March 21, 2023 | 4:26 pm

Table of Contents

Small business owners find tax season particularly stressful due to constantly changing

regulations, the pressure to meet deadlines, and the fear of making costly errors. But what

if you could make tax season stress-free with practical tips?

Preparing taxes well before the April 15th deadline minimizes stress, allows for more

accurate filing, and could uncover opportunities for tax savings.

Furthermore, the Ease of Paying Taxes (EOPT) Act was recently signed into law. This act aims

for more relaxed tax regulations, such as lower fees, simplified requirements, and a

hassle-free tax filing process.

Crush the tax season stress! This blog is packed with simple-to-follow tips for small

businesses like yours. We’ll show you how to navigate the tax season and transform a

potential headache into a smooth, stress-free experience.

What are stress-free tax tips for small businesses?

Navigating tax season can be challenging, even for seasoned taxpayers. With the filing of the annual income tax return (ITR) set for April 15, here are practical tips for a stress-free tax season.

Stay on top of tax changes

Running a business is no small feat; keeping up with the ever-changing tax regulations can

feel like another huddle. But staying informed can keep you stress-free this tax season.

Knowing the latest rules lets you know how much tax you owe, deductions you can claim, and

even the filing procedures. Furthermore, understanding the tax rules that apply to your

business means you stay compliant and avoid costly penalties.

What is the Ease of Paying Taxes Act?

A significant change recently implemented was the signing of the Ease of Paying Taxes (EOPT)

Act on January 5, 2024. This law contains significant amendments to make the tax system more

taxpayer-friendly and efficient.

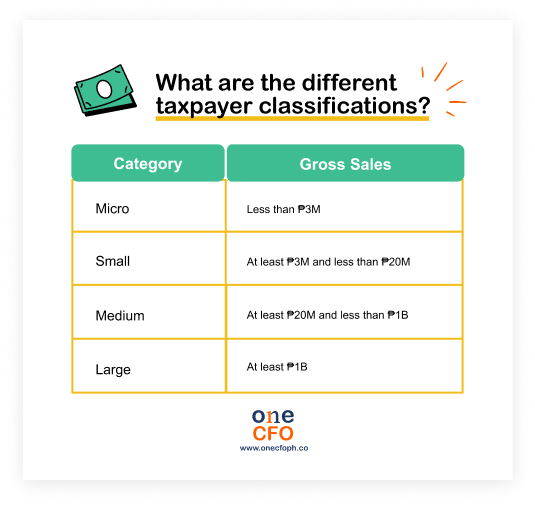

A critical aspect of the EOPT Act is that taxpayers are now

classified into new categories

based on their annual gross sales, making tax administration more responsive and tailored to

each taxpayer’s needs.

Knowing which classification your business falls into also clarifies the benefits you can

enjoy from being a taxpayer.

For example, the EOPT Act provides a provision exempting micro taxpayers from paying

withholding tax thereby saving them from additional expense.

Micro and small taxpayers also can expect significant relief. The surcharge for failure to

file a tax return or filing an incorrect return drops from 25% to 10%.

Furthermore, the interest penalty is halved, and the compromise penalty for invoicing issues

is reduced by 50%.

What is the simplified rule on Value-added Tax?

For business owners who need to pay value-added tax (VAT), familiarizing yourself with the

new VAT rules will inform you of your requirements for VAT and income tax filing.

For one, businesses should now use gross sales as the basis for VAT for both sales of goods

and services. Previously, taxpayers had to use different documents as their VAT basis -

gross sales for sales of goods and

gross receipts for services sales.

By making the basis uniform for all sales transactions, businesses will find it easier to

track documentation, especially since they will only need to refer to their invoices from

now on.

Know your tax obligations

Aside from familiarizing yourself with tax regulations, you should also know the taxes that

apply to your business, which generally depend on your business's legal structure.

Understanding business-specific tax obligations is key to a smooth and stress-free tax

season. Here’s why:

What are the applicable tax rates for SMEs?

For those in sole proprietorships or partnerships, business owners would need to pay

personal income tax quarterly, at a graduated rate of

up to 35% or at a fixed rate of 8%.

However, note that the 8% rate is only available to businesses whose sales don't exceed the

current VAT threshold of ₱3M.

If you opt for the graduated tax rates, your business will also be subject to a 12% VAT or

monthly percentage tax, also called sales tax or business tax, equal to 3% of your gross

sales, as applicable.

Corporations, on the other hand, are subject to corporate income tax of up to 25%.

Like the

other legal structures, corporations also have a VAT threshold of ₱3M, and exceeding this

would result in an additional 12% tax.

Businesses with salaried employees must also remit taxes they withheld from their employees'

income to the BIR.

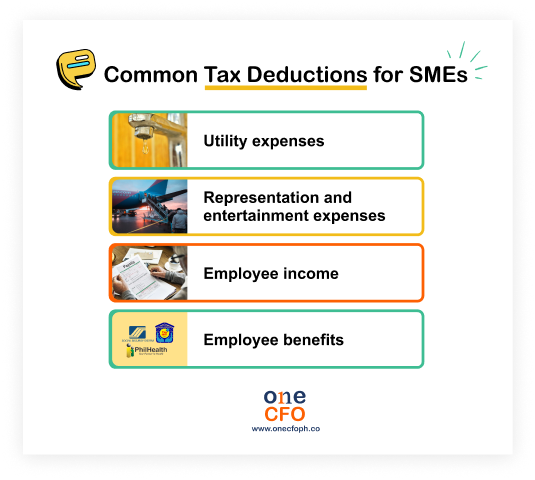

Take advantage of tax deductions

While all businesses have a responsibility to pay taxes, there are smart strategies to

minimize your tax burden legally. This is where tax deductions come in: they allow

you to

subtract specific expenses from your taxable income, ultimately reducing the taxes your

business owes.

Furthermore, the recent changes to tax regulations have simplified the process of claiming

allowable deductions.

The EOPT Act has removed the requirement to pay withholding tax before claiming a tax

deduction on certain payments and expenses. Previously, businesses must prove that they paid

withholding taxes to the BIR before claiming deductions.

With the tax rules being eased, claiming allowable tax deductions is easier. This translates

to a reduced tax burden and increased cash flow for reinvestment in operations, growth

initiatives, or other strategic priorities.

Some of the most common tax deductions are:

Watch this video to learn the secrets to maximizing tax deductions:

Organize your documents

Meticulous record-keeping might seem like a chore, but it's one of the secret weapons to a

stress-free tax season.

Proper bookkeeping involves

organizing financial documents during tax season and at all

times. These documents may include sales invoices, official receipts, checks, utility bills,

etc.

Your financial documents will serve as your reference when calculating how much taxes to

pay. At the same time, BIR may request a copy of these documents, especially if the business

is audited or when declaring tax deductions.

Moreover, the EOPT Act requires taxpayers to preserve their books of accounts and accounting

records for five years after the date or

deadline for filing the returns.

To safeguard your documents better, it’s also best to upload backups of your files to

accounting software.

Avoid costly mistakes and ensure your data are accurate with these proven bookkeeping tips:

File and pay your taxes anywhere

The EOPT Act includes the ‘File and pay anywhere’ process, providing more convenience to

taxpayers in settling their tax payments.

Previously, taxpayers could only file and pay their taxes within the jurisdiction of where

their business was registered. If they filed in the wrong venue, the business had to pay the

25% surcharge on the tax due.

But with ‘File and pay anywhere,’ taxpayers like SME owners can now file anywhere without

any surcharge. This option gives taxpayers more flexibility in filing their tax returns.

In addition, payments are allowed electronically or manually through payment channels such

as authorized agent banks, RDOs, and authorized tax software.

How do you manage tax deadlines?

There are many ways business owners can manage tax deadlines and avoid late filing of

taxes.

One is setting up calendar reminders, whether on your phone or digital business accounts,

for easier tracking. This way, you can proactively track when your deadlines will be and

ensure you’re prepared.

You can also set these tax reminders on your accounting software like Xero. Using accounting

software gives entrepreneurs more flexibility in handling finances, and they can even set up

other automated

reminders for payroll, invoice payments, and such.

Consult a tax professional

Business owners should engage the help of a tax professional to ensure a stress-free tax

season.

Consulting a tax professional is beneficial to SMEs for the following reasons:

Enlisting the expertise of tax professionals offers businesses, regardless of size and stage, comprehensive support they could use to make tax season less complex and stressful.

Are small businesses required to register with BIR?

The short answer is yes if you’re still unregistered and wondering if you should register

your business with the BIR. Registering with the BIR ensures your business complies with the

government.

Running a business is already challenging enough without the looming possibility of

penalties and fines if you’re found unregistered.

According to the Tax Code, failure to register your

business can result in a fine of ₱5,000

to ₱20,000 and imprisonment of six months to two years.

Moreover, being a registered business gives you access to more financial services. Opening a

business bank account or acquiring loans may require a tax identification number (TIN),

which you can only obtain from the BIR.

Customers are also more likely to transact with registered businesses, especially if they

require official receipts (OR) for every transaction. ORs are especially important for B2B

companies or those who serve other businesses since customers need receipts to document

their business spending.

How much is the BIR registration fee in 2024?

Previously, businesses needed to pay an annual fee of ₱500 every January to renew their BIR

business registration. Fortunately, starting this year, the EOPT Act has eliminated the

annual registration fee (ARF)

payment.

While BIR stops the collection of ARF payments, the business’s current Certificate of

Registration (COR) remains valid, ensuring uninterrupted operations for companies.

Business owners, however, may still choose to update their COR at their convenience. To do

so, they should visit their registered Revenue District Office (RDO) until the end of the

year and surrender their old COR.

Avoid the stress this tax season

By staying informed about tax regulations and obligations, keeping meticulous records, and

taking advantage of the EOPT Act’s simplified processes, you can transform tax season from a

stressful ordeal into a manageable task.

To make things even better, seek professional guidance from OneCFO, experts in tax. Keep

peace of mind knowing that your business is shielded from potential errors and missed tax

deadlines.

As your all-in-one partner for growth, OneCFO can help your business

navigate the complex

world of tax and ensure you’re maximizing your resources and getting the best advice.

Visit us at onecfoph.co or at [email protected] to learn how to approach tax season

with a

sense of control and stress-free!

Read our disclaimer here.