August 10, 2023 | 4:51 pm

Table of Contents

All small businesses incur small but necessary expenses in their daily operations. A

properly set up petty cash system makes covering and managing these expenses much easier!

Having petty cash available for emergencies or everyday business expenses makes using money

more convenient than writing a check. Petty cash is also helpful for small transactions

where using a business credit card, or online banking isn’t an option.

As a small business owner, you must learn how to manage your petty cash best to prevent

possible employee fraud or theft.

A properly set up petty cash system also facilitates proper bookkeeping. Small transactions

can pile up over time, so record them as the documents are given to ensure everything is

evident in your books.

Read on to learn what petty cash is, its importance, how it works, and the best practices in

small business petty cash management.

What is petty cash in accounting?

A petty cash or petty cash fund is a small amount of

money a business keeps readily

available. Cash-on-hand makes it easy to cover any small or unexpected business expenses,

where writing a check or using the non-cash mode of payment doesn’t make sense.

Some examples of business expenses that use petty cash are snacks and meals, transportation

or commute costs, tokens, and office supplies with minimal costs. These purchases are

relatively low-cost, so handing out cash or reimbursing your employees is more convenient.

How much petty cash should a small business have?

The amount of petty cash you should keep depends on the size and nature of the business.

Whether you have a small business or a large company, there may be differences in handling

petty cash in the office.

Small businesses with few expenses may only need around ₱1,000 to ₱5,000 worth of petty

cash. Meanwhile, large companies may store more in their petty cash fund, often divided

between departments.

Like other business expenses, account for petty cash in your books. With that said, it’s

necessary to create a system for tracking and managing your petty cash to maintain the

accuracy of your records.

Why do small businesses need petty cash?

Even with the rise of cashless transactions, there are still a lot of small everyday

expenses where using money is the best option. A petty cash fund in your business offers

more flexibility, helps cover minor costs, and simplifies employee reimbursement.

Petty cash becomes convenient when writing a check is more time-consuming. The check

issuance process takes longer when you only need the money for a low-cost purchase.

Some business expenses are also unexpected or immediate, so formally requesting money can

take time and effort. An example is when paying a delivery rider or photocopying documents

for work.

How to manage petty cash in a business?

Setting up a petty cash fund makes dealing with small business expenses more effortless.

However, petty cash funds can lead to

mismanagement, inaccurate record-keeping, or theft.

Businesses should establish petty cash management procedures to serve as an internal control

and ensure appropriate use of the money.

Knowing how to manage your petty cash also ensures that all business expenses, even the

smallest ones, are accounted for. This tracking is useful when claiming tax deductions and

evaluating your cash flow.

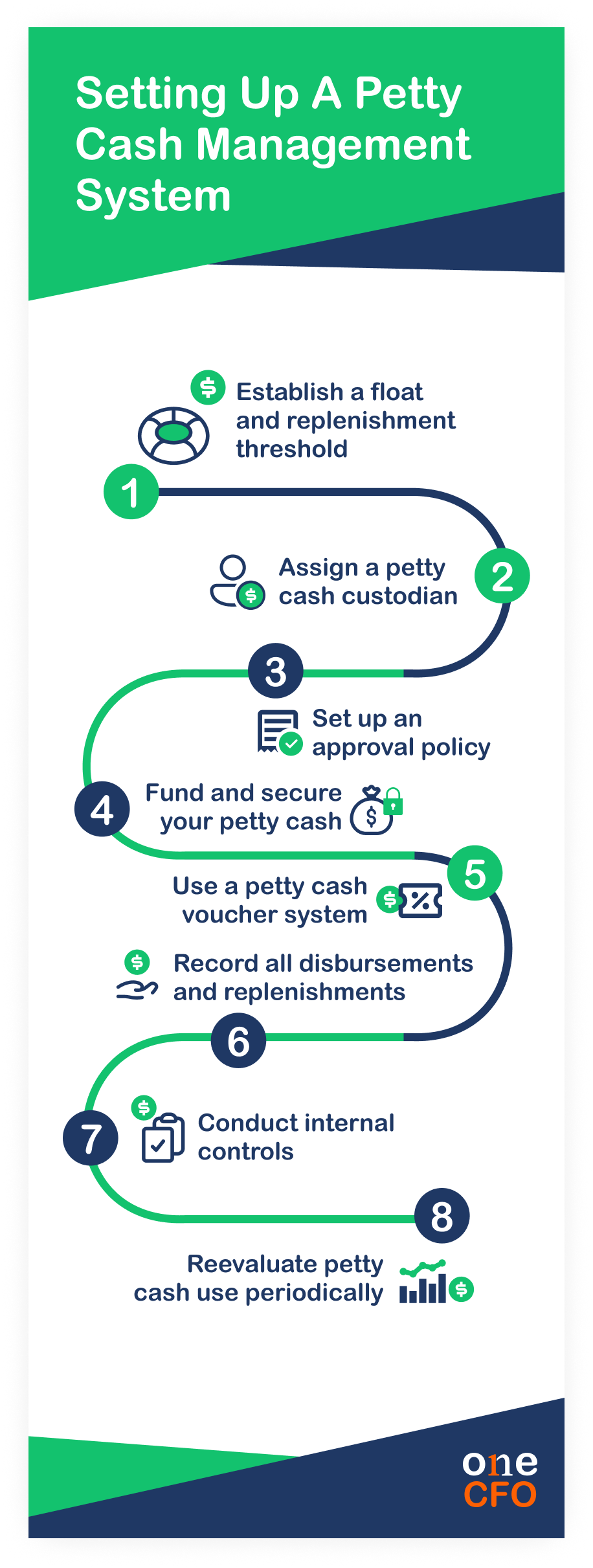

Step 1: Establish a float and replenishment threshold

When setting up your petty cash, you must first establish your float and replenishment

threshold.

Petty cash float is the maximum amount of readily

available money your business can hold. It

is also your initial cash upon funding your petty cash fund. Having a float helps you avoid

having too much money sitting around.

Consider the typical small payments your business incurs regularly to set up a float amount.

Petty cash floats in small companies can start from ₱1,000 and be adjusted as the business

grows.

On the other hand, the replenishment threshold dictates when you should replenish the petty

cash fund. Once the petty cash available goes below the replenishment level, the custodian

or manager should request the reimbursement of the disbursed funds.

Step 2: Set up an approval policy

Creating a written policy on approving petty cash requests helps set expectations among

employees.

In this policy, you should include an expense limit or the maximum amount one can take out

of the petty cash at a time. For example, employees can't use petty cash on items or

transactions exceeding ₱800.

In addition, include a list of allowable items for purchase using petty cash. Some examples

of items are food, travel expenses, office supplies, gifts, and more. You can also make the

policy more flexible by adding a clause that allows employees to buy items excluded from the

list as long as it's within the expense limit and approved by a manager.

Step 3: Assign a petty cash custodian

Another best practice is selecting a trusted employee to be the petty cash custodian. The

custodian is responsible for handling, disbursing, and safekeeping the petty cash fund. They

also monitor the expenses, how much is available, and request replenishment whenever needed.

Ideally, assign another person to approve the petty cash expenses and ensure appropriate use

of the money. However, this might not be possible for small businesses with few employees.

In that case, this responsibility can also fall under the main custodian’s.

At the very least, the petty cash custodian should be different from the one recording the

expenses in the general ledger and providing the replenishment. Segregating these roles

serve as additional internal control and prevents fraud and abuse of petty cash funds

Step 4: Fund and secure your petty cash

After creating your written policy and determining the custodian, it’s time to fund the

petty cash. Add a petty cash account to your chart of accounts, referenced whenever you or

the bookkeeper records transactions in the general ledger.

The business owner writes and cashes a check equal to the petty cash float to start the

fund. Once the cash is on hand, secure it in a cash box for safety. Only the custodian and

the business owner should have key access to the cash box.

Other petty cash items, such as receipts and vouchers, are also kept in the cash box, which

makes tracking and reconciling more convenient since you only need to check one location.

Step 5: Use a petty cash voucher system

Business owners should use a petty cash voucher system to organize funds' disbursement. Petty cash vouchers are slips used whenever a disbursement happens and record crucial information such as:

After the employee makes the purchase, they should surrender the receipt and petty cash

voucher to the custodian for recordkeeping. The voucher-receipt system helps the custodian

track the money from the fund and ensure nothing is missing.

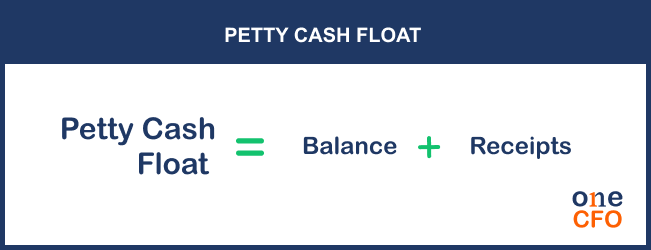

The custodian should check from time to time for any discrepancies in the petty cash fund. A

simple formula is to add up the

balance and surrendered receipts, and this should equal the

petty cash float:

Step 6: Record all disbursements and replenishments

When the cash fund reaches the replenishment threshold, the custodian submits a request for

replenishment along with all the supporting documents, such as petty cash vouchers and

receipts.

The bookkeeper or business owner checks the vouchers and receipts to see if they match the

requested replenishment. Also, the documents serve as proof of recording each petty cash

transaction and replenishment in the general ledger.

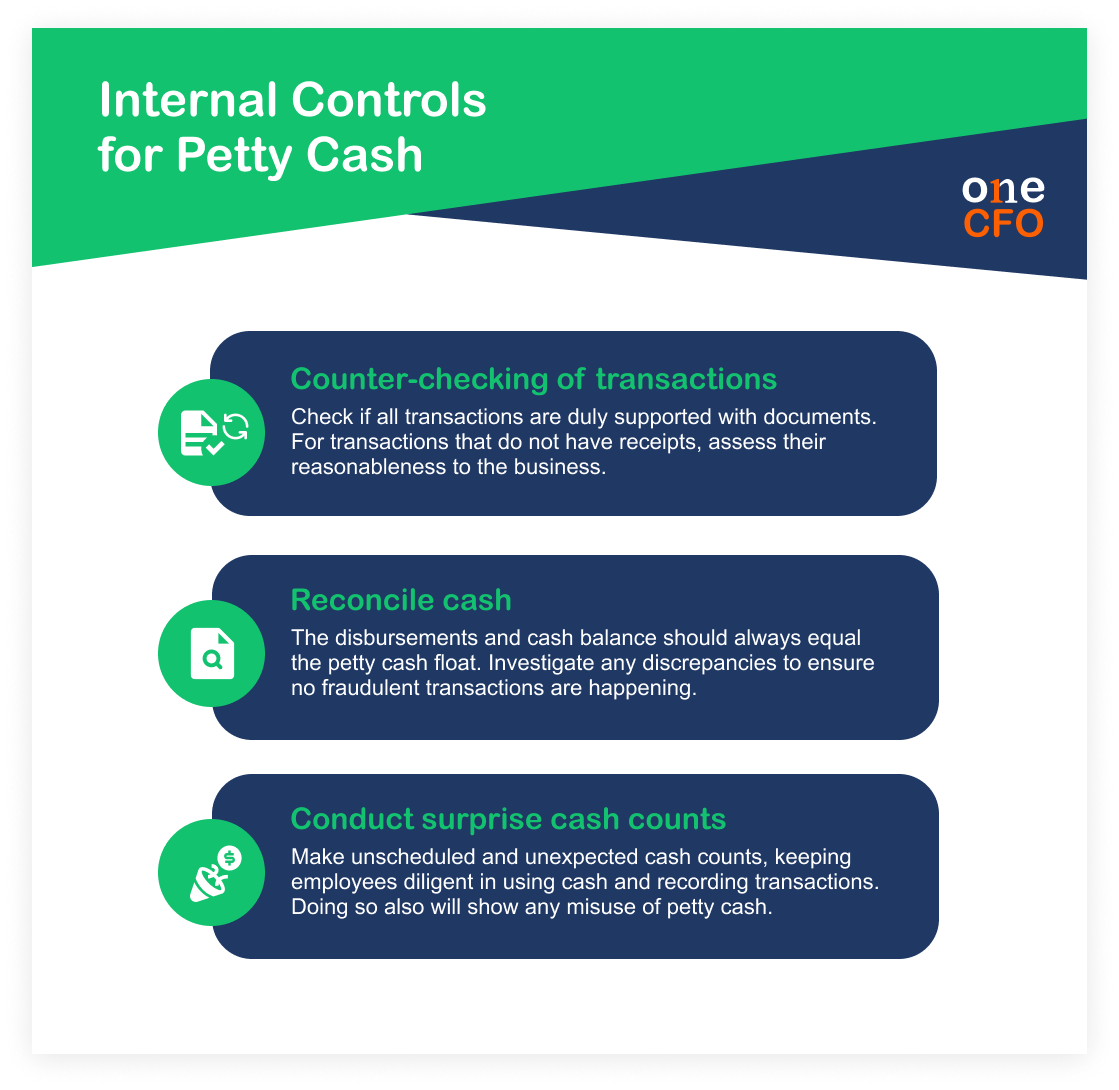

Step 7: Conduct internal controls

The business owner should conduct internal controls as part of the checks and balances of the petty cash fund. Internal controls ensure that the custodian records transactions and manages petty cash meticulously. It also helps monitor if employees follow the petty cash processes and limitations.

What are the three common internal controls for petty cash?

The first control a business owner can do is to check the disbursements are backed by

vouchers and receipts. Counter-checking all transactions allows you to see if expenses are

within the limits.

Some costs, such as jeepney rides, will not have receipts. You must determine the

reasonableness of such expenditure.

Next, the business owner should also reconcile the petty cash fund. The amount disbursed and

the balance should always equal the petty cash float.

Investigate any discrepancies to ensure no fraudulent transactions are happening. An unequal

amount can mean some petty cash is missing, no supporting documents are surrendered, or

transactions are left unrecorded.

Thirdly, conducting surprise cash counts is also a control small business owners should

implement in managing petty cash. Since surprise cash counts are unscheduled and unexpected,

this keeps employees honest and diligent in their petty cash usage.

Conducting surprise cash counts also helps catch potential fraud, as there is no time for

employees or the custodian to manipulate documents or receipts when the business owner

arrives.

Step 8: Reevaluate petty cash use periodically

It’s a best practice to reevaluate how your business uses petty cash. As your business

grows, you may notice that you need to replenish your petty cash more often, which can be a

sign to increase your petty cash float.

You should also check the usual expenses covered by petty cash to see how you could use your

money better. For example, your expenses are mostly from printing and photocopying documents

in computer shops. In that case, investing in a printer or photocopier for the office may be

best.

Need help with petty cash management?

Setting up and managing a petty cash fund is essential to any small business. Without proper

petty cash management, business owners can quickly lose track of where their resources go,

leading to fraudulent transactions. It is also needed for proper bookkeeping and not to miss

benefits like tax deductions.

As small business owners, you must stay on top of your finances while continuously growing

and improving your business. Juggling these tasks can be challenging, but you don’t need to

do it alone!

With OneCFO, you will have a team of professionals managing your business finances -

including bookkeeping, taxes, payroll, and CFO services! OneCFO takes time to understand

your business needs and helps you develop processes to grow your business.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with

petty cash management and streamline your business processes.

Read our disclaimer here.