business in the

Philippines. It is a strategic step that enhances credibility, fosters trust, and unlocks

market opportunities.

In this guide, we’ll explore the different legal business structures, shedding light on the

‘why” behind ‘what’ you choose. Read on to make informed decisions that will be your

passport to legitimacy and success.

What does business legal structure mean?

A business legal structure is a classification the government requires all businesses to

have upon registration. It establishes the framework that defines its ownership, management,

tax obligations, and legal responsibilities within the eyes of the government.

Entrepreneurs must thoroughly evaluate their business goals, size, and risk tolerance to

determine the suitable business registration option for their venture.

4 Types of Legal Business Structure

Once you have a business idea and business plan, it’s time to register your business. But

before doing so, you must choose the appropriate structure for your company.

Here are the four types of business structures to choose from:

Sole Proprietorship

A sole proprietorship is the most common

type of structure since it's also the simplest to

set up. Only a single individual owns and controls the business in a sole proprietorship.

Regarding taxes, the owners pay income tax at either a graduated

rate or an 8% rate. The

graduated tax rates range from 0% to

35% depending on the taxable income, while the 8% rate

only applies to those with yearly gross sales or receipts below Php 3,000,000.

To register a sole proprietorship, the business owner needs to go through the Department of

Trade and Industry (DTI), the local government units (LGU), and the Bureau of Internal

Revenue (BIR).

Advantages

The main advantage of sole proprietorships is that owners have complete control over the

business. All final business decisions will come from them, and they get to keep and manage

the profits.

Another pro is it’s the easiest one to register. Compared to the other business structures,

sole proprietorship has the least paperwork - all you need to do

is apply for a name with

DTI, get the necessary permits from the LGU, and register it with the BIR.

Disadvantages

The main disadvantage of sole proprietorships is that owners have no protection from the

business’s liabilities, as they are fully liable for all debts and losses incurred.

Financial institutions can legally seize personal assets when the business suffers losses or

goes into debt.

Sole proprietorships also can’t distribute shares, making it hard to attract investors. You

can use other means like bank loans to fund your business.

Partnership

If you start a business with at least one more person, where each contributes to the work

and shares the profit, then your business structure is a partnership.

In a partnership, each partner agrees to contribute money or service and gets a share of the

profit according to their capital contribution. Similarly, the partners distribute any

losses in the same proportion they share the profits.

Additionally, partners are liable for taxes on the income they earn separately. For example,

once the partners divide the profits among themselves, the amount a partner receives is now

subject to income tax, which that partner should pay accordingly.

Common examples of partnerships are law firms, accounting firms, and physician groups.

Because providing licensed professional services bears much weight and responsibility, their

businesses can only be partnerships with unlimited

liability to their stakeholders.

Business owners who want to establish a partnership should register with the Securities

Exchange Commission (SEC).

What are the two types of partnerships?

A partnership has two types: general partnership and limited partnership.

In a general

partnership, the partners evenly divide the profits among themselves. General

partners play a role in managing the business’s operations, but they also bear unlimited

liability in the company.

Unlimited liability means if the company or another partner takes on debt, all general

partners are liable for it. The partners’ assets are also unprotected.

Meanwhile, partners are only liable for the amount of their contribution in a limited partnership.

Limited partners also don’t have any management rights to the business.

Advantages

An advantage of a partnership is you’re not alone in running the business. Partnerships

distribute the workload and decision-making among multiple individuals, reducing the burden

on one person.

Partnerships allow more resources. Partners can pool their financial resources and

expertise, potentially enabling the business to access more capital and talent. It also

helps if each partner has a different expertise, so one’s weakness can be another’s

strength.

For limited partnerships, limited partners enjoy the protection of their assets since

they’re only responsible for the amount of their investment.

Disadvantages

Differences in opinion and conflicts among partners can arise, potentially leading to

disagreements or disputes that may be challenging to resolve. It may also disrupt the

harmony within the business and potentially affect employee morale and overall

productivity.

You also don’t have complete control over the business in a partnership. Partnerships

require a consensus on major business decisions, which can slow down the decision-making

process.

While general partners enjoy more profits and control, they bear more risk as they have

unlimited liability. Each partner is responsible for the business’s debts and liabilities,

with their personal assets at risk.

Corporation

Another option for a business structure is a corporation. Starting a corporation

requires

two to 15 incorporators, each with at least one share.

A corporation is a separate juridical personality from the stockholders owning the

corporation. All stockholders enjoy limited liability as they are only responsible to the

extent of their shared capital.

Business owners register their corporations with the SEC. When establishing a corporation,

the SEC approves the authorized capital the company will

have, which is

the maximum amount

of shares the company can distribute.

Moreover, corporations are subject to a corporate income tax of up to 25%.

Depending on the

type of corporation, they may also be exempted from paying income tax. Corporations can also

use tax deductions to lower tax obligations.

What are the two types of corporations?

Corporations can be stock corporations or non-stock corporations.

A stock corporation is your typical

corporation, where the company divides the capital into

shares and distributes them to the investors. Each investor will receive a dividend and

portions of the excess profits, depending on how much they invested in the company.

On the other hand, non-stock corporations don’t issue

stock shares. Instead of a

shareholder, incorporators of non-stock corporations are called members. This type of

corporation typically exists for charitable, religious, and educational purposes.

Advantages

The most apparent advantage of a corporation is all stockholders have limited liability in

the business, which means their assets are protected.

Corporations can often deduct a wide range of business

expenses from their taxable income.

Certain corporations, like non-stock and non-profit educational

institutions, also enjoy

income tax exemption.

A corporation is excellent for businesses that want to grow quickly since they can raise

funds from investors. Being a corporation allows them to distribute equity to venture capitalists,

helping them scale their operations.

Disadvantages

A disadvantage of running a corporation is that it’s expensive and highly regulated. Registering a corporation and complying with reportorial requirements is complex and takes time and money.

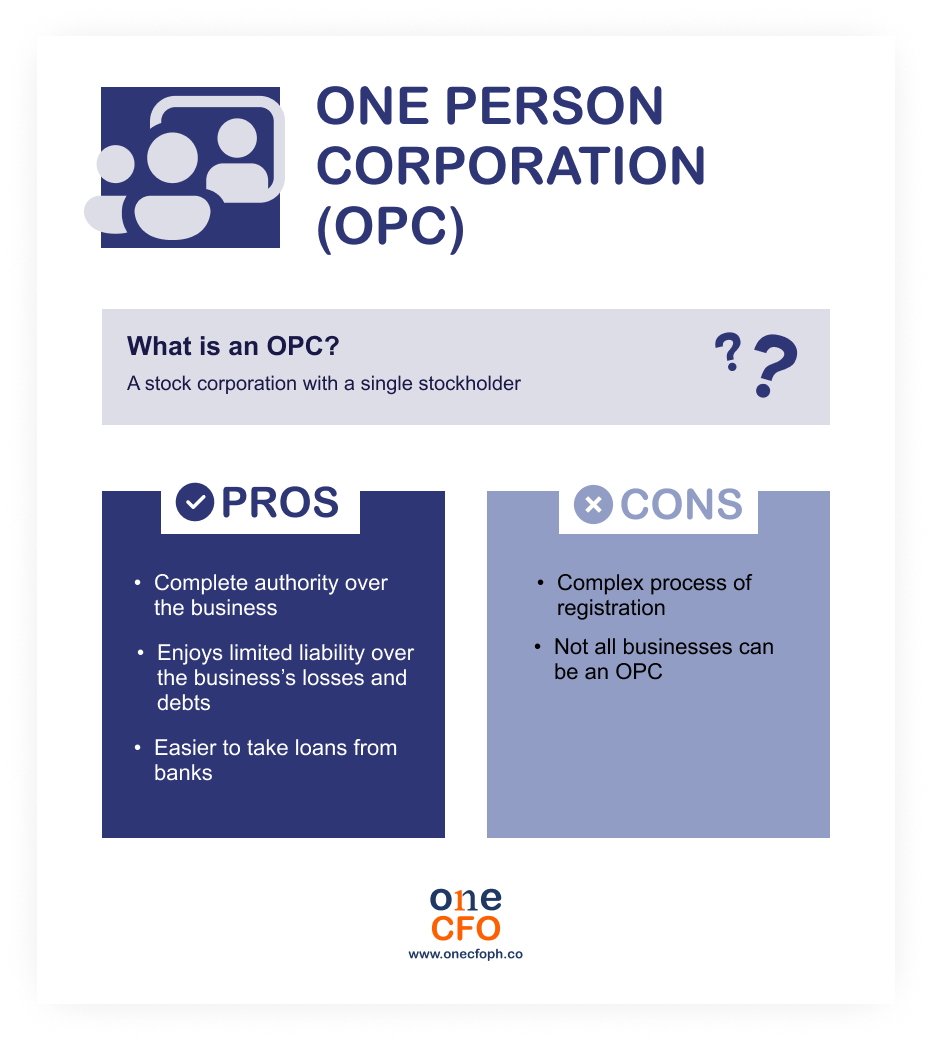

One Person Corporation (OPC)

A one person corporation or OPC is a

stock corporation with a single stockholder. This

business structure is like the incorporated version of a sole proprietorship, where the

owner enjoys complete business control but has only limited liability.

When establishing an OPC, the owner acts as the company’s director and president. The owner

needs to identify a nominee and alternate nominee, the following persons in line to run the

business if the owner can’t fulfill the duties.

Being a corporation, a business owner should register the company under the SEC. They should

also comply with the other requirements the LGU sets and register with the BIR.

Advantages

Like sole proprietorships, the owner has complete authority over the company. The owners

mainly control all business decisions and the business's directions.

An OPC also benefits from a corporation's limited liability, which means the owner’s assets

are protected from the business’s liabilities.

Seeking funding is also easier since the formality of a corporation brings more credibility,

inspiring confidence from financial institutions. However, once there is more than one

stockholder in an OPC, they should convert their business structure to

a traditional

corporation.

Disadvantages

A disadvantage of OPC is its more complex registration process compared to sole

proprietorships. The additional paperwork can be a struggle, especially since the owner

operates alone.

Another con is that not all businesses can register as

OPC. Certain financial institutions

and professionals exercising their profession are not allowed to register as OPCs.

OPCs also can’t go public since it goes against the

nature of the

structure, where there’s

only one stockholder. Going public means a company can now sell shares or stocks to the

public to raise capital.

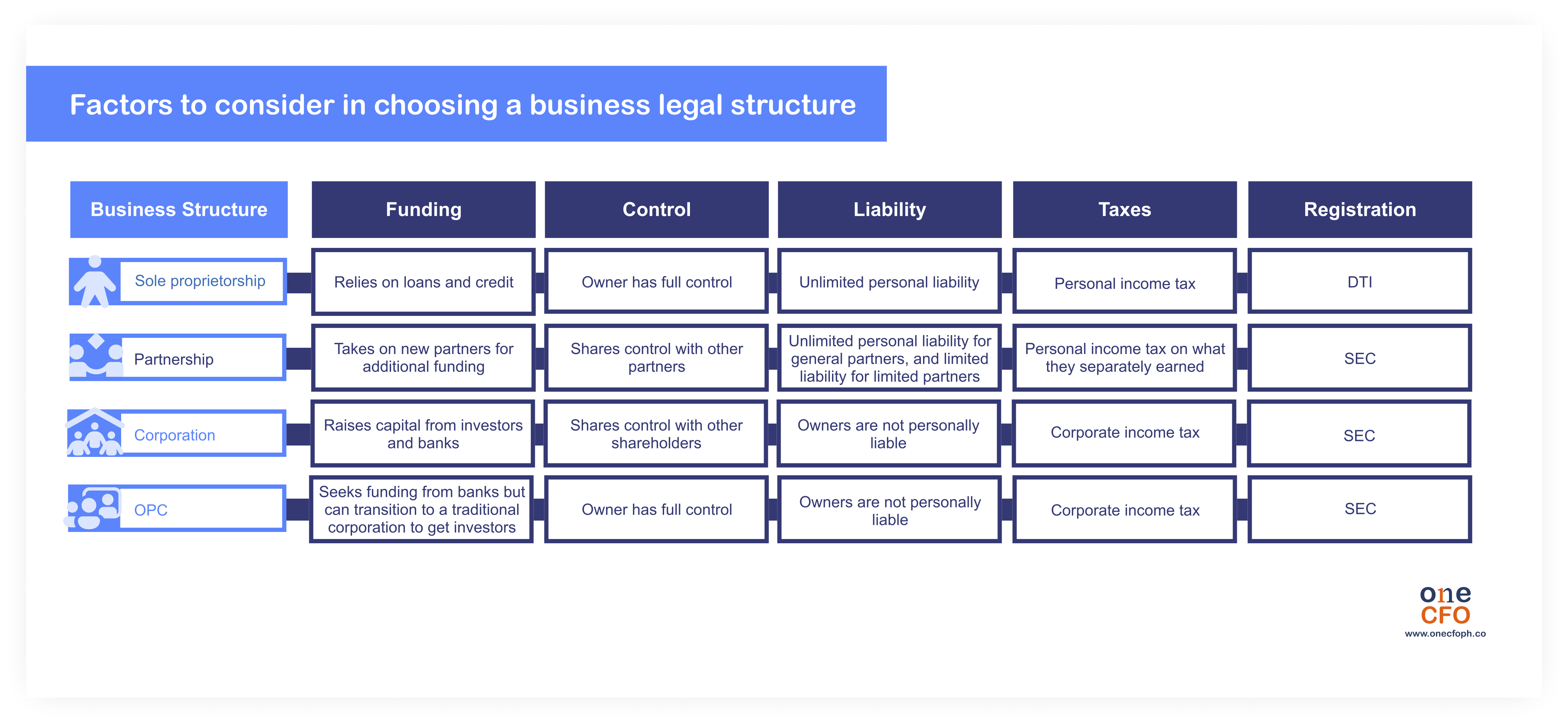

What is the best business structure for my business?

How you register your company plays a crucial role in the business's success. But how do you know which one is right for you? Here are some factors you need to check:

Seeking funding

If you want to grow and seek investors, start with a corporation where you can easily distribute shares to investors. Other structures can also seek funding differently but are less flexible than corporations.

Control over the business

Business owners who want full authority over the business should choose a sole proprietorship or OPC. These business structures allow the owner to operate independently and control the company.

Liability protection

Businesses like corporations and OPCs provide liability protection to their owners, which

means their assets are protected if the company suffers losses.

Partnerships may also offer the same protection if the person involved is a limited

partner.

Taxes

Each business structure has its tax compliance requirements and

rates. When assessing

potential income, it’s essential to check how the government taxes a business to see which

will be the cheapest.

Sometimes, being a sole proprietor can be beneficial because of the 8% tax rate. However,

once you exceed the VAT threshold, being taxed as a corporation might become cheaper since

it has lower graduated

tax rates ranging from 0% to 25%.

Ease of registration

A sole proprietorship is the easiest to register since DTI has fewer requirements than the

SEC.

However, suppose your business fits more for a partnership or corporation based on the

initial factors we mentioned. In that case, going through the hoops of complying with the

SEC requirements can be more beneficial.

Can you change your business legal structure?

The legal structure can change if it no longer aligns with your requirements as the business

expands.

While you can’t directly convert from a sole proprietorship to a corporation or OPC, and

vice versa, you can legally close your current business and open a new one to register the

new business entity.

Watch this video to learn more about your options in registering your business as well as

shifting to a different business structure:

Each business is unique, and knowing how you want to run your business will determine the

best structure for you. But if you’re still unsure of which business structure to choose or

confused with the requirements needed for each, we can help you!

OneCFO

can aid you

with the registration process and also help manage your business

finances, such as payroll, tax, and bookkeeping, so you can entirely focus on your growth.

Visit us at onecfoph.co or contact us at [email protected] to

learn how you can maximize our

financial services for your benefit.

Read our disclaimer here.