January 27, 2026 | 11:34 pm

Table of Contents

Running a small business or startup requires clear financial direction—understanding what’s

working, what’s draining resources, and how each decision impacts overall financial health.

A fractional CFO provides the strategic oversight needed to bring that clarity, without the

cost of a full-time hire.

As companies scale, basic accounting and spreadsheets are no longer enough to provide the

insights needed to bring the business to the next level. Business owners need a better

understanding of cash flow, profitability, and financial priorities to support smarter

decision-making.

This is where fractional CFO support becomes invaluable, offering senior-level financial

guidance that adapts to a company’s stage, whether navigating expansion, operational

changes, or periods of uncertainty.

Curious to know what a fractional CFO actually does? Read on to understand their role and

the key benefits their expertise delivers.

Key Takeaways

Why hiring a fractional CFO is your best growth move

What is a fractional CFO?

A Fractional CFO provides the same high-level leadership as a traditional CFO executive, but

without the full-time commitment. Instead of a permanent hire, businesses can bring in

experienced financial guidance on a part-time, outsourced, or project basis.

For many SMEs and startups, this approach fills a critical gap. Basic bookkeeping and

spreadsheets show what happened in the past, but they do not provide the insight needed to

plan ahead or make confident decisions. At the same time, hiring a full-time CFO is often

too costly at this stage.

A fractional CFO bridges that gap by bringing CFO-level insight and strategic

thinking—without the cost of a permanent position. The focus is on financial clarity,

planning, and decision support, so even in a flexible setup, the value is real.

Rather than acting as “extra help,” a fractional CFO works as a key advisor, offering the

perspective and experience typically found in the leadership teams of larger organizations.

Watch: A fractional CFO’s perspective on business survival and revenue growth

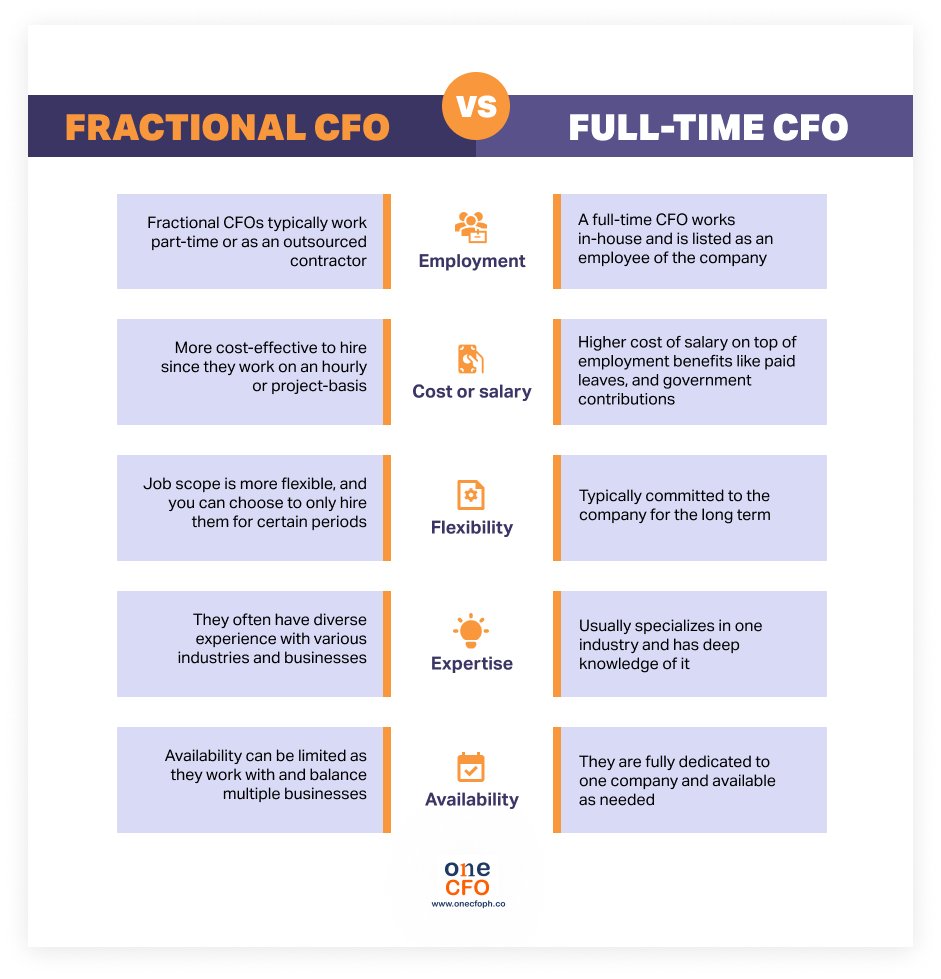

Fractional CFO vs. Full-Time CFO: Key Differences

Fractional and full-time CFOs offer similar expertise, but they differ in cost, flexibility,

and availability.

Here’s a quick guide on how they compare:

Why should SMEs and startups hire a fractional CFO?

Hiring a fractional CFO now means you don’t have to wait until you’re a giant company to

have expert financial leadership. It’s about getting a clear view of your financial health

and a strategic guide during your most critical growth phases, all through an affordable

partnership that grows as you do.

Here are the key ways fractional CFOs add value to SMEs and startups:

#1 Enhanced business efficiency

A fractional CFO improves business efficiency by implementing the right financial systems

and processes. They free up founders and business owners to focus on what they do best while

ensuring that operations like bookkeeping, reporting, and cash flow management run smoothly.

By automating workflows and introducing the right tools, fractional CFOs help startups and

SMEs save time, reduce errors, and make smarter, faster business decisions.

These seasoned financial experts can seamlessly integrate themselves into your existing

systems, providing the expertise and bandwidth you need to navigate the complexities with

confidence.

#2 Why does a fractional CFO improve financial health?

To build a successful business, you need to understand your numbers and manage your finances

effectively. Having a dedicated CFO, even a fractional one, ensures there’s an expert

tracking and improving your business’s financial health.

Fractional CFOs build financial projections to

anticipate potential risks and devise action

plans to mitigate them.

Furthermore, fractional CFOs are adept at managing cash flow, ensuring the business

consistently has enough to cover its dues and survive any cash crunch.

Learn what fractional CFO experts have to say about how to

effectively manage your cash

flow:

#3 Strategic decision-making

Bringing a fractional CFO into your business makes decision-making more strategic, as you

can base your choices on accurate financial information. Key decisions, like the right time

to scale, introduce a new product, or make investments, are all better informed with a CFO's

insights.

Using numbers and facts, fractional CFOs keep businesses on track to achieve their

short-term and long-term goals. They contribute to this by tracking KPIs and advising on how

to reach target values.

An example of an essential KPI that fractional CFOs

track is monthly recurring revenue

(MRR), which helps businesses understand their predictable revenue. Learn more about MRR

here:

Additionally, fractional CFOs offer innovative insights from their extensive experience

working with multiple companies. Their diverse backgrounds provide business owners with the

fresh perspective they need to enhance their business ideas.

A fractional CFO’s ability to use their cross-industry knowledge to adapt to new business

challenges also makes them a valuable asset. For example, they can introduce best practices

from other industries or suggest cost-saving strategies that have been successful elsewhere.

#4 How is a fractional CFO a cost-effective option?

Fractional CFOs are a cost-effective solution because they provide C-suite expertise without

the expense of a full-time hire. Businesses pay per project or on a retainer basis, making

it easier to access high-level financial guidance while keeping expenses predictable and

manageable.

Since fractional CFOs typically operate on a part-time or project basis, companies are not

obligated to provide them with the same compensation packages and full benefits as regular

employees.

Furthermore, the expense associated with recruiting and hiring fractional CFOs is notably

lower than hiring one full-time.

In a traditional hiring process for a senior role, companies incur expenses such as job

posting fees, recruitment agency charges, interview-related costs, signing bonuses, and

other administrative expenses - many of which are unnecessary when engaging fractional CFOs.

#5 Flexibility with scope

Another critical advantage of hiring a fractional CFO is the flexibility they offer. Unlike

full-time employees, founders can tailor the services they receive from fractional CFOs to

their current stage or needs.

This flexibility is particularly beneficial for companies with budget constraints, as

fractional CFO fees can be adjusted based on the scope of work. Fractional CFOs are also

ideal for businesses that require their expertise intermittently or for specific projects.

Engaging a fractional CFO is also a great way to test the waters before committing to a

full-time hire. Since they are outsourced, you have the freedom to decide whether to

re-engage them after the contract ends.

When hiring fractional CFOs, you can choose between getting them on a retainer basis or a

project basis.

Retainers enable fractional CFOs to work with your team on an ongoing or monthly basis,

covering the full scope of a CFO's responsibilities. On the other hand, project-based CFOs

focus on specific tasks as needed by the startup.

Watch the video to learn more about outsourced CFO services:

#6 Broad expertise

Fractional CFOs possess theoretical knowledge and bring years of experience working with

multiple businesses across various industries. Their diverse backgrounds enable them to

tackle challenges of varying complexity within a company.

Beyond their extensive expertise, fractional CFOs offer fresh perspectives, innovative

ideas, strategic insights, and best practices in business finance—skills honed through years

of hands-on experience.

As seasoned financial veterans, fractional CFOs require minimal training and supervision.

They can hit the ground running and start making positive changes in the business

immediately.

#7 Extensive network and connections

Because of their diverse experience, fractional CFOs have also built an extensive network,

which can be a big advantage for your business.

With a fractional CFO’s broad connections, they can help you form strategic partnerships

that will lead to various growth opportunities for the company. Some of the people your

fractional CFO can connect you to are:

Learn more about leveraging networks and strategic connections in this KwentuOne Podcast with Coach Artie Lopez:

#8 Increased stakeholder confidence

A seasoned fractional CFO can boost stakeholder confidence by ensuring SMEs and startups

finances are well-managed and transparent. Investors and partners know the business is in

capable hands, making them more likely to trust your decisions and support growth

initiatives.

They provide timely and accurate financial reporting, giving investors clear insights into

your company’s health. This transparency is especially valuable when seeking external

funding, whether through investments or loans.

Having expert financial guidance in the boardroom reassures investors as well that your

financials and models are well-prepared and clearly communicated. At the same time, founders

and business owners receive support to fully understand the company’s current standing and

develop strategies aligned with stakeholder expectations.

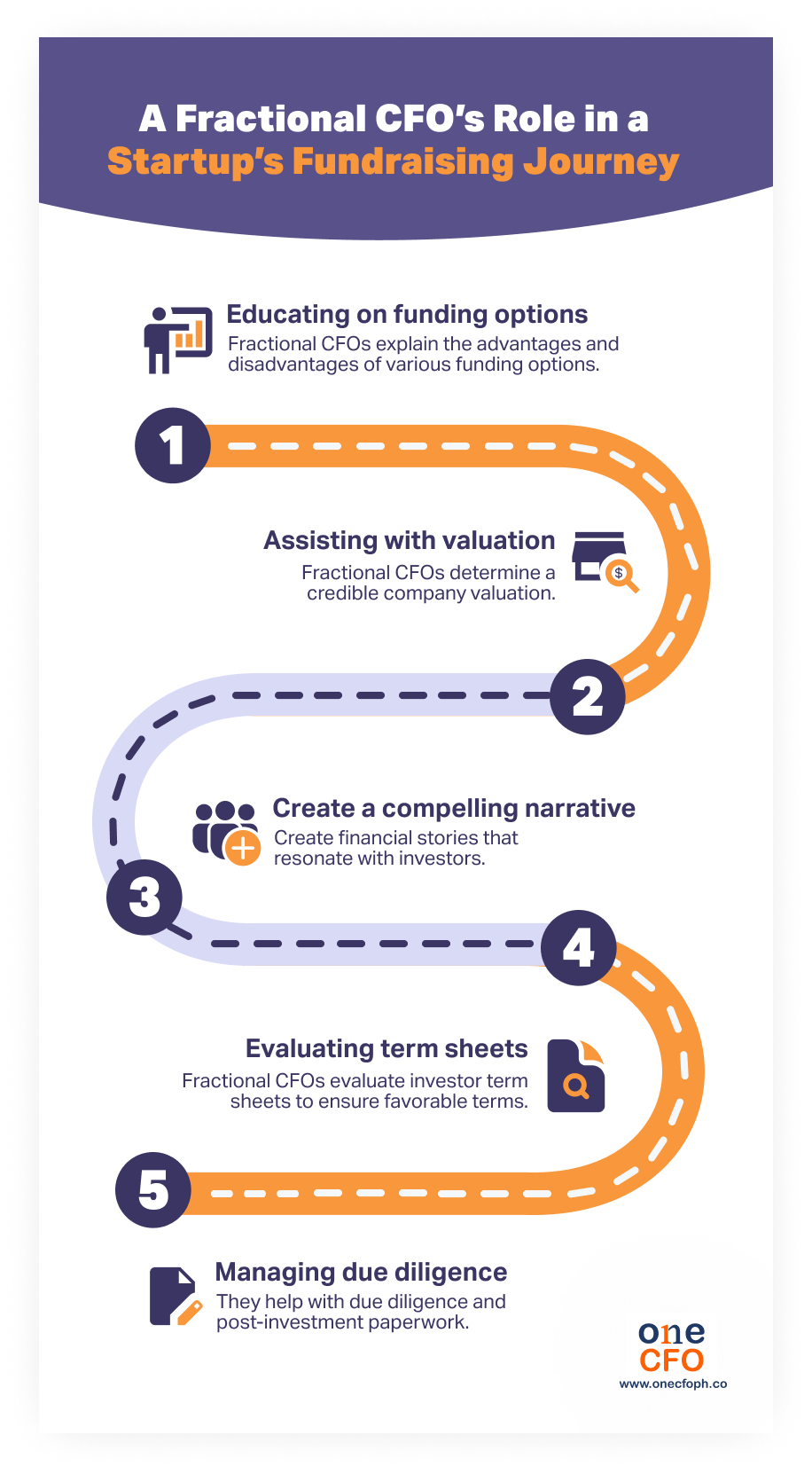

#9 Fundraising assistance

Most businesses require external funding to expand or scale, but the fundraising process can be tedious for founders.

Fractional CFOs help startup founders navigate the complex funding landscape by:

If the company opts for alternative funding sources, such as

loans, fractional CFOs can also

assist by comparing different banks and negotiating loan terms.

Here’s a video on fundraising options for your

startup:

#10 Keeping Your Business Compliant and Up to Date

All businesses must comply with laws and regulations, but keeping up with these changes can

be a burden for decision-makers who are already occupied with growing the business and

running daily operations.

Having a fractional CFO by your side ensures your business remains compliant by tracking

regulation changes and handling compliance requirements, helping you avoid costly penalties

or, worse, business closures.

A fractional CFO ensures your business stays proactive and confident, navigating regulatory changes

smoothly while minimizing risk.

When should you hire a fractional CFO

SMEs and startups should consider hiring a fractional CFO when they need more than

historical reports. They should engage a fractional CFO when they need help interpreting

their numbers and using them to make smarter, forward-looking decisions.

As finances become more complex, managing cash flow, preparing for funding, and planning

next steps can quickly become overwhelming. Handling everything internally adds pressure,

while hiring a permanent CFO at this stage is often costly and unnecessary.

A fractional CFO offers a practical alternative—providing experienced financial guidance

when it’s needed, without the commitment of a full-time role.

With partners like OneCFO, businesses receive financial support tailored to their size and

budget, helping them move forward with greater clarity and confidence.

OneCFO works with SMEs and startups to turn financial data into practical guidance that

supports day-to-day and long-term decisions. Rather than focusing solely on reports, the

team helps business owners understand what the numbers mean, where to focus, and how to

approach financial management more strategically.

This includes improving cash flow visibility, setting up financial processes that scale with

the business, and providing clear input on budgeting, pricing, and tax planning.

When funding or expansion is part of the conversation, OneCFO also helps businesses assess

options and prepare their numbers—always with context and clarity.

All of this support is delivered through a fractional model, giving businesses access to

experienced financial leadership without the cost or commitment of a permanent CFO role.

Learn more at onecfoph.co or email us at [email protected].

Read our disclaimer here.