January 15, 2024 | 4:02 pm

Table of Contents

Prepare your small business for a solid start in 2024 with accounting best practices.

Implement these strategies to build a more robust financial foundation for your small

business.

These tips will ensure you stay ahead, from early tax preparation to proper bookkeeping and

reporting. Getting your financial data spot on means better financial strategies, less

stress, and a smooth ride year-round.

Explore the 10 accounting practices designed for small business owners like yourself! We’ll

break down each one, share insights, and help propel your business to new levels.

What are accounting best practices?

#1 Proactive and timely tax planning

Tax planning helps small businesses think ahead and get ready for taxes in advance. This

means figuring out your income, finding possible deductions, and making money decisions

considering tax savings.

To be a proactive planner, familiarize yourself with the tax deadlines that concern your

business. Small business must know when taxes are due to avoid penalties.

Filing on time keeps businesses compliant. In addition, knowing when to file and pay taxes

helps manage cash flow better.

For example, January alone has a lot of deadlines related to taxes which you need to file

and pay. Here are some of the BIR forms small businesses need to remember and comply with

this January:

Another important deadline is filing the annual income tax return (ITR). Even if the deadline is still in April, small business owners should start laying the groundwork by organizing all documentation, such as receipts, invoices, bills, etc.

What is strategic tax planning and management?

Strategic tax planning and management mean planning from the start.

Understand your business structure and legal requirements when registering your business to

know the taxes your business will be subject to. This helps minimize taxes and ensure you

have the needed cash.

Consulting professionals is key for strategic planning. They guide in

setting up the right

business structure and model and staying tax compliant.

In addition, small business owners can also get accurate updates on changes in tax

regulations in the coming months.

Experts also help entrepreneurs find ways to minimize taxes through business-specific

deductions and

credits. Click on the video below to get more tax insights:

#2 Improve bookkeeping system

The new year is also an opportunity for businesses to inspect their bookkeeping system and

further improve it.

Given how complex financial systems can be, it's not uncommon to make bookkeeping mistakes.

The important thing is that small businesses can detect them early on and make the necessary

changes.

Common bookkeeping mistakes small business owners make:

Get more insights on the bookkeeping mistakes to avoid in this blog:

#3 Embrace technology

Upgrading accounting tools is another practice small businesses should consider in the

coming year.

Accounting software and ERPs are investments that enhance the efficiency and productivity of

business accounting - saving you more money in the long run.

Nowadays, many software programs are available in the market, like Xero and Britana, which

aim to transform how you conduct your business. Automating repetitive tasks like expense

tracking, data entry, categorization, and payroll is just one of the few things these tools

can do for a business.

In addition, entrepreneurs can leverage these advanced accounting tools to obtain real-time

insights and a financial picture of the business anytime and anywhere.

How do I know if I need a bookkeeper?

Upgrading to the latest tools is not the be-all and end-all of bookkeeping. Aside from

having these tools, there needs to be someone in the business who’s knowledgeable in

bookkeeping to maximize the usage of these tools.

While it’s not impossible for small business owners to learn how to bookkeep independently,

they may still need time, especially since accounting is not a common skill set among

entrepreneurs.

With that said small business owners should hire a trusted bookkeeper to handle their books

so they can focus on what they do best - growing the business.

#4 Choose the right accounting method

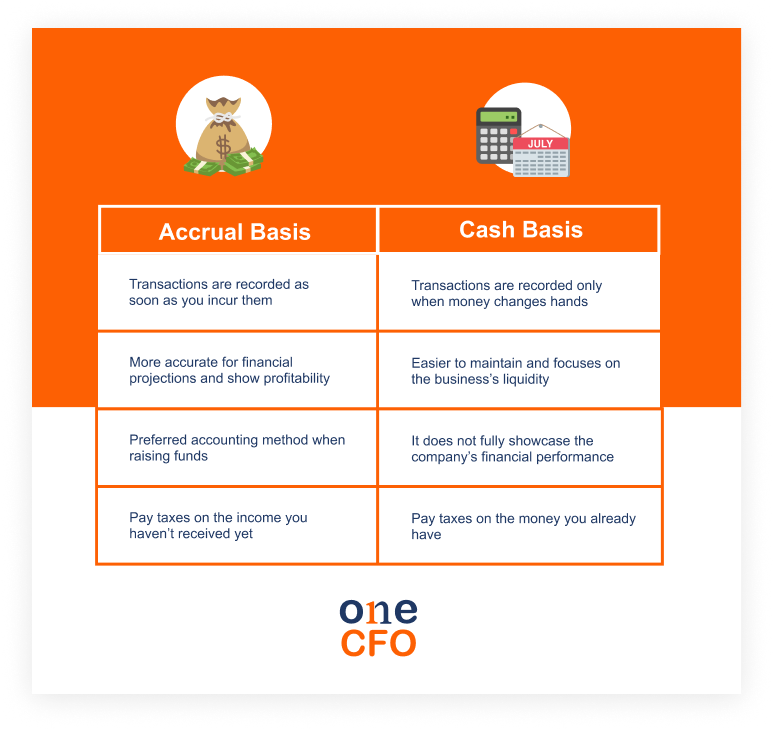

Businesses can choose from two main accounting methods when recording their transactions: the accrual basis and the cash basis.

Small businesses should assess what fits their needs best when choosing an accounting

method.

On an accrual basis, businesses record their income and

expenses as they incur and don’t

necessarily wait until they receive or disburse their money. For example, if they rendered a

service for a customer, they will automatically list the payment due as income even when the

customer hasn’t paid yet.

On the other hand, in a cash basis accounting, businesses

track their transactions only when

money changes hands. This accounting method best fits cash-only micro businesses since it’s

more simplistic, straightforward, and easier to maintain.

#5 Regularly track inventory

Whether small or big business, regularly tracking inventory should be a common practice, by doing so, companies can mitigate any spoilage from expiring products, minimize storage costs, and avoid tying their cash to excess inventory that won’t sell.

What is a POS system?

Inventory tracking can be as simple as listing each sale or purchase on a notebook.

But the more efficient way would be to use a point-of-sale (POS) system, a combination of

hardware and software that processes transactions, primarily by retail stores.

With a POS system, retail businesses can process payments, print receipts, and record

various information on the product sold. Not only does this make the checkout process easier

for customers, but this system can automatically record changes in the inventory balance

after each transaction.

But even if a business uses a POS system, it’s still advisable to occasionally conduct

manual audits and check if the actual count matches the records in the inventory software.

#6 Enhance invoicing processes

Customers don’t always pay on time, affecting your cash flow. It’s time to implement tactics

that could help encourage customers to pay on time.

Before sending an invoice, ensure that it has the complete information the customer needs to

settle their bill:

With accounting software, businesses can also automate sending invoices so they won’t forget

to remind customers of their payables.

Furthermore, send automated reminders days before the invoice deadline and even after the

deadline. Sending regular prompts pushes customers to pay early or reminds them of penalties

they may incur for paying late.

#7 Perform bank reconciliations

Bank reconciliations mean checking your books or

business accounts against your bank

statements and ensuring the transactions match.

Ideally, businesses should conduct bank reconciliations every month or every quarter. But if

you missed doing this or haven’t started, start on this habit now. It’s also crucial to

implement a plan to reconcile your accounts regularly.

Reconciling accounts helps small business owners find errors in their bookkeeping process

and fix them immediately. Entrepreneurs can also detect possible wrongful payments or

fraudulent transactions that may have occurred.

#8 Generate financial reports

Depending on the business structure and gross income, some companies may need to submit financial

reports or statements to the BIR and Securities Exchange Commission (SEC).

But whether or not your company is obligated to submit financial reports, it’s still crucial

to generate these statements to assess the performance of the business.

Creating financial reports such as income statements, balance sheets, and cash flow

statements helps businesses make informed decisions. These reports are the basis for KPIs

such as gross profit and revenue run rate, which companies can analyze to improve their

systems and strategies.

On top of that, financial reports are also essential when taking out credits or loans from

banks. Financial institutions use these reports to see how profitable a business is and

ensure they can repay their loans.

Investors look at the financial statements to decide if a company is worth investing.

#9 Effective expense tracking

If you haven’t diligently tracked your business expenses, it’s time to

change that. Without

proper tracking, all your bills can pile up easily, and there will be no way of knowing if

you’re using the money to grow the business effectively.

For easier tracking, entrepreneurs should open a dedicated bank account for their business.

They can sync this bank account to their accounting software, so it automatically records

expenses or withdrawals from the account.

Furthermore, small business owners should leverage their accounting software when

categorizing expenses. Having categories for each expense allows you to analyze your

spending data and identify areas where you spend the highest or most frequently.

#10 Outsource accounting functions

When companies don’t have enough time to manage all their business functions, it may be time

to outsource some to professionals.

Sometimes, entrepreneurs get so caught up in growing and planning for their businesses that

they prioritize their accounting functions less.

One of the best business practices is outsourcing accounting functions to experts who can

manage them better. By doing so, small business owners can entirely focus on growing their

business while being confident that their finances are in good hands.

Not only do business owners save costs since there will be no need to hire full-time

employees to manage their accounting, but they also free up more time to focus on other

critical aspects of the business.

How accounting best practices help your small business succeed

One of the keys to business success is assessing and continuously improving your accounting

practices.

The best practices we laid out, such as proper tax planning, polishing business systems,

keeping tabs on inventory and accounts, and outsourcing to professionals, will become your

roadmap to financial efficiency.

If you’re wondering how to juggle these alone, then OneCFO is the one to call!

As your dedicated partner, OneCFO can handle the intricacies of your

bookkeeping, payroll,

and taxes.

Additionally, our expertise in CFO services will ensure that all your financial processes

and strategies are constantly optimized for growth.

Let us be your strategic ally and help your business reach new heights. Visit us at

onecfoph.co or

contact us at [email protected] to learn more.

Read our disclaimer here.