July 8, 2024 | 5:53 pm

Table of Contents

Starting a business as a solopreneur means making all the decisions yourself. Besides coming

up with a good product or viable business plan, choosing the right business structure is

also crucial.

Solo business owners have two options for their business structure: sole proprietorship and

OPC. Choosing the appropriate structure for your company is not a light decision, as it

becomes the legal foundation of your business. Your chosen structure determines how to

register your company, pay your taxes, remain compliant, and more.

Given the legal structure's impact on your business, making an informed decision is vital.

In this guide, we’ll explore the details of a sole proprietorship and an OPC and their pros

and cons.

Discover which structure best aligns with your goals and set the proper foundation for your

budding business.

What is a sole proprietorship?

A sole proprietorship is the most common and basic form of business ownership. In this form,

only a single individual—the sole proprietor—owns and controls the business. Due to its

simplicity, sole proprietorship has become the go-to choice for new entrepreneurs,

freelancers, and self-employed professionals.

It’s essential to note that a sole proprietorship is not a separate legal entity from the

owner. There’s no boundary between the owner's personal and business assets. The sole

proprietor assumes full ownership of all company assets and bears full liability for debts

and losses.

How do you register a sole proprietorship?

Registering a sole proprietorship is a straightforward process involving the Department of Trade and Industry (DTI), your local government unit (LGU), and the Bureau of Internal Revenue (BIR):

When hiring employees, you must register your business with the following agencies to provide them with the government-mandated benefits:

Advantages and disadvantages of a sole proprietorship

Understanding the benefits and drawbacks of a sole proprietorship is essential for deciding if this structure is right for you. To start, here are some advantages of a sole proprietorship:

While the advantages of sole proprietorship can be appealing, it also has its drawbacks:

What is a one-person corporation?

A one-person

corporation (OPC) combines the best features of a sole proprietorship and a

corporation. In an OPC, the owner maintains control over the business but enjoys a

corporation’s limited liability.

The business owner is the sole stockholder, the director, and the president of an OPC. In

contrast, a corporation requires at least two incorporators and can have up to fifteen.

If you plan to have more than one incorporator in your business, you should register as a

corporation. Although OPC has shares, selling or transferring part of your shares to another

investor or potential shareholder requires converting your OPC into a traditional

corporation, as the company will have at least two shareholders.

They must also appoint a nominee and alternate nominee to take over their duties if rendered

incapable.

There is no board of directors, but the owner assigns a Corporate Secretary and a Treasurer

for the company. Owners can appoint themselves as the Treasurer if they comply with the

Securities and Exchange Commission (SEC) surety bond requirements.

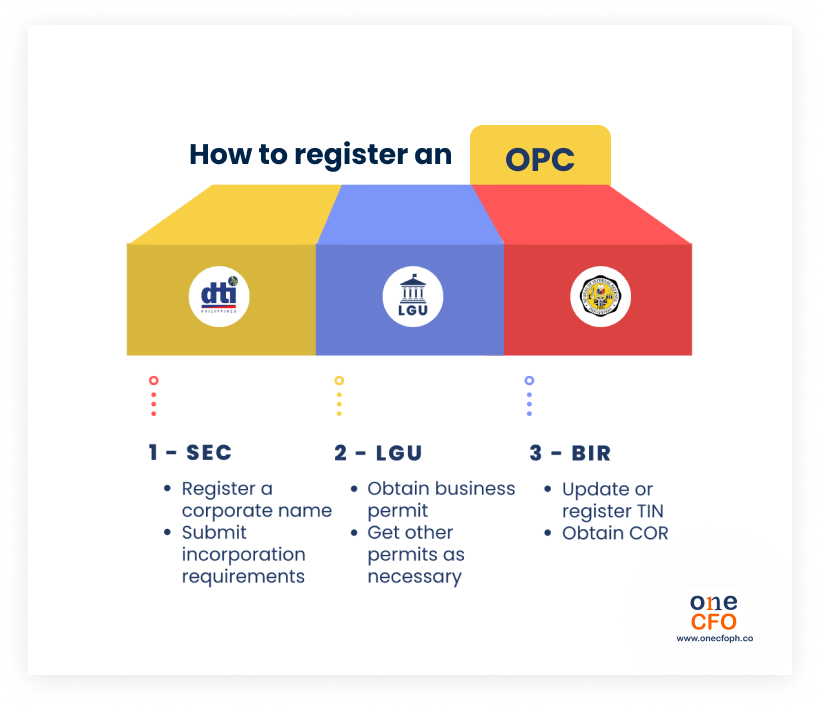

How to register an OPC?

The main difference between registering a sole proprietorship and an OPC is that OPC

registration goes through the SEC instead of DTI.

Afterward, the owner should also comply with the requirements of the LGU and BIR:

If they plan to hire employees, OPCs should also register with SSS, Pag-IBIG, and PhilHealth, the same as sole proprietorships.

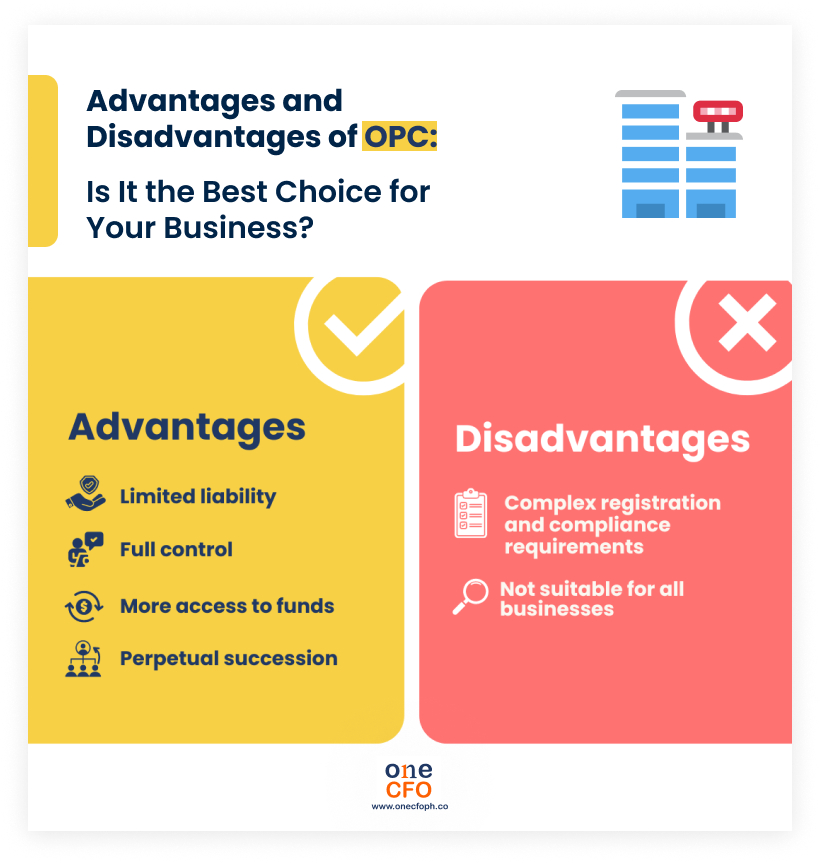

Advantages and disadvantages of an OPC

Knowing OPC's advantages and disadvantages is essential to determining whether it is the

right choice for your business.

An OPC offers key benefits, such as:

Beyond the benefits, being an OPC has its trade-offs:

Can foreigners register a sole proprietorship or OPC?

Foreigners can establish sole proprietorships and OPCs only in industries with no foreign

ownership restrictions and those excluded from the Foreign Investment Negative List (FINL).

Some of the industries foreigners can venture into are business process outsourcing (BPO),

knowledge process outsourcing (KPO), and retail trading upon meeting the minimum paid-up

capital of ₱25M.

For sole proprietorships, the DTI requires foreigners to obtain a Certificate of Authority

to Engage in Business in the Philippines (CAEB) before registering a business

name.

What factors should you consider when choosing a business structure?

There’s no one-size-fits-all answer when choosing between sole proprietorship or OPC.

Instead, the best thing to do as a solopreneur is to assess your circumstances and goals and

see which offers you more advantages.

Here are the factors to consider when deciding on a business structure:

Registration process

Establishing a sole proprietorship is undoubtedly easier than registering an OPC.

You must only submit a business name when registering a sole proprietorship with the DTI.

Meanwhile, you must submit a corporate name, articles of incorporation, and other documents

when registering an OPC with the SEC.

OPCs also have more reportorial requirements to remain compliant, such as audited financial

statements and business self-dealing disclosure.

Taxation

Diligently paying taxes is a crucial part of running a business. But what’s the tax

difference between a sole proprietorship and an OPC?

For sole proprietorships, BIR generally offers more options when paying income taxes.

Sole proprietors with income below the value-added tax (VAT) threshold of ₱3M can choose

between an 8% tax rate or a graduated rate, ranging from 0% to

35% plus a 3% percentage

tax.

Businesses over the VAT threshold are subject to the graduated and 12% VAT rates.

OPCs, on the other hand, are typically taxed at a flat rate of 20%- 25%, depending on their

net income and assets. Once they exceed the VAT threshold, they should also pay a percentage

tax or VAT.

With these tax schemes, it might be more beneficial for a business to register as a sole

proprietorship if they have a lower income and could avail of the 8% rate or a lower

graduated rate.

Conversely, it might be more helpful to be an OPC if you have a higher taxable income to

keep your tax rate at a maximum of 25%.

You can estimate your expected income based on market research or industry benchmarks for

new business owners without any income history. Consulting with experienced business owners

can help create your projections.

Consider consulting with tax professionals to see which tax

scheme is more advantageous for

your company, depending on your potential income, expenses, and tax benefits you could avail

yourself of.

Seasoned tax experts also offer valuable advice based on their experience with clients in

the same industry and help you choose the optimal business structure.

Liability

While sole proprietorships offer simplicity and potentially lower taxes, they have the

drawback of unlimited liability, which can put the owner's personal assets at risk.

In contrast, OPCs offer limited liability, protecting the owner’s assets from

business-related liabilities unless ill intent is proven.

Long-term growth

Scaling a business requires funding as you need money to improve or make more products,

expand the business, or hire more people.

Long-term growth can be challenging for sole proprietorships since they can’t issue shares

to get funding from investors. If bootstrapping isn’t an option, sole proprietors can take

loans, which could be problematic if they don’t have good credit.

On the contrary, OPCs are simpler to scale because they have more access to financial

assistance, and banks are more likely to lend to corporations.

Also, perpetual succession makes OPC ideal for legacy building since it ensures the

company’s continued existence by easily transferring company ownership. This succession

helps generations of families continuously develop the business and foster long-term growth.

Can you convert a sole proprietorship to an OPC?

Technically, you can’t directly convert a sole proprietorship to an

OPC, and vice versa,

since they have different governing bodies: DTI and SEC. However, a workaround is legally

closing your sole proprietorship and registering a new company as an OPC.

Ensuring you have closed your sole proprietorship business with the DTI and BIR is crucial

to avoid unnecessary fees and penalties while operating your new OPC.

When should you change your sole proprietorship to an OPC?

There are many reasons why sole proprietors switch their business structure to an OPC. If you're contemplating whether an OPC might be right for your business, here are some signs that it may be time to consider making the transition:

Watch this video for more insights on sole proprietorship and OPC:

Need help with your business structure?

All decisions fall onto your shoulders as a solopreneur, so being well-informed is always

important.

If you’re having trouble choosing between a sole proprietorship and OPC or need help with

your business registration, OneCFO is the one to call!

With our team of finance experts, OneCFO can assess which structure best suits your

goals

and needs.

In addition, OneCFO is the one-stop shop and end-to-end business registration service

provider for SMEs and startups in the Philippines.

Launching your business in the Philippines shouldn’t be a paperwork nightmare. We handle

everything from incorporation to employee benefits with government agencies and opening your

bank account, all at a competitive price.

Schedule your FREE consultation today to learn how

we can help you legally register your

business and start it right from day one.

Read our disclaimer here.