May 6, 2025 | 11:58 pm

Table of Contents

How often does gut feeling dictate how you scale your company? Strategic business growth

demands more than intuition; it requires the power of financial clarity to transform data

into actionable insights.

Financial clarity simply means having a solid understanding of your company’s financial

health, including its revenue, expenses, cash flow, and profitability. This deep

understanding fuels data-driven growth in key areas: marketing, sales, operations, and

product.

Imagine the transformation that occurs when you move from guesswork to data-driven

decisions. Let's explore the impactful results this clear financial understanding can bring

to your bottom line and future success.

How does financial clarity propel business growth?

Financial clarity empowers businesses to use numbers and data-driven insights when taking

action instead of relying on guesswork or instinct.

Here are five ways financial clarity improves data-driven business growth decisions:

#1 Promotes informed decision-making through financial clarity

Without a clear understanding of your data, you could take steps forward without

guaranteeing you’re headed in the right direction. Financial clarity directs you to the

right growth path by helping business owners objectively assess their finances and make

decisions based on facts, not assumptions.

For example, if your business suddenly experiences a drop in profit, you can use financial

data to determine whether the issue is due to increased expenses, a decline in customer

demand, or ineffective marketing.

By understanding the clear financial picture, you can make data-driven decisions that

directly address the root cause of the problem, whether you need to adjust your prices, cut

costs, or improve your marketing strategies.

Using accurate financial information when making decisions also boosts your team’s

confidence, knowing it’s backed by logical and real numbers. When everyone trusts the plan,

they work together better and put more effort into making it succeed, which is how the

business grows.

#2 Cuts unnecessary costs with clear financial visibility

One of the biggest threats to business growth is overspending money. Without financial

clarity, it can be easy to overlook hidden costs and small, wasteful expenses that quietly

add up and erode profits.

You must incorporate precise data during financial planning and analysis to maximize your

growth. This will reveal the specific business areas that incur unnecessary costs, such as

unused software subscriptions, excess inventory, and other operational inefficiencies.

An example is how a manufacturing company can reduce costs by investigating its data. Upon

careful analysis, switching suppliers or renegotiating contracts might significantly reduce

expenses.

The money the business saves can now be allocated to initiatives that drive growth, such as

marketing, product development, or expansion.

Besides cutting unnecessary costs, understanding financial data also helps avoid costly

mistakes.

For example, if a company makes decisions based solely on intuition, it may overestimate its

sales potential. This can lead to purchasing excessive stock and incurring unnecessary

storage costs.

When businesses utilize accurate data, they can more effectively predict sales and make

informed decisions. This saves money and resources.

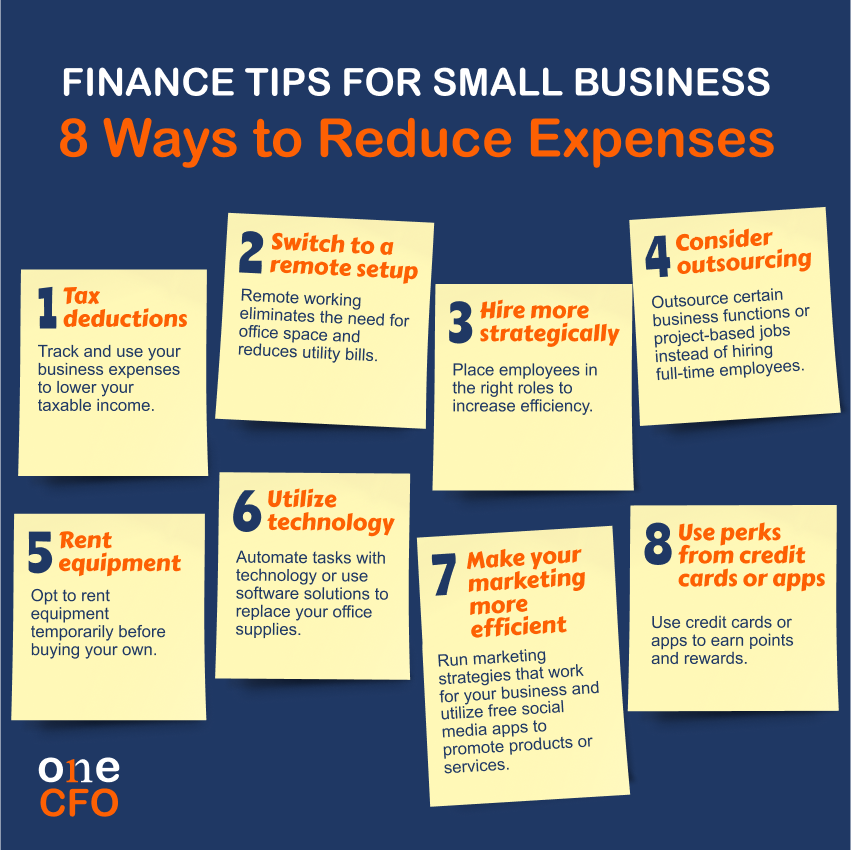

Here are also some tips you can follow to reduce expenses in your business:

#3. Optimizes business profitability with financial insights

An increase in sales and profits is essential to a growing business. Financial clarity can

help business owners improve profits and maximize returns by analyzing key profitability

drivers, such as pricing.

Businesses that lack a clear understanding of their finances may rely on outdated data to

determine product pricing, resulting in potential underpricing and limited revenue. In some

instances, this could even result in losses if they overlook increased selling costs.

Furthermore, financial clarity reveals the most lucrative aspects of your business, enabling

you to prioritize and capitalize on them, ultimately driving profit growth.

For instance, a restaurant can check its financial data to see which menu item performs the

best. This way, it can market the dish more effectively or create variations to drive

additional sales.

#4 Supports strategic planning for growth initiatives

Any business owner can think of possible ways to grow their company, but it takes financial

clarity to strategically plan and assess which growth initiative is most effective.

An example is planning to expand your business by opening a new location. Some business

owners may choose a location blindly based on their gut feeling.

When choosing an area for expansion, it is essential to utilize financial insights.

Analyzing factors such as foot traffic, operational costs, and competitor presence can help

ensure you make the most informed decision.

With financial clarity, business owners also gain the confidence and direction needed for

effective strategic planning, such as:

#5 Strengthens risk management with financial transparency

Every business faces financial risks, including economic downturns, cash flow shortages,

unexpected expenses, and other challenges. However, risks can be mitigated if they have a

deeper understanding of their finances.

Accurate and timely data analysis enables business owners to identify and assess potential

risks, and develop strategies to mitigate or eliminate them.

For example, an online shop can use data to project its cash flow and identify any seasonal

dips that could lead to a cash crunch. Knowing these risks in advance allows

businesses to

take proactive measures. They can, for example, secure short-term financing or adjust

inventory levels accordingly.

If you want to learn more about managing your inventory, check out this video for some

practical tips and tricks:

A clear financial understanding also strengthens risk management by assessing how each

decision can impact the business.

Remember that just because a business decision is backed by data, it doesn’t mean it’s

always foolproof. Assessing the financial implications of your choice – through reviewing

forecasts or analyzing cost-benefit tradeoffs – is essential in managing risks.

How to achieve clarity in finance?

Achieving financial clarity involves transforming raw numbers into a clear understanding of

your business's financial position.

Organizing, analyzing, and interpreting your financial data is key to gaining actionable

insights. By adopting a data-driven approach, you'll uncover your business's true health.

Here's how to get started:

Maintaining accurate financial records for clarity

Embracing financial clarity begins with maintaining accurate and timely financial records,

which you will rely on when making informed decisions. Without reliable financial data, the

business is essentially just guessing what steps it should take next.

Maintaining accurate records is essentially about employing best bookkeeping practices in

business, such as regularly reconciling bank accounts, properly categorizing business

expenses, and establishing a clear tracking system.

It’s also essential to avoid common bookkeeping pitfalls to ensure the integrity of your

data.

Check out this video to learn the most common bookkeeping mistakes you should watch out for:

Understanding and analyzing your financial reports

Financial reports, including income

statements, balance sheets, and cash flow statements,

are treasure troves of crucial financial information, such as profitability, financial

position, and cash flow.

These reports provide business owners with an overall picture of the company’s financial

health, which they can use to identify patterns, derive insights, and make informed

strategic decisions.

However, interpreting financial statements can be complex or require a certain degree of

financial knowledge. If you’re unsure about what your financial reports say about your

business, it’s best to consult expert fractional CFOs to ensure you obtain the right

insights and make the most out of your data.

Tracking Key Performance Indicators (KPIs) for financial insights

Monitoring key performance indicators (KPIs) is

another way businesses can utilize data to

improve their decision-making approach.

KPIs such as gross margins, customer acquisition

cost, and revenue growth help business

owners determine if they are meeting their milestones and understand how to improve their

financial performance.

Another important KPI is monthly recurring revenue (MRR), especially if your business offers

products on a subscription, membership, or retainer basis.

Here’s a helpful video you can watch to learn more about MRR:

Conducting regular financial reviews for proactive management

Establishing a system to record, analyze, and track accurate data is a critical step in

achieving financial clarity. To maintain this practice, you also need to conduct regular

financial reviews to ensure that all financial decisions you make remain backed by accurate

data.

For example, a routine check-in might reveal the discrepancy between your initial budget and

the actual expenses incurred by the business. Knowing this information can help you allocate

resources more effectively and enhance your budgeting practices.

To learn more about creating annual budgets for your company, check out this video:

Using financial management tools for strategic growth

Utilizing financial management tools such as

accounting software or enterprise resource

planning (ERP) systems also aids businesses in achieving financial clarity. Not only do

these tools increase efficiency, but they also ensure that financial data remains accurate

and updated.

Financial management software such as Xero and Juan automates bookkeeping

processes,

reducing human error. These tools can also generate real-time reports, allowing businesses

to make informed decisions quickly.

Building a data-driven culture around finance

Achieving financial clarity isn’t just your responsibility as the business owner, but it

should also be embedded in the company culture. When everyone in the company understands the

value of data, your team becomes more empowered to make data-driven decisions.

Here are some ways you can build a strong data culture in the company:

By involving your team in making data-driven decisions, you give them a sense of ownership and accountability and improve collaboration.

The power of clear finances: fueling your business's future success

Financial clarity is a crucial tool in driving continuous growth and success in businesses.

When entrepreneurs rely on precise financial data instead of relying solely on gut feelings,

they can make more informed choices, optimize their profitability, and manage business

risks.

While there are steps business owners can take to practice data-driven decision-making, a

true understanding of finances still requires the right expertise to utilize their data to

its fullest potential.

If you’re looking for proper and complete guidance in understanding your data, setting the

right KPIs, or creating strategic plans specific to your business, OneCFO is the one to

call!

OneCFO not only provides tax and bookkeeping services designed to improve data accuracy but

also world-class fractional CFO expertise to help you

plan and strategize for the future.

Visit us at onecfoph.co or email us at [email protected]

to learn how we can help you

embrace financial clarity and turn your numbers into effective, data-driven insights to

propel your business growth.

Read our disclaimer here.