April 26, 2024 | 4:45 pm

Unicorn is quite a common term in the world of startups, especially as this is the goal that

most companies want to achieve. However, there is now what you call zebras - another startup

status that is becoming more common. What’s the difference between the two, and which

startup are you?

A unicorn is commonly known as a mythical creature. Still, for startups, this term refers to

privately held companies with a valuation of at least a billion dollars. Achieving a

billion-dollar valuation is a feat most startups dream of. Still, only a few companies have

reached this level.

The good news is that being a unicorn isn’t the only way for startups to become successful.

Recently, the term zebra came to light to describe startup companies that balance their

profitable goals and provide social impact. Unlike unicorns, zebras may not achieve a

sky-high valuation quickly, but they focus on profitability while addressing societal

challenges.

Should you choose a billion-dollar dream or build a sustainable business? Find your answer

here.

What does unicorn status mean?

Aileen Lee, a venture capitalist (VC),

coined the term “unicorn” in 2013 when she started

her investment firm. Since then, many startups have aimed to achieve unicorn status,

revolving their entire business models around this goal.

Unicorn startups are fast-growing companies that have

only been in business for under ten

years and achieved a valuation of $1B without going through an initial public offering

(IPO). These startups are mostly venture-backed and prioritize growth by increasing their

customer base and revenue.

Startups achieve their unicorn status by dominating their industry and expanding rapidly

through massive rounds. These businesses focus primarily on getting big fast, especially if

they’re in a winner-takes-all market, where they

could capture a substantial share if they

grow quickly enough.

Who are the unicorn startups?

According to CB Insights, there were 1224 unicorn startups

worldwide as of December 2023.

Some unicorns most people know are Facebook, Google, and Airbnb—all of which have already

gone public.

Currently, famous unicorn companies include:

The Philippines also boasts startups that already achieved

unicorn status. Some of these are

the leading fintech platforms Mynt, which operates GCash in the country, and

Voyager Innovations, which owns Maya.

There are also variants to unicorns like decacorn and hectocorn, valued at $10B and $100B,

respectively - an even more challenging feat than just achieving unicorn status.

What are the downsides of chasing after unicorns?

Aspiring unicorns are highly focused on rapid growth, raising rounds of investment after

round, and sometimes need to solidify their business plans. An example of this case is

WeWork, where the company grew too

fast, and yet the unsustainability of its business model

eventually became its downfall.

WeWork's business model involved leasing large properties on long-term contracts and

subleasing them with shorter, flexible terms to individuals and small companies. While

initially promising, this approach led to substantial losses because WeWork was locked into

costly leases even as clients canceled agreements, a situation worsened during the pandemic.

The article, Sex & Startups, also discussed how

VCs often prioritize quantity over quality

or quick exits over sustainable growth. By emphasizing rapid growth and disruption too much,

founders sometimes forget to pay more attention to their role in building a product or

service that could help people.

With that said, it’s essential to reflect on the prevailing business model in startups and

look for an alternative where companies can be profitable and sustainable.

What are zebras?

The term “zebra” for startups came to light when entrepreneurs Jennifer Brandel, Mara

Zepeda, Astrid Scholz, and Aniyia Williams, who all founded Zebras

Unite, used it to

describe an alternative to the unicorn status.

Unlike unicorns, which prioritize rapid growth and expansion, zebras prioritize building

sustainable and profitable businesses that benefit and serve the community.

Zebras creates a positive impact by addressing meaningful problems and providing solutions

to underserved communities.

Additionally, they prioritize customer success by offering high-quality products/services

that meet genuine needs and cultivate an inclusive, positive company culture that emphasizes

employee happiness.

What are the characteristics of a zebra startup?

In the article, Zebras Fix What Unicorns Break,

Zebras Unite described why they used the

term zebra to describe companies that value profitability, sustainability, and social

responsibility.

First, zebras are real, unlike unicorns, making it a more realistic and sustainable goal for

most startup founders.

Zebras are also known for their black-and-white stripes, which symbolize the dual purposes

of these companies: making a profit and improving society. These companies operate for

profit and cause, seeking financial returns and actively pursuing social or environmental

causes integrated into their business model or operations.

Another thing is zebras run with the pack. They are mutualistic, which means they ride

together in a group and help one another.

This characteristic emphasizes how zebra companies recognize the importance of collaboration

to achieve more significant goals. By working with others, like partners, stakeholders, and

communities, zebras innovate solutions and share their expertise and resources.

Why are Zebra startups gaining traction?

Given the downsides of chasing after unicorn status, more founders are looking for an

alternative approach to their business, which is how the emphasis on building zebras

emerged.

Zebras foster lean, efficient, and adaptive growth by prioritizing sustainability in

business early on.

Here are some of the ways zebra companies gain traction and showcase sustainability

practices:

A famous example of a zebra startup is Patreon, whose business model revolves around

circulating money between creators and their viewers.

Basecamp, also a zebra company, is a project

management software company whose teams are

distributed worldwide remotely. This company focuses on employee happiness by promoting

flexibility and salary transparency across the organization, among other benefits.

What’s the difference between unicorns and zebras in startups?

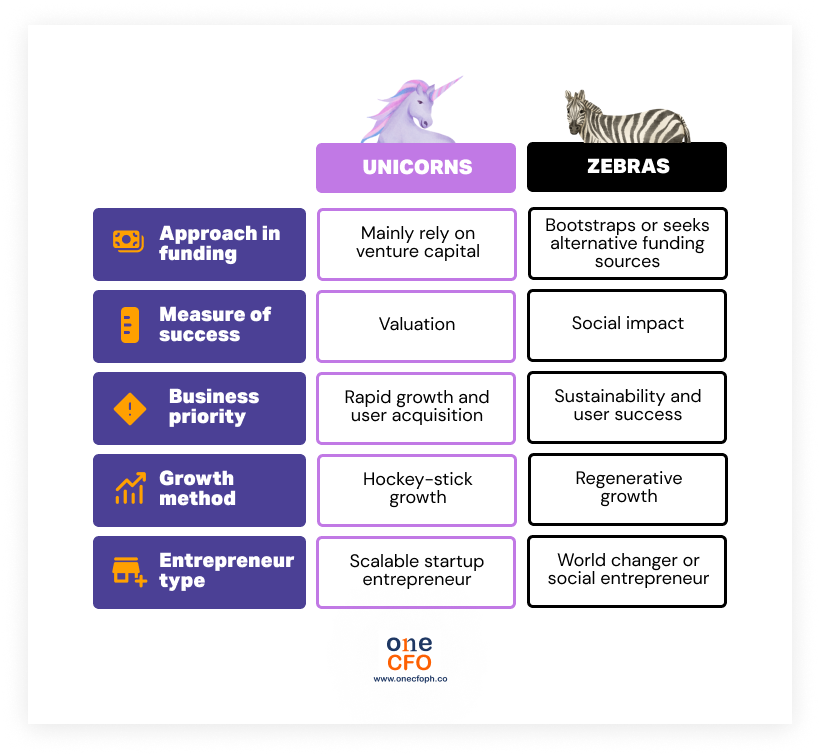

Gunning for unicorn status or working to become a zebra are two approaches to running startups. Here are some of the stark differences between the two:

Approach in funding

Prioritizing growth above else requires large sums of money, so unicorn startups mostly rely

on venture capital for funding. Venture

capitalists have bigger budgets and can provide

strategic guidance to startups, allowing them to grow rapidly.

Startups aiming for unicorn status use the funding they raise every round to invest in

technology and research to enhance their products. They can also use this money to market

aggressively and make the company more visible.

Meanwhile, zebra companies seek alternative funding sources, such as

bootstrapping,

community funding, or impact investing, to grow their businesses.

One notable zebra company, Buffer, has even decided to buy out

its investors to pursue more

sustainable methods.

Discover proven fundraising strategies for startups in this video:

Measure of success

The way unicorns and zebras quantify success is also different.

Unicorns emphasize their valuation mainly because this is the metric they use to define

themselves as such. However, focusing on growth and valuation can be detrimental when

founders start burning out or sacrificing their values to strive for success.

For example, founders may face significant stress and long work hours due to pressure to

meet sky-high targets. They may also compromise on company values and prioritize short-term

gains over long-term sustainability.

On the other hand, zebras do not only measure profitability to define their success. They

also evaluate their social impact and engagement with the community. Instead of focusing on

hyper-growth, zebras value building profitable businesses that have a long-lasting impact.

Business priority

To achieve their success metric, unicorns and zebras have different priorities when running

their businesses.

Unicorn startups prioritize hyper-growth to achieve a $1B valuation as quickly as possible.

With this, unicorns are more about expanding their market share and growing user

acquisition.

One of the targets of these startups is to become the monopoly or dominating business in the

industry, which is why they need to take in as much of the market as possible.

Meanwhile, zebras focus on growing its businesses sustainably without sacrificing its social

impact. These companies promote user success, which means ensuring that every person who

uses the company’s product or service is happy and gets what they actually need from it.

Growth method

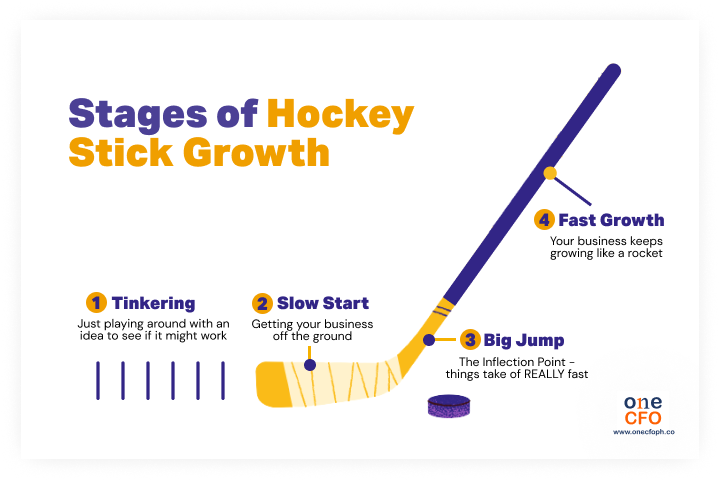

A way to describe growth in unicorn startups is a hockey stick, which shows rapid,

exponential growth after an initial period of stagnation.

This revenue growth pattern demonstrates the different stages of startups, where they spend

the first years tinkering and hustling until they reach a turning or inflection point of

hyper-growth.

In contrast, zebra companies focus on regenerative growth, prioritizing long-term sustainability over short-term gains. With regenerative growth, zebras can be profitable while replenishing resources and positively contributing to the community.

Type of entrepreneur

Given the opposite nature of unicorns and zebras, it’s easy to see how the type of entrepreneur

who builds a unicorn differs from that of a zebra.

Scalable startup entrepreneurs mostly build unicorn companies. They develop innovative

solutions and technology to quickly disrupt and capture significant market share. To achieve

their goal of rapid growth, they must create a business model that is both scalable and

repeatable.

On the other hand, the founders of zebra companies are world changers or social

entrepreneurs. They address inequality, environmental concerns, and other societal

challenges. As social entrepreneurs, zebra founders are not only inspired by financial gains

but also aim to improve society and other people’s lives.

What type of startup should you choose?

Ultimately, growth is essential in every startup—the only difference between unicorns and

zebras is how you approach this factor.

Reflecting on your desired growth will help you determine what kind of startup you should

be, regardless of your current stage.

Being a unicorn company might be suitable if you want to innovate and disrupt the market

with genius ideas.

Meanwhile, you can be a zebra company if you prefer balanced and steady growth while

ensuring social impact on the market you’re addressing.

Both approaches also require your business to be profitable and financially sound;

otherwise, it will not last. This is why it’s crucial for startup founders like you to have

a trusted partner who can help you through your

financial journey.

With OneCFO, your

startup will get reliable guidance from our expert CFOs. Our insights can

empower you to navigate complex financial decisions and push you toward financial growth.

We also offer incorporation and 409a valuation services for startups at any stage. These

services will help your business build a solid foundation while complying with regulations.

Additionally, OneCFO helps you focus more on innovating in your business by freeing up your

time and seamlessly handling critical financial tasks such as bookkeeping, taxes, and

payroll.

Visit us at onecfoph.co or reach out to us at [email protected] to

learn more about how we

can unleash your startup’s full potential and achieve success.

Read our disclaimer here.